A fresh case of WLFI Whale Accumulation is making waves in the crypto market after blockchain showed a new wallet buying millions of tokens. Large purchases like this often grab attention because they can hint at what bigger investors are thinking.

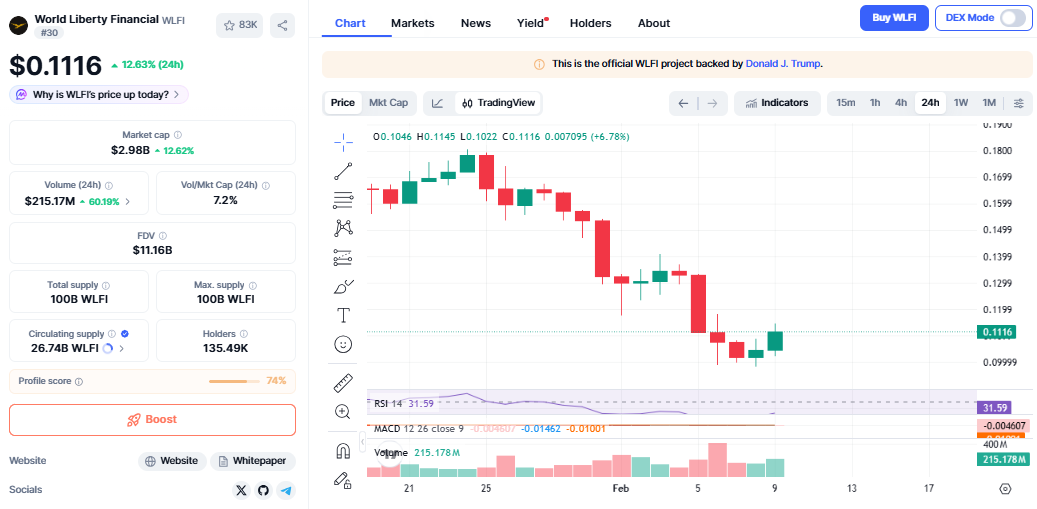

It is trading close to $0.111, up around 11% in the past day. The broader market has been uneven, but the token managed to move higher. Many traders believe the recent WLFI Whale Accumulation is playing an important role in this rise.

Source: CoinMarketCap Chart

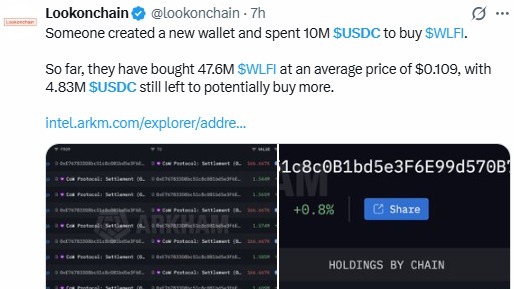

On-chain tracker Lookonchain reported that a newly created wallet used about 10 million USDC to buy WLFI. So far, the wallet holds roughly 47.6 million tokens, purchased at an average price near $0.109. It also still has about $4.83 million left, meaning more buying could happen.

Source: X (formerly Twitter)

This type of buying usually does not come from short-term traders. It often suggests a planned strategy. When investors accumulate slowly instead of rushing in, they are usually thinking beyond quick profits. The ongoing World liberty financial token Whale Accumulation could also limit how many tokens are available on exchanges, which sometimes helps prices stay firm.

For many market watchers, moves like this signal confidence.

World liberty financial is not the only token moving. Traders appear to be shifting money into mid-sized crypto projects that show momentum. Several similar tokens have posted strong gains recently, pointing to a broader trend rather than a single event.

This environment has helped the latest WLFI Whale Accumulation stand out even more. Still, momentum-based rallies can cool off fast if traders decide to lock in profits.

Another reason the price jump looks meaningful is the rise in trading activity. It recorded about $213 million in 24-hour volume, a sharp increase from the previous day.

Higher volume often means real buyers are stepping in instead of the price rising on thin trades. Combined with the steady WLFI Whale Accumulation, it suggests the current move has some support behind it.

Analysts usually prefer to see volume stay high if a token wants to continue climbing.

A few recent updates have also brought attention to the project. Reports of meetings involving major financial players have added a layer of credibility. At the same time, a Binance wlfi airdrop is attracting new participants and boosting liquidity.

The project has also shown interest in expanding into banking services and real-world assets, which could signal longer-term goals. Even regulatory attention linked to a major investment has increased visibility.

All these factors create a stronger backdrop for continued World liberty financial Whale Accumulation.

Right now, $0.10 looks like an important level for the token.

Bullish Case: If the price stays above it, the token could try to move toward $0.12 in the near term.

Bearish Case: But if support breaks, the price may slip closer to $0.09, especially since overall crypto sentiment remains fragile.

In simple terms, the trend looks positive but not risk-free.

The latest WLFI Whale Accumulation shows how big investors can influence market direction. Strong buying, higher volume, and growing attention are helping the token hold its ground.

Still, the next move will likely depend on whether whales keep buying and if the market stays supportive. Traders will be watching closely to see if this momentum continues or slows down.

YMYL Disclaimer: This article is for informational purposes only, kindly do your own research before investing in crypto market.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.