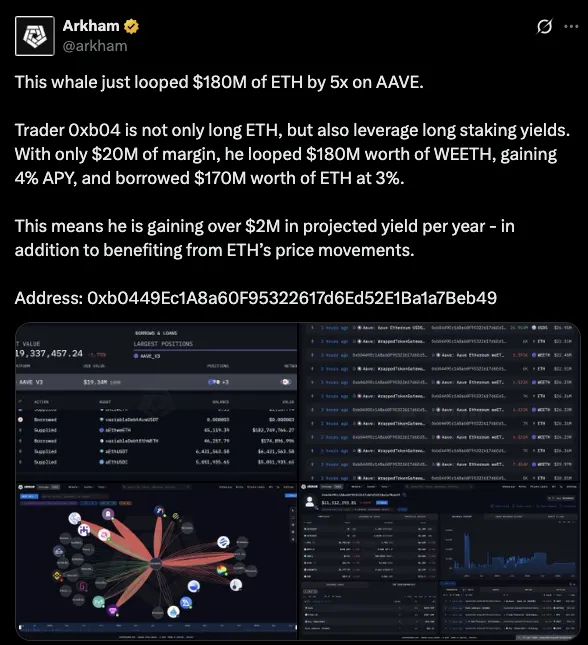

A crypto whale has reportedly leveraged $180 million worth of Ethereum five times on the AAVE protocol.

The trader, identified by the wallet address 0xb04, is deploying a high-risk, high-reward yield farming strategy. According to Arkham Intelligence, the trader began with just $20 million in capital. He then repeatedly looped it into $180 million worth of wrapped Ethereum (wETH) on AAVE.

By doing so, the investor is not just long Ethereum but also capitalizing on staking yields. The position reportedly earns an annual yield of 4% from wETH deposits while borrowing \$170 million worth of Ethereum at an estimated 3% interest.

Source: Tweet

This structure allows the trader to potentially earn more than $2 million annually in passive yield alone. In addition, he gains exposure to ETH price increases, significantly amplifying his upside if the asset appreciates.

The aggressive yield strategy has caught the attention of on-chain analysts. Many are watching to see how this highly-leveraged Ethereum play unfolds in current market conditions.

The ETH price experienced a notable decline on July 29, 2025, slipping by 1.84% to close at $3,757. This drop signals increasing bearish pressure after failing to sustain above the $3800 psychological level, which now acts as a key resistance zone.

On the daily chart, the price has created a lower high, which indicates that the price could make a bigger correction once a support is not reached. The short-term support stands at 3700 which has in the past mitigated negative momentum. Melting down under this region would lead to a subsequent route to additional losses.

The indicator of momentum reflects diminishing buying strength. The Relative Strength Index (RSI) is at 44, intact below the 50 mark of neutrality.

It indicates that bearish momentum is starting to pick up. However, as long as RSI does not rise above 50, there could be a lack or weakness of bulls in the short run.

In the meantime, the MACD indicator increases the alarming mood. The MACD crosses over the signal line, falling below the signal line, and the negative histogram is at -4.87. This bearish crossover further confirms a shift in momentum and possibly signals a deeper correction.

In the near future, the support level of $3,700 might be retested in case the sellers remain in control. In case bulls recapture the current levels of $3800 and turn them into support, then the potential targets would be set to $4000 and later at $4300.

Source: Tradingview

Nevertheless, the inability to maintain current levels can add to selling pressure that will pull down the price to the levels around the $3500 mark or those lower.

In conclusion, the leveraged ETH position by the whale is another example of the high-risk profile of the DeFi platform, whereas current market sentiment underlies general risk aversion among participants in the market.

Muskan Sharma is a crypto journalist with 2 years of experience in industry research, finance analysis, and content creation. Skilled in crafting insightful blogs, news articles, and SEO-optimized content. Passionate about delivering accurate, engaging, and timely insights into the evolving crypto landscape. As a crypto journalist at Coin Gabbar, I research and analyze market trends, write news articles, create SEO-optimized content, and deliver accurate, engaging insights on cryptocurrency developments, regulations, and emerging technologies.