The latest update from recent highlights a strong shift in professional investment trends as XRP Outperforms major digital assets in institutional capital inflows. According to CoinShares data, The token attracted about $150 million in fresh allocations this year, even while the broader environment remained risk-off. In contrast, Bitcoin and Ethereum experienced roughly $1.5 billion in combined withdrawals from investment products. This divergence signals a clear capital rotation toward payment-focused blockchain infrastructure, with analysts pointing to utility narratives, ETF exposure, and enterprise adoption as key drivers behind the momentum.

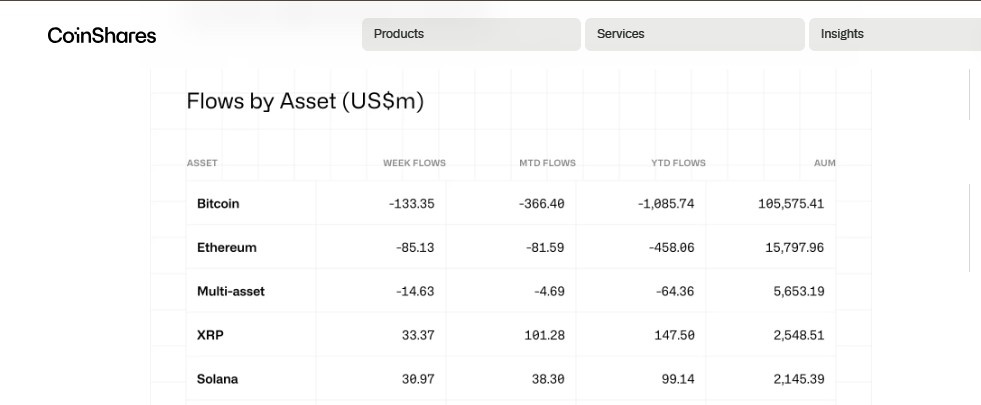

CoinShares reported sustained inflows into XRP-linked products, while competing assets recorded persistent withdrawals.

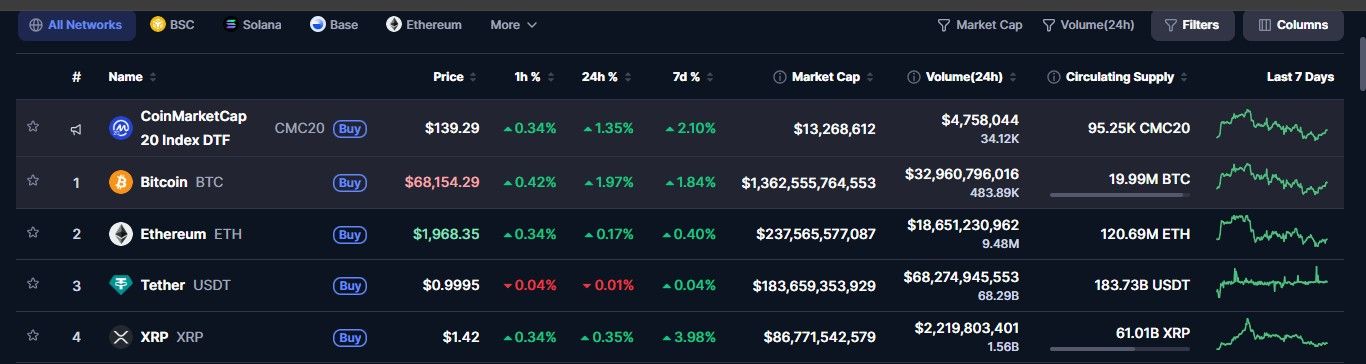

CoinMarketCap price snapshots show XRP trading near $1.42, Bitcoin around $68,154, and Ethereum close to $1,968 during the reporting window.

Additional weekly datasets indicated about $63.1 million inflows into XRP at one point, outperforming several competing altcoins combined. Another period showed $33.4 million entering XRP products, while Bitcoin saw approximately $133 million withdrawals and Ethereum around $85 million outflows. Over a longer timeframe, year-to-date allocations reached roughly $109 million, reinforcing consistent institutional interest.

Structured investment vehicles tied to blockchain experienced steady demand, including a single-day inflow of nearly $46 million after launch activity.

Institutional disclosures revealed around $152 million exposure from a major global bank, representing roughly 14% of its ETF allocations.

Relative performance metrics also strengthened the narrative. Market analytics showed XRP gaining roughly 15–20% during certain recovery phases while Bitcoin and Ethereum lagged. In ratio terms, The token appreciated about 20% versus Bitcoin in comparative performance metrics. Some broader research estimated approximately $1.3 billion in activity tied to token-related institutional positioning and whale accumulation, suggesting deeper market engagement.

Real-world payment infrastructure remains the primary attraction for financial firms seeking faster settlement rails.

Existing partnerships with banks and payment providers provide confidence in long-term adoption.

Unlike speculative tokens, it focuses on cross-border settlement, enabling near-instant transactions at lower cost compared with legacy systems such as SWIFT. This functional design positions the asset as infrastructure rather than purely a trading vehicle. Growing ETF availability further supports professional participation by offering regulated exposure.

From a strategic perspective, XRP Outperforms narratives are linked to capital rotation themes where investors diversify beyond large-cap assets into utility-driven networks. During uncertain macro conditions, infrastructure-focused tokens often attract attention due to perceived real-world demand and enterprise integration potential.

Borrowing frameworks, liquidity bridges, and tokenization tools on the XRP Ledger expand financial use cases.

Proposed lending vault models aim to deliver institutional credit products directly on blockchain rails.

For customers, benefits include cheaper remittances, faster international transfers, and enterprise-grade payment capabilities. For institutions, advantages extend to liquidity management, settlement efficiency, and tokenized asset experimentation. These features help explain why capital continued flowing towards token while competing assets saw withdrawals.

The broader implication suggests growing recognition of blockchain networks as financial infrastructure. As tokenization and real-world asset markets expand, payment-focused ecosystems could receive increasing allocations from professional portfolios.

The latest data confirms XRP Outperforms competitors in institutional capital rotation. Strong inflows, ETF demand, and payment utility are reshaping investor perception, positioning it as an infrastructure within digital finance while highlighting shifting priorities across professional crypto portfolios globally.

This content is for informational purposes only and does not constitute financial or investment advice. Readers should conduct their own research before making financial decisions

Krishna Tirthani is a dedicated crypto news writer with 1 year of hands-on experience in the cryptocurrency market. With a strong focus on market trends, token launches, price movements, and blockchain innovations, Krishna delivers timely, accurate, and easy-to-understand crypto content for both beginners and experienced investors.

Over the past year, Krishna has closely followed major developments across Bitcoin, Ethereum, altcoins, DeFi, NFTs, Web3, and emerging crypto projects. His writing style blends data-driven insights with clear explanations, helping readers stay informed in a fast-moving and often complex market. From breaking crypto news and exchange listings to tokenomics analysis and price predictions, his work aims to simplify information without losing depth.

Krishna believes that credible research, transparency, and consistency are essential in crypto journalism. Each article is crafted with SEO best practices in mind, ensuring high visibility while maintaining originality and factual accuracy. His growing experience in the crypto space allows him to spot early trends and explain their potential impact on the wider market.

With a passion for blockchain technology and digital assets, Krishna Tirthani continues to evolve as a crypto writer, committed to delivering reliable, engaging, and value-driven crypto news content.