While BTC floats just above $102K, the real storm is forming inside the U.S. Federal Reserve. In a bombshell shift, Governor Christopher Waller has hinted that the central bank could start easing with a Fed rate cut July decision.

According to Coin Bureau’s latest post, Governor Christopher Waller said that a rate cut “could come as soon as the July meeting.” That statement is now driving fresh debates across the global economy—and crypto is listening.

Source: Coin Bureau Official Account

In fact, this could be the most important Fed Governor Waller speech today, as it opens the door for a sharp turn in U.S. monetary policy.

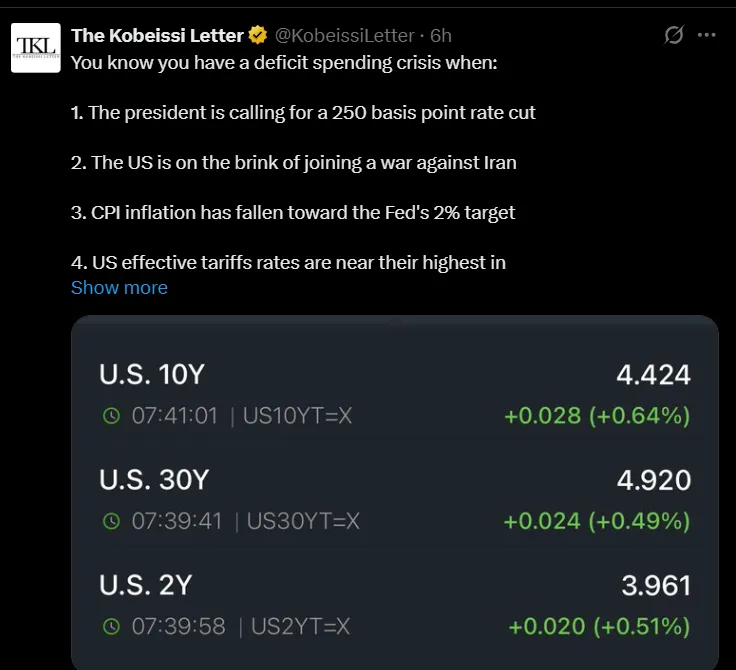

A report by The Kobeissi Letter summed up the current situation in five shocking points:

Source: X

Tensions with Iran could pull the U.S. into war.

Inflation (CPI) is dropping close to the Federal reserve's 2% goal.

U.S. tariffs are near their highest levels in history.

The Federal reserve started cuts with a 50 bps slash—the first time since 2008.

Yet despite all this, interest rates are still rising in the bond market. Something isn’t adding up. And that’s what’s fueling fear and opportunity.

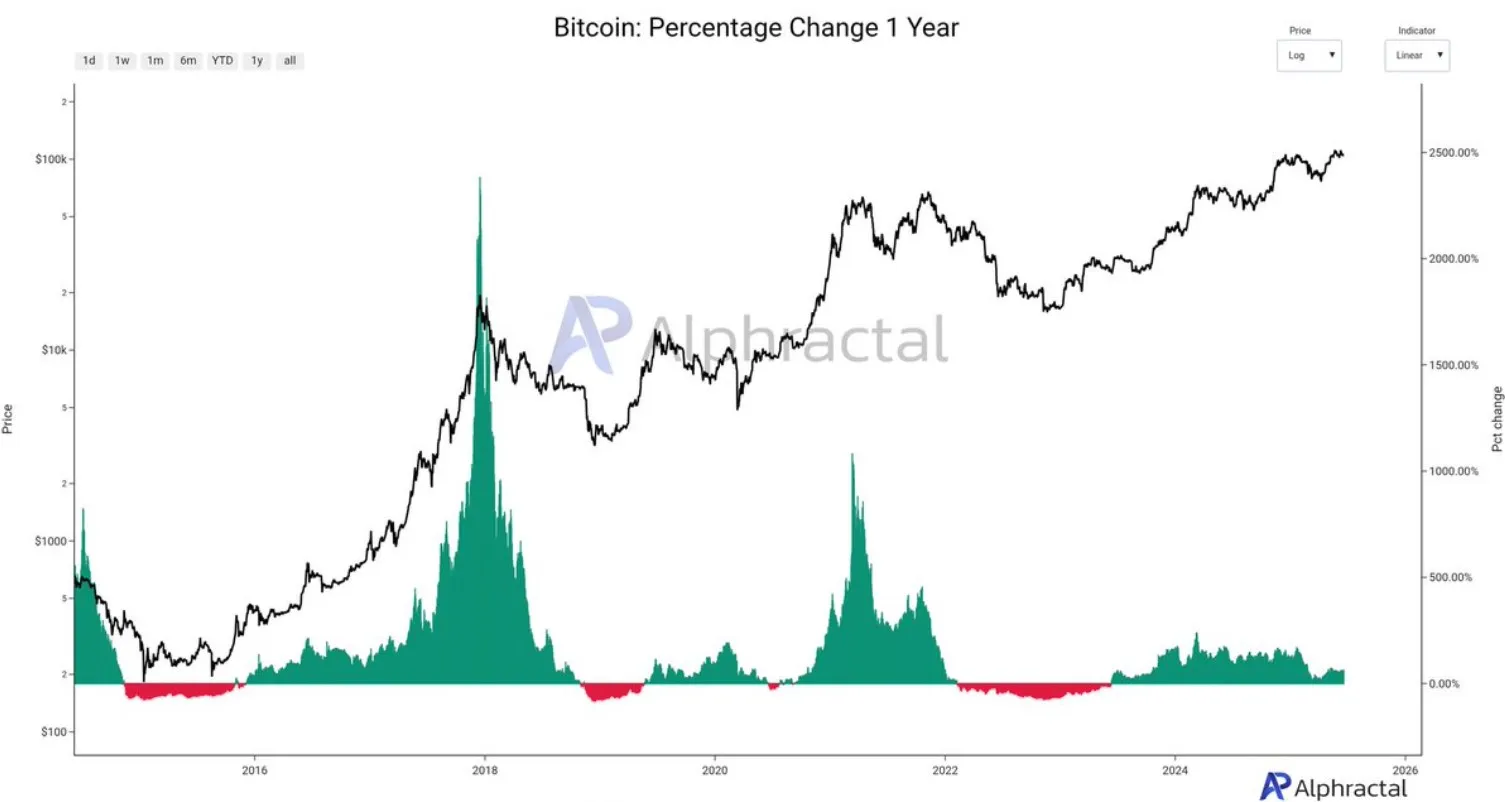

While $BTC trades above $102,000, some say it doesn't feel like a bull run. Analyst CryptoGoos called it the “weakest Bitcoin cycle ever” in his latest post.

Source: X

After Waller's speech Bitcoin price crashed, it is down 1.73% in 24 hours, sitting at $102,975.68. This has sparked questions like:

Is the currency already overpriced or did the governor hinted something?

Or is it just waiting for the Fed rate cut July trigger to shoot higher?

The Federal Reserve July FOMC meeting is just weeks away. Markets are now pricing in a possible 25 to 50 basis point reductuion, the first such move since 2020.

That’s why this rate cut news today is not just for Wall Street. Crypto traders, hedge funds, and even AI models are aligning positions ahead of this date. If Waller speaks again or CPI drops further, expect more momentum.

If this price reduction is the turning point, here’s what could follow:

Short-term: High volatility around this meeting could push the coin crash around $$99,000, based on its current crash .

Mid-term: BTC retests $110k–$120k based on liquidity surge.

Long-term: If price stay low, Bitcoin price prediction 2025 could aim for $180k–$250k range.

But as per Coingabbar’s top analysts, if the Fed U-turns again due to war, inflation, or debt ceiling issues, that outlook could change fast.

The crypto market may seem dull now, but macro pressure is building. As Fed Governor Christopher Waller speaks, and the world listens, remember one thing: markets don’t move when you expect them to. They move when you're not ready. And if the Fed rate cut July happens, Bitcoin price won’t stay quiet.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.