Is the world’s most bizarre crypto bet heading toward a scandal? A prediction market on Polymarket—asking if Ukrainian President Volodymyr Zelenskyy wore a suit before July—has turned into a $160 million controversy.

Despite photos, designer confirmations, and mainstream media coverage showing that he did appear in formal attire in June, the market is being pushed toward a “NO” resolution.

In the latest Zelenskyy news today, this chaos was first flagged by Coin Bureau’s recent post on X, sparking confusion and backlash from crypto users, traders, and observers.

Source: Coin Bureau

The question at the center of it all — Did Zelenskyy wear a suit before July? — has a very clear answer: Yes, he did.

The designer who created the attire confirmed it was worn at an official event in June.

Major media outlets including the BBC and Reuters reported on his appearance.

He himself acknowledged wearing the formal wear.

According to many users, this is nothing short of a scam against the “YES” side, with some calling it “a blatant manipulation in plain sight.”

The whole situation has raised serious concerns — why is Polymarket saying no on Zelenskyy suit, even when the proof is obvious and verifiable?

This isn’t just a misunderstanding—it’s potentially a manipulated outcome using oracle flaws in the crypto market. The UMA protocol, which powers the resolution system behind this Polymarket question, uses validator voting. And that’s where the trouble begins.

Popular X account Chart Simpson highlighted something unusual:

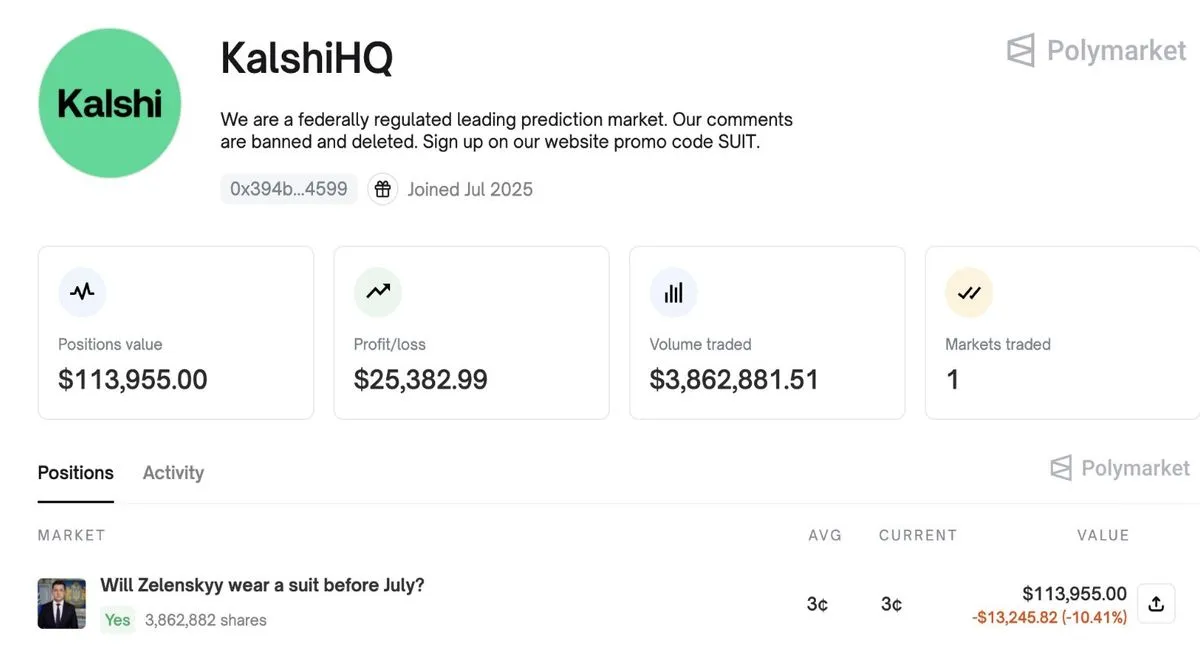

An account possibly linked to Kalshi, a regulated competitor, took a $127,000 YES position.

Many believe this is a legal trap, a strategy to sue Polymarket if the market is resolved as “NO” against factual evidence.

This shows how powerful players may be exploiting weaknesses in UMA’s oracle system.

The latest Polymarket news today shows clearest evidence of the manipulation’s effect in the chart itself.

Source: PolyMarket

Earlier in June, confidence in the “YES” side surged, with industry odds reaching 30%.

But as July neared, and oracle manipulation rumors grew, those odds crashed to 4% by June 30.

Even though the evidence that he wore a formal wear before July kept mounting, the chart said otherwise. The crowd lost confidence—not in the answer, but in the system itself.

Being an experienced crypto writer, I believe, this kind of price behavior is usually seen during events like protocol hacks or whale manipulation.

All attention now shifts to July 8, the final resolution date of this wild prediction market. If the market resolves “NO,” it could trigger a legal battle like a ripple case, particularly if the rumored Kalshi-linked whale follows through.

But beyond just this one market, the Zelenskyy no suit scandal opens up larger questions:

Can decentralized prediction platforms be trusted?

And most importantly, who protects the retail traders when the truth is ignored?

With Zelenskyy suit prediction now one of the most discussed crypto controversies of 2025, all eyes are on July 8, not just for a result, but for what comes after. Whether or not Zelenskyy wore a suit isn’t the real issue anymore — it’s about whether decentralization can survive manipulation.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

3 months ago

Good