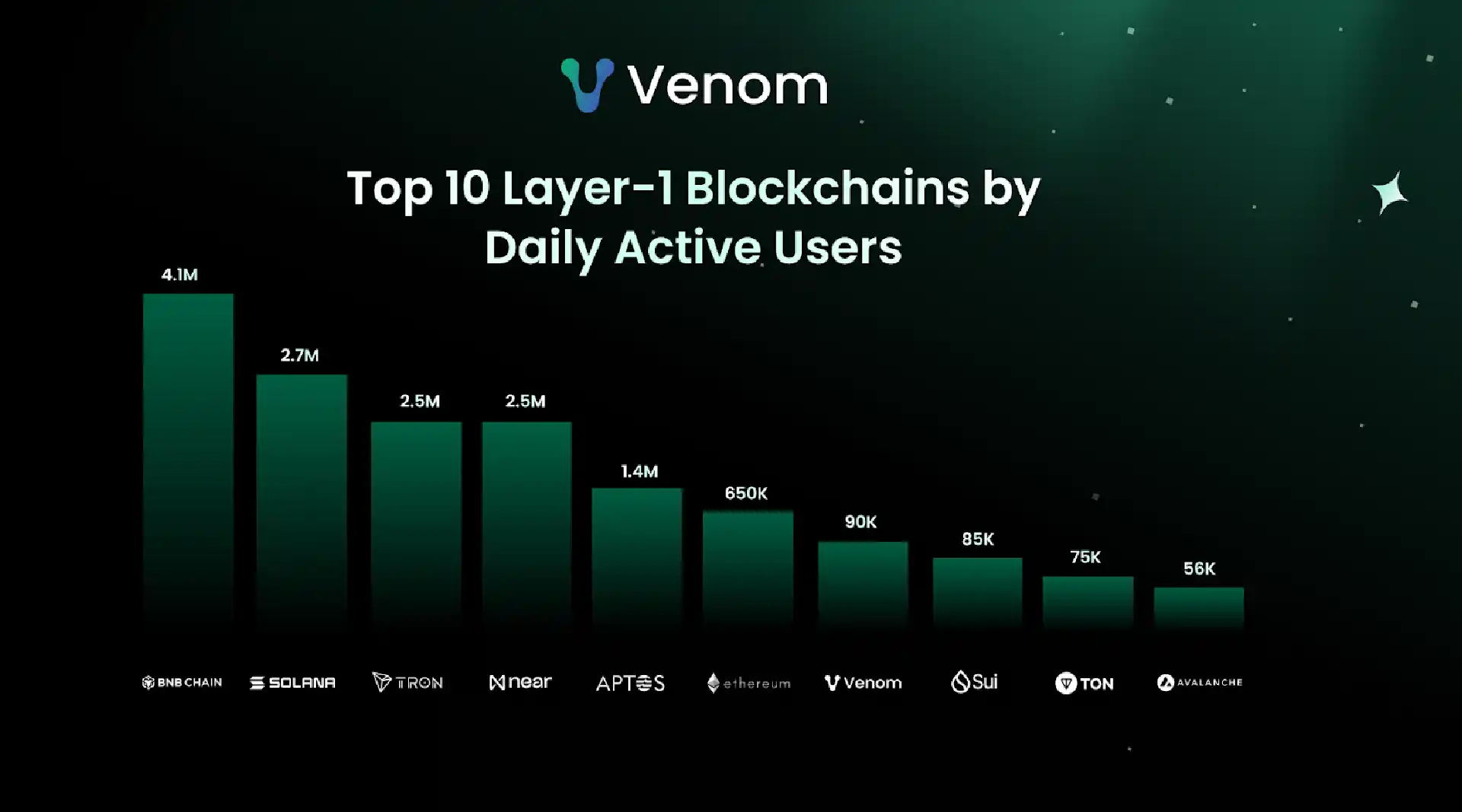

A ranking of the most-used Layer-1 Top Blockchains by daily active users has been published. The study reveals a clear division between mass-market networks and institutional platforms.

A new study has identified the top ten leading blockchains by actual usage. Unlike traditional market cap rankings, this analysis is based on daily active users (DAU), arguably the most direct indicator of practical technology adoption.

As of mid-January 2026, the top three leaders are BNB Chain with 4.1M DAU, Solana with 2.7M, and Tron with 2.5M users per day. These networks dominate thanks to low fees, high speed, and mass adoption in DeFi, meme coin trading, and stablecoin transfers.

The second tier consists of technologically advanced platforms targeting corporate and institutional segments: Aptos (1.4M DAU), Ethereum mainnet (650K), Venom (90K), Sui (85K), TON (75.6K), and Avalanche (56.4K).

Venom Foundation, an Abu Dhabi-based blockchain company, occupies a unique position in the ranking as specialized infrastructure for government and corporate solutions. Unlike retail platforms, Venom focuses on large-scale projects: CBDCs, real-world asset tokenization, and regulated stablecoins.

“We're not competing for retail meme coin users,” comments Christopher Louis Tsu, CEO of Venom Foundation. “Our target audience is central banks, sovereign wealth funds, and financial institutions that need infrastructure with 100,000+ transactions per second throughput, sub-second finality, and full regulatory compliance.”

Venom is built on a hybrid Layer-0/Layer-1 architecture with Mesh technology and dynamic sharding. In May 2025, the network successfully completed stress testing at 150,000 TPS and plans to reach 200,000 TPS by year-end. This performance is critical for servicing national payment systems and high-frequency trading of tokenized assets.

The study demonstrates clear blockchain market stratification: some networks are capturing millions of retail users through accessibility and viral products, while others are building the foundation for a regulated institutional economy. In 2026, both strategies are viable but serve fundamentally different segments.

Venom Foundation is a fintech company founded in Abu Dhabi, specializing in the development and implementation of high-performance blockchain solutions. Venom's mission is to provide blockchain infrastructure that streamlines financial services and is adaptable and scalable to the needs of massive national and international enterprises.

The Venom Foundation specializes in the creation, deployment, and integration of decentralized applications and services with a focus on security, speed, and regulatory compliance. The Venom network provides throughput capacity of up to 150,000 TPS with minimal fees and 99.99% uptime, supporting an ecosystem of DeFi, NFT, gaming, and enterprise solutions.

Contacts: Irene Kol, email: irene.kol@venom.network

https://venom.foundation

https://t.me/VenomFoundationOfficial

https://x.com/venomfoundation

https://discord.com/invite/venomfoundation

Mona Porwal is an experienced crypto writer with two years in blockchain and digital currencies. She simplifies complex topics, making crypto easy for everyone to understand. Whether it’s Bitcoin, altcoins, NFTs, or DeFi, Mona explains the latest trends in a clear and concise way. She stays updated on market news, price movements, and emerging developments to provide valuable insights. Her articles help both beginners and experienced investors navigate the ever-evolving crypto space. Mona strongly believes in blockchain’s future and its impact on global finance.