Aave price has soared to above $323 as it registered over 24% price growth in the past month, with powerful technical indicators, increased DeFi usage, and healthy on-chain development.

The asset is testing one of the major resistance areas that, should it be overcome, would precondition a further shift towards the $370-380 area.

Since the bottom of 2022, Aave price has been building a three-year ascending triangle on the monthly chart as each pullback draws in aggressive buyers.

Source : X

The daily chart reveals the asset pressing against an important resistance region, and RSI staying in the bullish range at 64.

Source : X

A break above this resistance may trigger an immediate run to $370-380, and a longer-term target is $459 and above.

Weekly and daily momentum indicators imply continued buying interest, and a golden cross formation earlier this year supports the same.

The market sentiment is positive with ETH approaching all-time highs, which can add more tailwinds.

Analysts observe that the performance of Altcoin and the strength of Ethereum has in the past been linked to major rallies in bull markets.

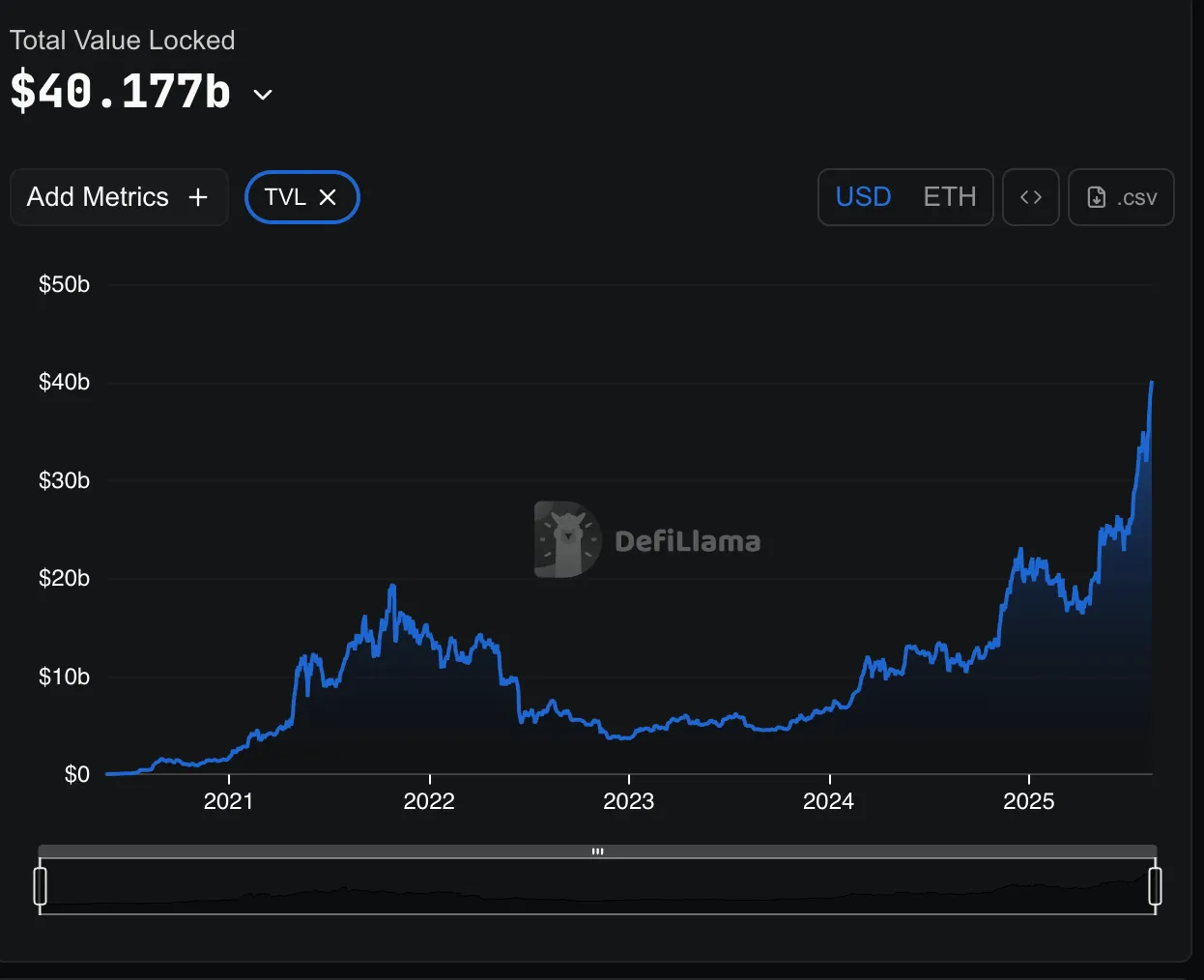

July was a breakout month of on-chain activity for Altcoin, as net deposits increased by 55% and reached over $60 billion at the beginning of August.

The total value locked (TVL) increased by 47.5% in July, aided by growth in liquid staking tokens such as cbETH, wstETH, and wETH on the Base network of Coinbase.

Source : DefiLlama

In Ethereum, TVL grew by 47% and TVL on Base was more than 40% to reach 1 billion.

Aave now comprises 28% of the total DeFi TVL, or deposits equal to major banks in the U.S. In this month alone, the lending protocol has facilitated $16.4 billion worth of loans, and the protocol has made $223 million.

These metrics underline the leadership role of the platform in the decentralised lending field and the interest of the institutions and retail customers.

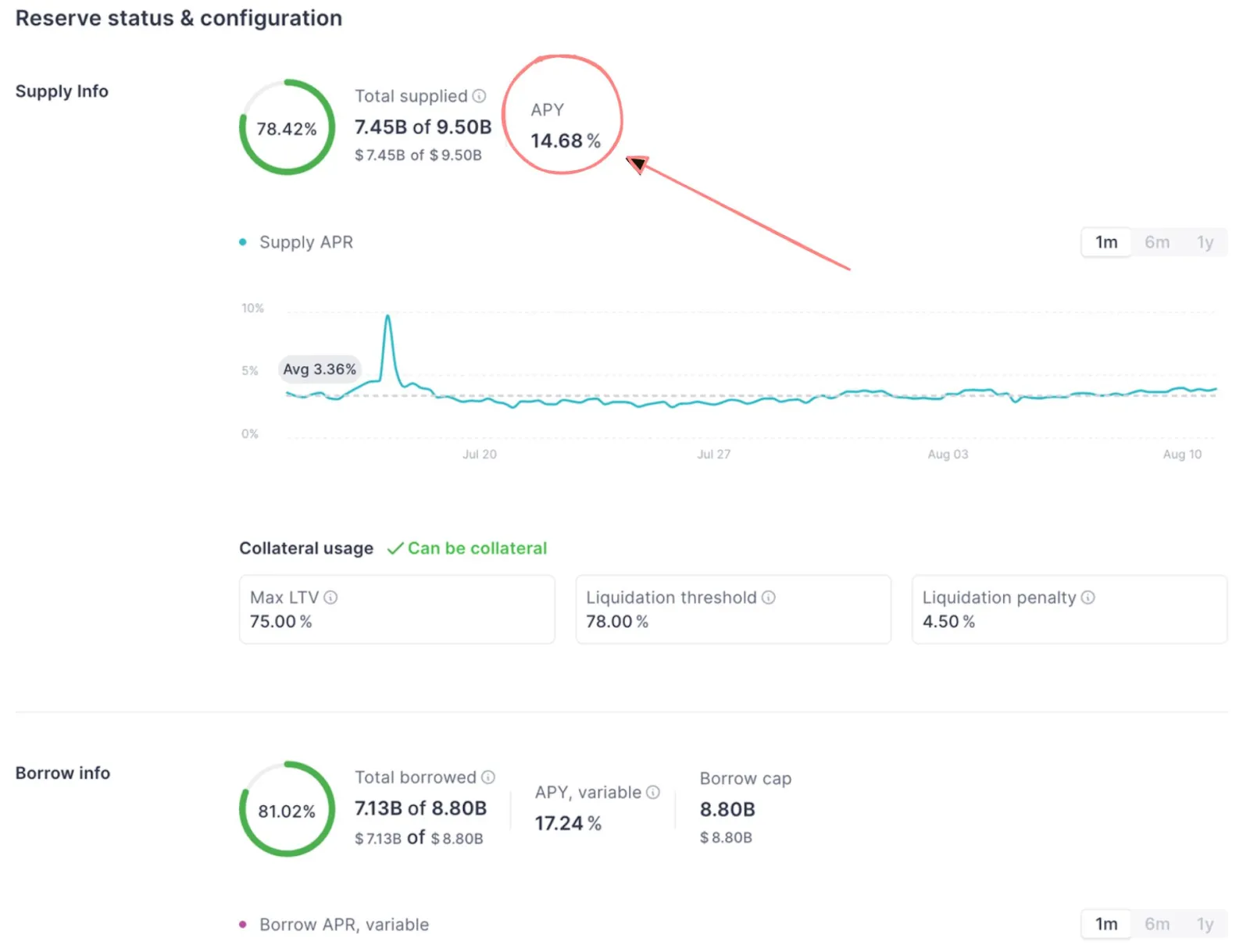

USDT supply APY on Altcoin has shot up to 14.68%, which is commonly seen during bull markets.

Borrow demand is also high, as 81% of the liquidity is utilized, and the variable borrow APY is 17.24%. This is an indicator of an active capital deployment and constant borrowing pressure, which strengthens the revenue streams of the platform.

Reserve Status & Configuration : Source : X

Whale buildup has been outstanding, with big wallets purchasing large amounts of Altcoin within the past few weeks.

This purchasing is in line with a more general trend toward long-term holding, with short-term traders de-emphasising speculative positioning.

These trends, together with the constriction of supply, can continue to boost the next leg up in Altcoin price.

Aave could explode past its short-term target of $380 with several catalysts. Indirect momentum could come via continued ETH strength and ETF inflows that are boosting overall DeFi valuations.

The platform has a cross-chain expansion, especially on Base, as well as innovations in the collateral offerings, which contribute to its competitive positioning.

Also, the persistence of high yields, the increasing institutional involvement, and positive regulatory trends in the U.S. may attract more capital to the protocol.

Ronny Mugendi is an experienced crypto journalist with four years of professional expertise, having made substantial contributions to multiple media platforms covering cryptocurrency trends and innovations. With more than 4,000 published articles to his name, he is dedicated to informing, educating, and bringing more people into the world of Blockchain and DeFi. Beyond his journalism work, Ronny finds excitement in bike riding, enjoying the adventure of exploring fresh trails and landscapes.