At press time, Cardano price was trading at $0.88 after increasing more than 11% in the last 24 hours. The trading volume also rose over 103%, as market data indicates that daily transactions surpassed the $2.5 billion mark.

Its market capitalisation is currently pegged at $31.35 billion with a fully diluted value of $39.63 billion.

ADA open interest in derivative contracts also increased by 16.16% to reach $1.54 billion, whereas spot volume has not dropped significantly, although there was a sharp drop in the options volume.

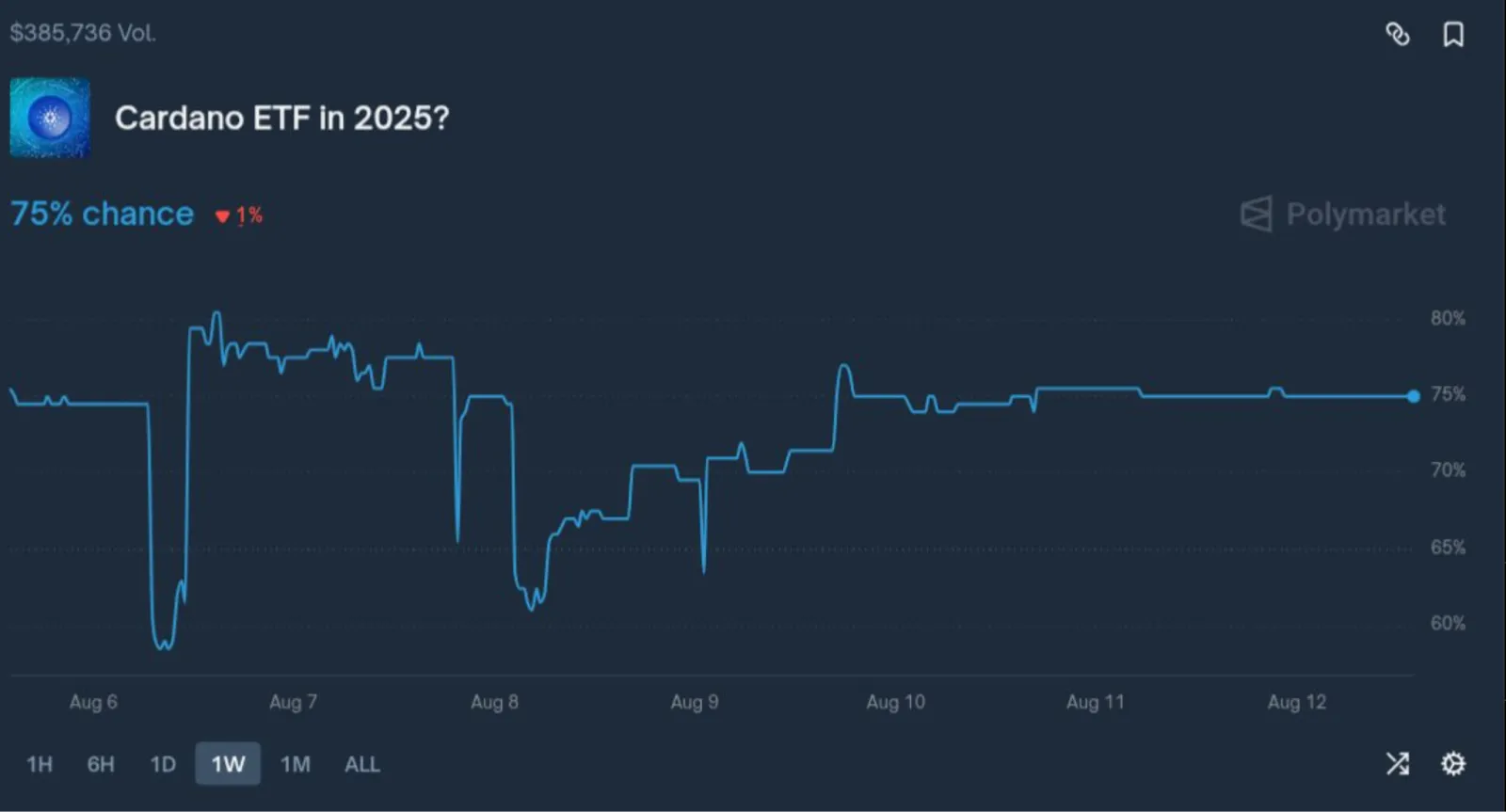

Whale activity has increased, with more than 200 million Altcoins accumulated within 48 hours. The growth in high-volume purchases correlates with the prediction market odds of Cardano ETF approval of 75%.

Cradano ETF in 2025? | Source : Polymarket

These developments have increased purchase interest in both retail and institutional markets. Present setup reflects market environment witnessed in 2021, when the confluence of supply shortages and escalating demand led to a protracted price surge.

Historical launches of ETFs on Bitcoin, Ethereum, and Solana have led to robust inflows and price gains, leading to speculation that Altcoin could take a similar path should its own ETF achieve approval.

Cardano price is testing the $0.88-$0.90 short-term resistance area spotted in recent chart analysis.

A confirmed breakout above this range may pave the way to the $0.94-$0.97 area and, later on, the $1.01-$1.07 zone.

Source : X

The golden cross on the weekly chart, which is the cross of the 50-day moving average above the 200-day moving average, supports the bullish sentiment.

Daily time frame patterns also show a breakout out of a downward trend line, as Ethereum did before its rally in 2020.

Analysts say that clearing the major resistance may put ADA on a path to recapture the all-time high of $3.10 set in September 2021, with the potential to move even higher should the momentum pick up.

On-chain data shows that long-term ADA holders have been accumulating positions steadily since 2021, with no large distribution.

The short-term holders are showing little signs of selling behavior unlike in previous rallies that saw heavy profit taking. This trend limits the selling pressure and maintains prices in an upward trend.

https://x.com/Alphractal/status/1955151319548956813

The risk-adjusted returns of Cardano, Sharpe Ratio, is approaching a historically significant level of $2, which has in the past preceded parabolic rallies.

Valuation and profitability indicators of market temperatures are at a neutral level, which means that the market can appreciate further prices without being overbought.

Cardano founder Charles Hoskinson has cited the Midnight sidechain and Minotaur consensus model of the network as a successful blockchain defence.

Minotaur combines Proof of Work and Proof of Stake, which distribute the control over a variety of resources and avoids a single point of network dominance.

This announcement came after a long-running 51% attack on the Monero network during which one mining pool had temporarily achieved majority control.

https://x.com/IOHK_Charles/status/1955259058149081429

The multi-resource consent design of Altcoin lessens the chances of such an attack, which increases the confidence of the investors in its long-term stability.

As the accumulation of whales increases, the speculation of the ETFs goes higher, and the bullish technical setups are in place, the Altcoin price market outlook is positive.

Institutional action, Grayscale making ADA its largest holding in its Smart Contract Platform Fund with 18.5% weight and seeking SEC approval to launch a Cardano Trust ETF, all lend credence to the bullish argument.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.