Crypto markets are bleeding, fear is extreme, and yet Xenea wallet just pushed a major upgrade. With $430B wiped from the market in four days and Bitcoin under pressure, silence around the Xenea listing date and price is raising one sharp question—delay, or strategic timing?

As the crypto market struggles under heavy macro pressure, the Xenea wallet listing update has once again become a key topic among traders. The release of Xenea Wallet Version 2.2.1 has restarted discussions that were quiet for months, especially after the earlier Q4 2025 listing plan was postponed. While the update signals technical progress, broader market stress continues to shape expectations around when $XENE may finally reach exchanges.

According to the latest update from the official X account, Version 2.2.1 is now live on both the Play Store and App Store. Users have been advised to download and upgrade to ensure compatibility with upcoming blockchain developments.

The original Xenea wallet listing date was planned for quater-4 2025. However, that period turned into one of the weakest phases for crypto markets in recent years. Bitcoin faced sustained bearish pressure in Decemebr 25, as global macro risks intensified.

Key concerns included the Bank of Japan’s interest-rate stance, weak PPI data, disappointing jobless claims, and a sharp drop in overall market breadth.

By December, the Top 200 Crypto Index reached extreme levels on the 365-day New Lows indicator—conditions last seen during Q1 2019 and Q3 2022, both deep bear-market phases. Under such fragile conditions, launching a new token carries a high structural risk. This explains why the project chose caution over speed.

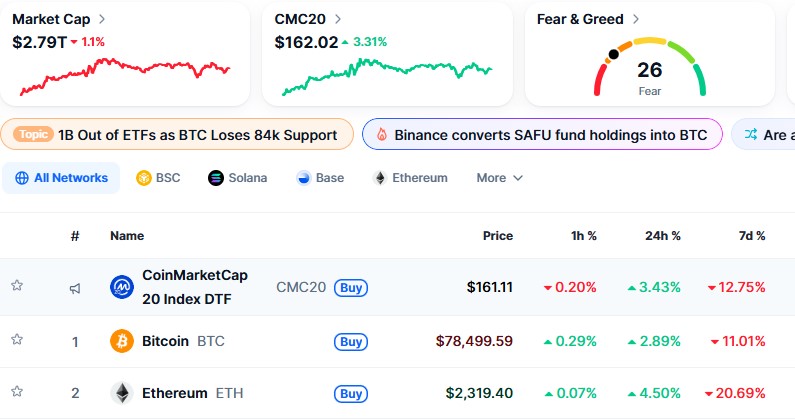

Even though the calendar has moved into Q1 2026, the crypto market crash remains harsh. Bitcoin has fallen nearly 10% in a week to around $78,510, while Ethereum is down close to 20%, trading near $2,321.

In just four days, the total crypto market lost about $430 billion, with the Fear & Greed Index dropping to 17, signaling extreme fear. Historically, such signals are negative for risk assets like crypto.

CoinGabbar experts note that the Version 2.2.1 release strengthens the case for a late-Q1 listing date, potentially in March, if liquidity conditions improve.

However, given ongoing stress, a shift to quater-2 2026—most likely April or May—appears more realistic from a risk-management standpoint.

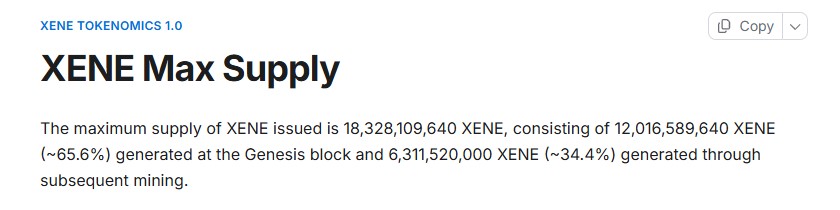

From a fundamentals view, $XENE tokenomics builds confidence among investors before the debut. The maximum supply is capped at 18,328,109,640 coins as seen in the chart.

Out of this, 12,016,589,640 tokens (about 65.6%) were issued at the Genesis block, while 6,311,520,000 tokens (around 34.4%) are reserved for mining rewards that begin only after mainnet launch.

There is no inflation beyond this cap. The team has confirmed that Genesis allocation and lockup details will be shared shortly before mainnet, and wallet-level KYC is generally not required.

The $XENE Wallet Version 2.2.1 has revived confidence, but macro pressure still dominates. Market analysts widely agree that launching a new token during extreme fear often leads to heavy selling and weak price discovery.

The current silence around the Xenea wallet airdrop listing date reflects caution, not poor communication. For investors, patience and risk awareness remain essential.

YMYL Disclaimer: This article is strictly for information only, and does not support any financial advice. The cryptocurrency market is highly volatile, so readers should do their own research before investing in any token.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.