The crypto market is once again making headlines with its strong performance. Today, the total market cap of all cryptocurrencies has reached $3.42 trillion, showing a small but steady 0.1% rise in the last 24 hours. Trading volume has also been active, with around $137 billion moved in the last day. Bitcoin continues to dominate with 60.2% market share, while Ethereum holds 8.5%.

So, what’s causing this fresh boost in the crypto world? Let’s break it down in simple words.

Coinbase Starts 24/7 Futures Trading in the U.S.: One of the biggest reasons for the current industry jump is Coinbase’s new move. On May 9, 2025, Coinbase launched 24/7 Bitcoin and Ethereum futures trading in the U.S. through its CFTC-regulated platform, Coinbase Derivatives LLC. This is a big deal because it's the first time a U.S.-regulated exchange allows traders to trade futures around the clock—day or night, even on weekends.

Source: Coinbase

Before this, traders in the U.S. were stuck with limited trading hours. Now, they have full freedom to react to changes at any time, making it easier to manage risks and take action fast. This has brought fresh excitement and more activity to the crypto space.

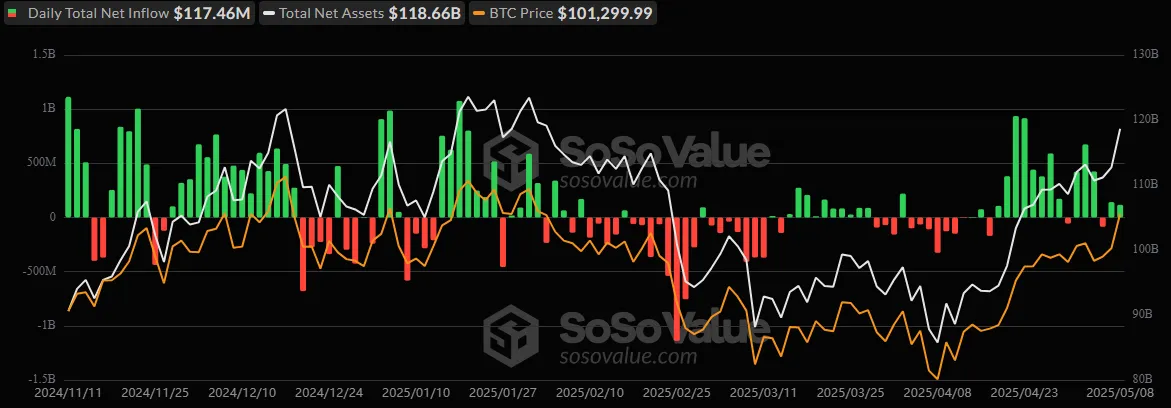

Bitcoin Spot ETF Sees Strong Inflows: Another major reason is the strong inflows into Spot Bitcoin ETFs. According to recent data:

Source: SoSoValue

Weekly net inflows: $599.59 million

Monthly inflows: $1.70 billion

Single-day inflow (May 9): $321.46 million

In total, these ETFs have collected about $41.16 billion in net inflows, and their total assets are now worth $121.19 billion. This is nearly 6% of Bitcoin’s full market cap, showing how much confidence investors have in Bitcoin right now. as of now, BTC is trading at $103,620.62, with an intraday surge of 0.22% with $2.05T in market cap.

Galaxy Digital Gets SEC Green Light for Nasdaq Listing: Galaxy Digital has received a green signal from the U.S. SEC to move its registration to Delaware. The company is now preparing for its Nasdaq listing under the symbol “GLXY”. This shows that big crypto firms are working hard to become part of traditional U.S. financial markets, which could mean more trust and stability in the future.

Lastly, the Fear and Greed Index—which tells us how investors are feeling—is now at Greed (70). Last month it was Fear (39), so the mood has clearly shifted. However, experts say that when greed is high, the sector might see a correction soon.

In the future, the cryptocurrency market may continue to evolve as long as such favorable trends last. The U.S. Federal Reserve still maintaining interest rates at a level of 4.25% to 4.5% still leaves room for crypto to stay stable.

But, as usual, the sector is extremely volatile. While all seems well at the moment, investors have to be careful. Prices can soar and plummet quickly, and anything can go wrong.

Disclaimer: The content is for general information purposes only and should not be taken as an investment suggestion. Always do your own research or consult with a financial advisor before investing in crypto.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.