The cryptocurrency is facing a sudden drop today, leaving traders and investors asking: Why Is Crypto Down Today? According to CoinMarketCap, the total market cap is now $3.99 trillion, down 2.94%, while 24-hour trading volume jumped 20.38% to $292.82 billion.

This sudden drop shows that markets are nervous, and many are wondering if this crash will continue or recovery ahead.

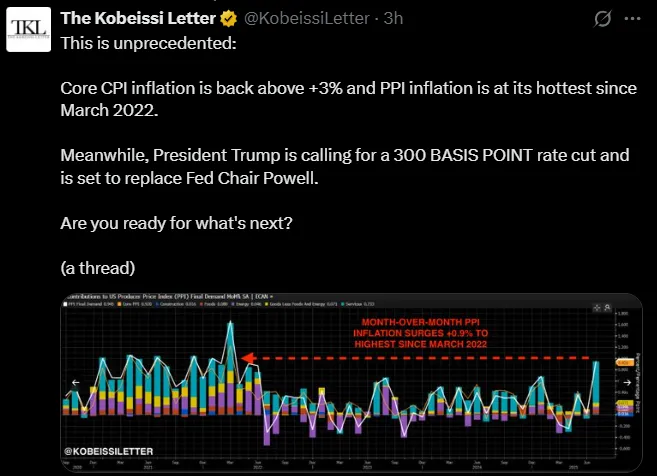

Even Core PPI inflation climbed to 3.7%, higher than the predicted 2.9%. Month-over-month, inflation is now the hottest since March 2022 as per The Kobeissi Letter X post.

This news worries traders because it may force the Federal Reserve to tighten policies triggering the rate cut buzz. Many are asking: why did cryptocurrency crash and will it recover? Clearly, rising inflation is one of the top crypto down reasons.

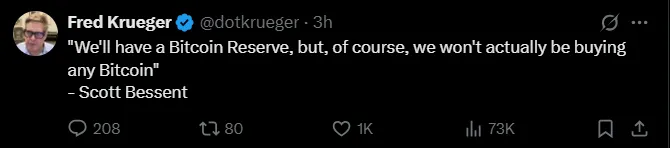

No Bitcoin Buy from U.S. Treasury: Adding to the pressure, Treasury Secretary Scott Bessent said the U.S. will not buy any Bitcoin and use reserve assets as the backup.

Earlier, some investors hoped that government purchases could support prices. Now, Bitcoin has fallen to $117,939.53 after briefly reaching $124,000. The lack of a US Bitcoin Reserve makes traders cautious.

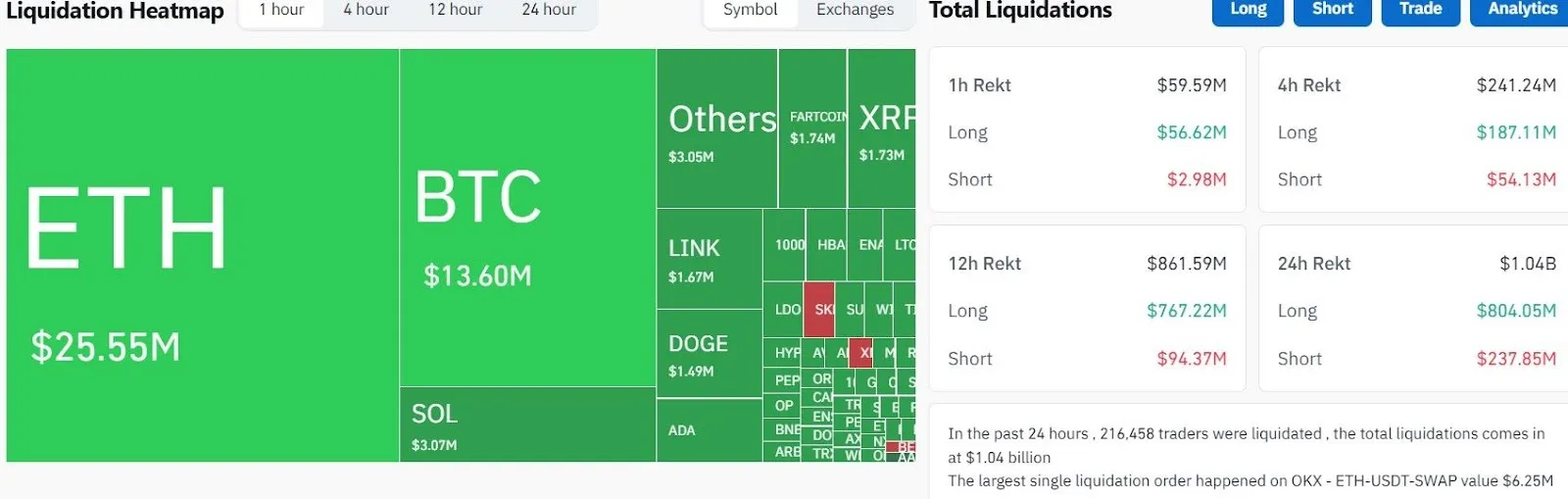

Liquidations Wipe Out Billions: In the latest crypto news today, the third reason is massive market liquidation. Over the last 24 hours, $1.04 billion in positions were liquidated, affecting 216,000 traders.

Long positions suffered the most with $803.22 million lost, while shorts lost $237.89 million. Ethereum had the largest single-asset liquidation at $25.55 million, followed by Bitcoin at $13.60 million. Forced selling like this causes a chain reaction, making prices fall across all major coins.

Despite the crash, the Fear & Greed Index is at 75 (Greed). This shows that investors still feel confident and are ready to take risks. Compared to last week’s 62 and last month’s 73, the industry still has some strength.

So traders asking, will the crypto market recover could take the breath of relief for now, as per the sentiment index.

Note: High greed can also mean the marketplace is overheated. So even though the index acts like a knight in armour, it’s also a warning for possible sudden drops.

So, Why Is Crypto Down Today? The main reasons are rising inflation (US PPI data surge), no new Bitcoin purchases by the U.S. Treasury, and massive market liquidation.

Traders should be careful. Some may see this as a chance to buy, but the industry is still volatile. Will Bitcoin and Ethereum recover fast, or is this the start of a bigger correction? Only time will tell. The key is to watch the market closely and avoid taking unnecessary risks.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.