The global crypto market is seeing a drop today, and many investors are asking what’s going wrong. According to CoinGecko, the total crypto market cap is around $3.44 trillion, showing a 3.1% fall in the last 24 hours. Even though the 24-hour trading volume is high at $164 billion, some serious issues are pulling it down.

Spot Bitcoin ETF Inflows Drop, Investor Confidence Shakes

One of the biggest reasons for the drop is the sharp decline in spot Bitcoin ETF inflows. These crypto ETFs have been a strong support for Bitcoin (BTC) prices in the past. But recently, inflows have slowed down a lot:

Source: SoSoValue

On May 12, total daily net inflows fell to $5.10 million

Just a few days earlier on May 9, the net inflow was $334.58 million

This shows that investor interest in Bitcoin ETFs is cooling off

Even though the total value of assets held in Bitcoin ETFs is still $119.67 billion, this slowdown reflects growing fear among investors. At the time of writing, Bitcoin's price is around $103,478.76, dropping 1% in 24 hours. Its marketcap stands at $2.05 trillion, but the weakening support is making it harder for prices to stay stable.

Curve Finance Hack and US-China Trade Pause Add More Pressure

Another big reason behind the dip is a security breach at Curve Finance, a popular DeFi platform. Reports suggest that the site may have been hijacked using a DNS attack. Other projects like Convex and Resupply said their platforms are safe, but since Curve’s data feeds are affected, many users and investors are being cautious.

In global news, the US and China have agreed on a 90-day pause in their trade war. While that might sound like good news, the uncertainty over what comes next is making investors nervous. Tariffs had gone as high as 34%, especially over issues like fentanyl sales. Now, with a temporary stop in place, long-term crypto investors are waiting to see if this is a real solution or just a break in the storm.

Whale Dump of Trump Coin and Sentiment Worsens

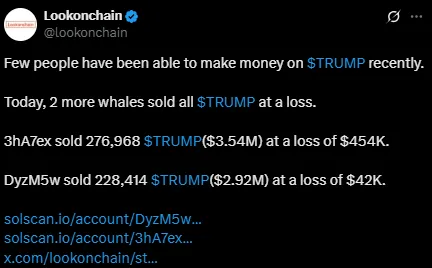

Adding to the panic, two big whales sold all their Trump Coin ($TRUMP) holdings at a loss, which pushed the token’s price down by 11%. According to Lookonchain:

Source: X

Wallet 3hA7ex sold 276,968 $TRUMP for $3.54 million, losing $454K

Wallet DyzM5w sold 228,414 $TRUMP for $2.92 million, losing $42K

After the sale, Trump Coin price is now $12.82 with a market cap of $2.56 billion. These types of massive sell-offs destroy confidence in the entire industry, not even in one token.

The Fear and Greed Index, which indicates the mood of the investors, is 70 (Greed). Although this may seem nice, it also indicates that the market is due for a correction. Here is a quick glance:

When the industry becomes too greedy, the market will self-correct — and that's what may be in the process of taking place now. Everything combined is destroying investor confidence. While some traders are viewing this fall as a time to buy, others are waiting for more news.

For now, it makes sense to stay knowledgeable, monitor the actions of the sector carefully, and not jump into trades without a good strategy.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.