With the FOMC Meeting December 2025 just one day away, traders are asking one big question: Is another Bitcoin price crash coming? The Fed’s decision has repeatedly shaken BTC this year, and the upcoming Fed meeting rate cut probability is already driving strong market speculation.

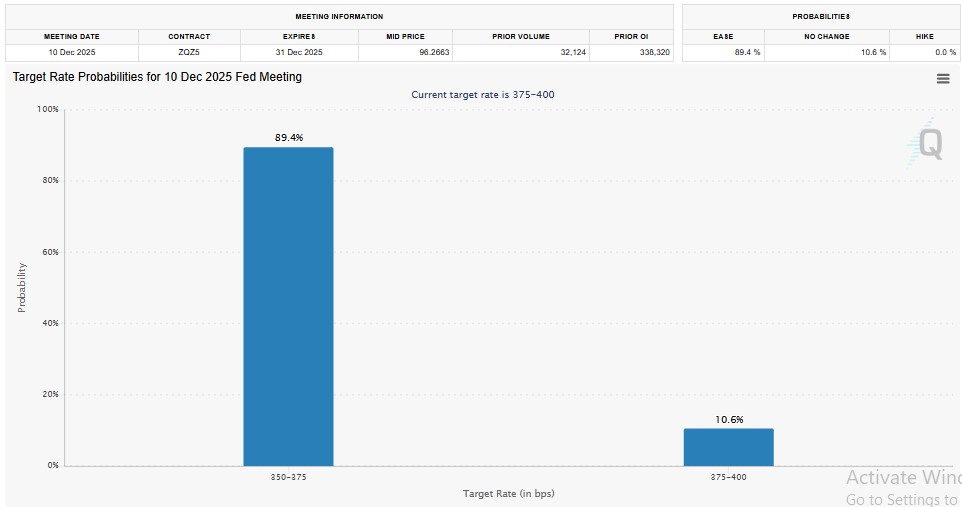

According to the CME FedWatch Tool, the current 375–400 target range is expected to shift again, with 89.4% probability of a 25 bps rate cut and 10.6% chance of a 50 bps cut.

Source: FedWatch Tool

The announcement will come on Wednesday, December 10, 2025 at 8:00 PM CET, followed by Jerome Powell's press conference at 8:30 PM CET, which is usually where volatility explodes.

While BTC generally likes rate cuts, it usually tends to experience sharp downside immediately following the event.

Here is how the crypto king reacted to every FOMC meeting date in 2025:

January 29:-25% (worst crash of the year)

March 19: –12%

May 7: +15% only bullish reaction

June 18: –8%

July 10: Negative volatility - chart showing red reaction

September 17: –7%

October 29: -19% (second-biggest Bitcoin price crash)

Six of the last seven meetings have sparked red candles. This is why traders fear that the FOMC Meeting Countdown may be setting up a repeat—possibly sending Bitcoin lower once again. The final meeting of the year, December 10, remains marked as “???” in most analyses, increasing market uncertainty.

At press time, It trades at $90,461, down 1.4% on the day but still up 4.49% weekly, with $57.34B in 24h volume and a $1.8T market cap. The Bitcoin price prediction shows a bearish flag, a continuation pattern that follows a major breakdown.

Source: TradingView

It was rejected from the $92,000–$93,500 resistance zone, creating multiple lower highs, and this strengthens bearish momentum. The flagpole stretches from $116,000 → $82,000, a $34,000 move.

If it breaks below $88,500, the measured target aligns almost perfectly with $70,000. This matches trader concerns asking: Will it crash to 70K after the Fed meeting?

Momentum indicators confirm weakness:

RSI at 45, struggling to cross the bullish zone

Volume remains average, but a spike during breakdown could accelerate a sell-off

Below $88,500, major supports lie at $84,000, $80,500, and finally $70,000—a potential 22–25% decline from current levels. To invalidate the bearish structure, it must reclaim $93,500.

Despite rising fear, institutional confidence is surging.

Data from Lookonchain shows Michael Saylor’s MicroStrategy bought 10,624 coins worth $962.7M, raising total holdings to 660,624 coins with an average price of $74,696—now sitting on $11.23B in unrealized gains.

Source: X

Last week alone, 9 public companies added 11,260 BTC, worth over $1B. This aggressive accumulation suggests that major players do not believe a deep Bitcoin price crash will damage long-term value.

With the FOMC meeting countdown nearly over, it sits at a crossroads. Bitcoin price prediction warn of a fall toward $70K, but strong institutional buying shows confidence in long-term upside. If it breaks $93,500, the bearish outlook fades. Until then, volatility is almost guaranteed. Traders should stay cautious but avoid panic—history shows that fear-driven dips often become the next big opportunity.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.