YMYL Disclaimer: This content is for informational purposes only and not financial advice. Crypto markets are volatile, so always do your own research before investing.

The crypto industry saw a meaningful update after XRPL adds Token Escrow with the rollout of the XLS-85 amendment on the XRP Ledger mainnet. RippleX confirmed that over 88% of validators supported the upgrade, showing strong agreement across the network.

Until now, escrow was mainly used for XRP. With this update, it can also be applied to trustline-based tokens and Multi-Purpose Tokens once issuers turn on the required settings. In simple terms, more assets on the XRP Ledger can now be locked safely until certain conditions are met.

The announcement came soon after XRP Community Day, where Ripple leaders spoke about building a blockchain that institutions can comfortably use.

Escrow works like a digital safety lock. Tokens are held securely and released only when preset rules such as time or payment conditions are completed. As XRPL adds Token Escrow, projects and companies get better control over how and when tokens move.

Source: X (formerly Twitter)

Some practical uses include:

Releasing team tokens gradually

Making conditional business payments

Handling secure OTC trades

Automating settlements

Managing institutional funds

In addition, RippleX described that "The goal isn’t just to lock your tokens but to make moving value on the network safe and predictable. And particularly, this would be important to financial organizations before they ever use a technology like this."

This update also comes at a period when tokenization has started receiving attention. In fact, Ripple has already partnered with a major asset manager like Aviva Investors on exploring the possibility of putting traditional funds on the blockchain.

There are many people in the crypto industry who think upgrades like this help to create more trust in the field. When the XRPL Ledger upgrades, it makes it easier to support stablecoins, tokens, and other financial products that require security.

Ripple President Monica Long recently said the ledger is moving closer to becoming a preferred platform for institutional DeFi. Features that improve transparency and reduce risk often make blockchain more appealing to large investors.

Ripple has also hinted that more tools including lending features and privacy technology could arrive later this year, suggesting the ecosystem is still expanding.

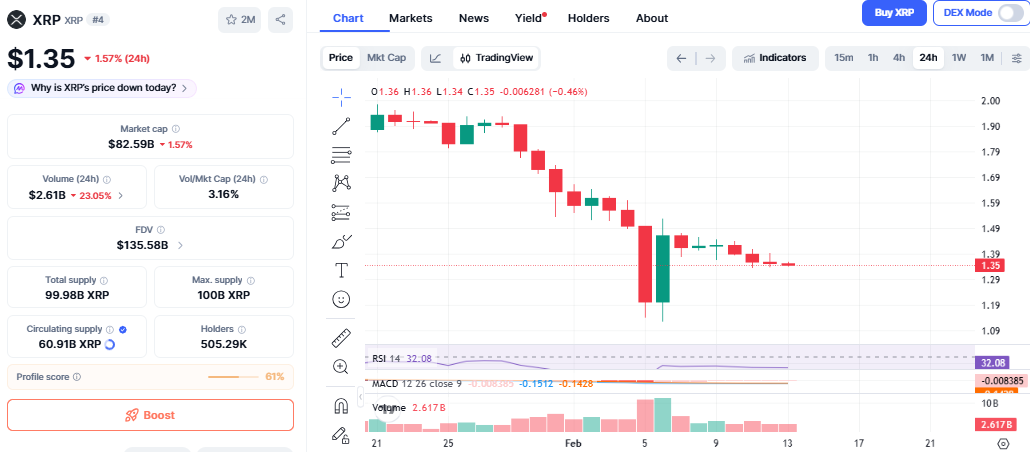

Even with the positive news, XRP news today shows the token trading around $1.35, slightly lower in the past 24 hours. The dip appears to be linked to overall market caution rather than any problem with token itself.

Source: CoinMarketCap Chart

Market Trend:

Crypto buying has slowed recently, and XRP is moving in line with the broader market.

Technical Signals:

The token is trading below key short-term levels, which shows sellers are still active. However, the RSI is near 32, an area often seen as oversold. This can sometimes signal that selling pressure is easing.

The $1.36 level is important right now.

Bullish Case (If buyers defend it): It could stabilize and try to move back toward $1.41.

Bearish Case (If it falls below): The price may revisit the earlier low near $1.13.

Short-term swings are possible, but stronger network upgrades could support confidence over time.

As XRPL adds Token Escrow, the ledger is slowly shifting from a payments-focused network toward a broader financial platform. Security tools like escrow help reduce risk, which is exactly what institutions look for before bringing money on-chain.

With rising partnerships and steady development, XRPL appears to be preparing for a future where blockchain plays a bigger role in traditional finance.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.