The cryptocurrency market faced a significant surge in volatility over the weekend, with all the top ten largest cryptocurrencies by market capitalization trading in the red.

Although signs of recovery have emerged, the total market capitalization remains down by 2.92% over the past 24 hours, settling at $3.25 trillion at press time.

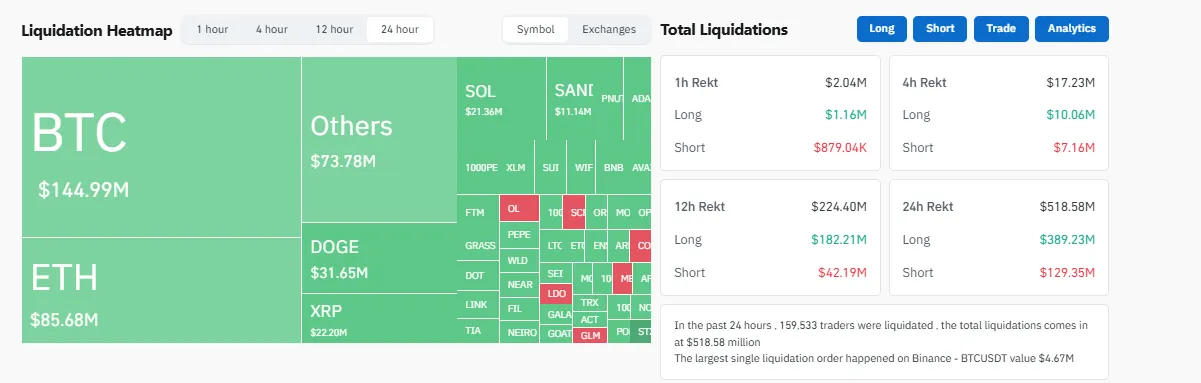

$518 Million Liquidated in 24 Hours

According to data from Coinglass, the crypto market experienced massive liquidations, with over $518.64 million wiped out in just 24 hours. This impacted more than 159,539 traders globally.

Traders holding leveraged long positions faced the most substantial losses, with over $389.30 million being liquidated. Bitcoin was notably affected, recording $33.28 million in liquidations—the highest single-day long liquidations on BTC in over a week.

Despite the recent market pullback, overall sentiment remains optimistic. The Fear and Greed Index currently stands at 79, reflecting a state of "extreme greed."

This high level of confidence among traders signals strong optimism, but it also raises caution. Historically, such extreme readings can indicate the potential for a trend reversal or a market correction. Traders should remain vigilant for signs of profit-taking, as it could trigger further declines in market prices.

Solana-based memecoin launchpad Pump Fun has indefinitely suspended its live streaming feature following reports of misuse. The platform emphasized that this is a temporary measure aimed at addressing the issues, not a permanent removal of the feature.

U.S. Bitcoin ETFs experienced substantial outflows on Monday, coinciding with Bitcoin's dip below $93,000. Collectively, the eleven spot Bitcoin ETFs recorded net outflows of $435 million. Notably, BlackRock's iShares Bitcoin Trust (IBIT) and Grayscale's Bitcoin Mini Trust (BTC) were exceptions, attracting inflows during this period.

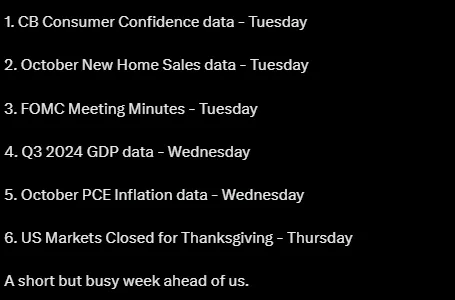

The cryptocurrency market is poised for a pivotal week with the upcoming release of key economic indicators, including the U.S. Personal Consumption Expenditures (PCE) inflation data, Federal Open Market Committee (FOMC) minutes, and Q3 Gross Domestic Product (GDP) figures. Investors are closely monitoring these events to assess their potential impact on asset prices.

Bitcoin's recent surge is encountering significant resistance at the $100,000 mark, prompting concerns about a possible downturn. A leading trader has cautioned that if Bitcoin fails to surpass this critical threshold, it could experience a correction, potentially declining to as low as $85,600 in a worst-case scenario. This warning comes as the cryptocurrency's momentum appears to be waning after approaching the $100,000 milestone.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

3 months ago

Cryptocurrency mining news

3 months ago

Blockchain integration in business