The birth of Bitcoin took place on January 3, 2009, by the mysterious character Satoshi Nakamoto, and now it is counting down to its 17th birthday celebration.

As the crypto market of January 3, 2026, approaches slowly, the crypto market is raising one major question: Will this historic occasion be the one to prompt the next big rally to $150,000, or will a pullback still be on the cards?

This is a significant moment as Bitcoin anniversaries usually breathe life into long-term trust. The fresh on-chain data, technical signs, and institutional that have been combined, the asset is now placed at a very important point of decision.

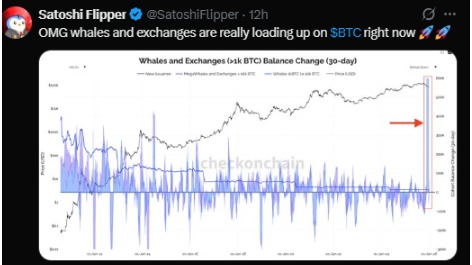

Recent on-chain charts indicate that whales and exchanges possessing more than 1,000 BTC holders have been very active in accumulating in the last 30 days. The sharp increase in the change of balance shows that large investors are very interested in buying up the coins.

In the past, one could easily associate whale accumulation with the appearance of major price recoveries or breakouts. Normally, big holders buy during uncertainty and not when there is hype. This pattern indicates that even though the short-term price action is volatile, there is an increasing confidence in Bitcoin's value in the long run.

To put it simply, large investments are quietly making their way in, which is a common practice that lays the groundwork for future gains.

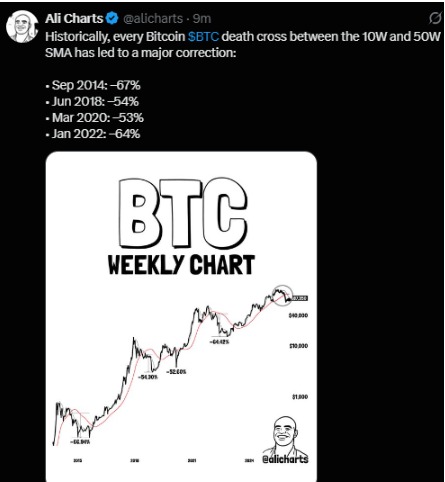

Although accumulation presents a bullish case, technicals offer a more conservative scenario. The world's largest cryptocurrency is nearing a weekly “death cross”, which is the crossover of the 10-week moving average under the 50-week moving average.

In the past, this signal resulted in big declines:

2014: −67%

2018: −54%

2020: −53%

2022: −64%

If the past repeats, then the price has to go through short-term downward pressure before seeing any rise in the rally. This makes risk management a very important aspect for traders, especially those using leverage.

MicroStrategy ($MSTR), the company that has the largest Bitcoin holdings in the corporate world, has experienced a loss of more than 67% in its stock price which is now around $152. The company possesses 672,497 BTC at an approximate average value of $75,000 as per the Saylor Tracker.

There are some fears about the company's position in case the price drops to $74,000. But the numbers actually tell a different story. Even if it reaches that price, the company's Bitcoin stock would still be worth nearly $50 billion which is quite high when compared to its $8.2 billion debt.

The market is showing fear rather than risking bankruptcy through the stocks' weak performance. The company founded by Michael Saylor also has enough cash to cover its operations for more than two years without having to sell any of its Bitcoin.

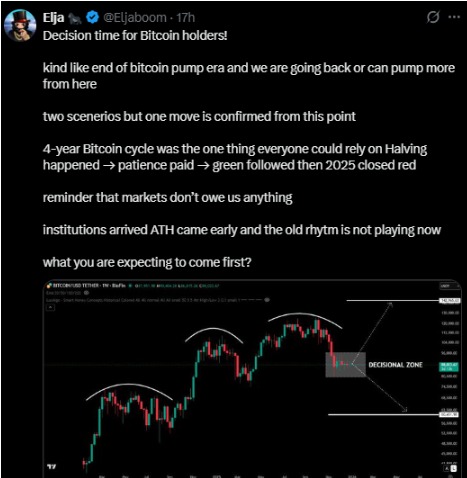

Analyst Elja points out that BTC is currently in a decisive period. The institutional investors have come in very early, the price peaks have been reached very fast, and the year 2025 has been closed in the red despite post-halving optimism.

If the old pattern is not followed, then the price might be highly affected by liquidity, macro trends, and institutional buying or selling rather than by set timelines. This would mean more uncertainty but at the same time more opportunities.

Short-Term Outlook (Next Few Months)

Bitcoin's price can trade up and down a lot during the period of the weekly death cross. It is also likely that the price will drop down to the areas of strong support before reflecting the stabilization of momentum.

Medium-Term Outlook (2026)

If the whale accumulation continues and the macro conditions are favorable, the asset can gradually regain its bullish momentum. Holding above the key support level would create a stronger foundation for confidence.

Long-Term Outlook

A move toward $120,000–$150,000 becomes realistic if the price breaks up with previous highs on a strong volume. The 17th anniversary could play the role of a sentiment catalyst, but confirmation would rely on continuous demand and liquidity.

Bitcoin is at a very unusual crossroads. Whale accumulation and institutional strength are one side of the coin indicating long-term upside, while historical technical signals on the other side of the coin say to be cautious in the near term.

So, is Bitcoin going to go through history—or create its own?

The next big move will most probably determine Bitcoin’s trend for the upcoming years.

Disclaimer: As always, this is not financial advice. Investors should manage risk and monitor confirmation levels closely.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.