The recent price fluctuations of Bitcoin cause enormous stress on one of its staunchest corporate advocates—the Strategy firm, formerly MicroStrategy. Even with BTC down over 30% from its all-time high, these vast holdings of the company in Bitcoin—acquired at average prices of $67,458—are now only 13% in the green.

As volatility escalates, the stakes couldn't be higher for the company and the entire crypto ecosystem. As pressure intensifies on Strategy and the crypto ecosystem at large, Bitcoin needs to regain higher ground in a hurry—or fall into an even deeper correction.

Michael Saylor's efforts at developing a strategy that aggressively amasses Bitcoin for the firm began in 2020. Oftentimes, he describes the currency as "digital gold" and as the ultimate hedge against inflation. Currently, according to public filings, the firm boasts a holding of 528,185 BTC with a market price of $35.63 billion. This once became a monument and an icon representing conviction regarding corporate infrastructure to the world outside finance and banking. Now, it is hanging by a thread.

According to data from Arkham Intelligence, If the BTC price were to dip below $67,458, it would put the entire Bitcoin position of the Strategy into losses. This kind of move could spark general panic, thus closing other corporate treasuries into fire sales and sending the market into further distortion.

Saylor's "never sell" slogan has become institutional faith in Bitcoin. But now, this very notion is being stress-tested. Analysts caution that a prolonged break below Strategy's cost basis may either force the company to do considerable thinking about its position or at least rouse investor concern about its financial stability.

Furthermore, if the price breaks even, it is not only a matter of accounting; it has a huge psychological aspect attached to it, especially from long-term holders' perspectives and those on Wall Street, who are watching the markets for clues of either unfaltering conviction or the first signs of capitulation.

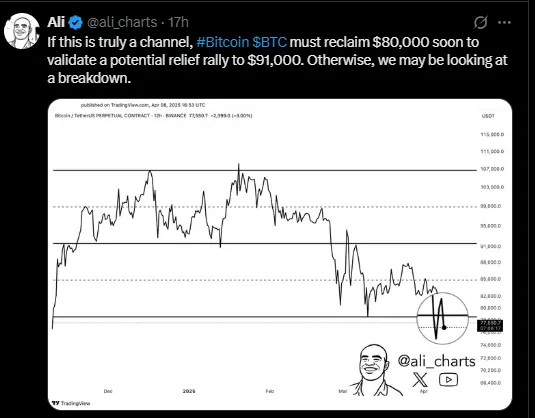

Well-known crypto analyst, Ali Martinez, proposes that BTC is currently trading under a channel pattern, which might endorse either a rally or a breakdown.

Bullish Scenario: If the price reaches above $80,000, it will possibly confirm a relief rally toward $91,000, with the intermediate rejection level at $82,000.

Bearish Breakdown: The inability to hold key support at $74,500 could pave the way for deeper corrections and ultimately invalidate bullish momentum.

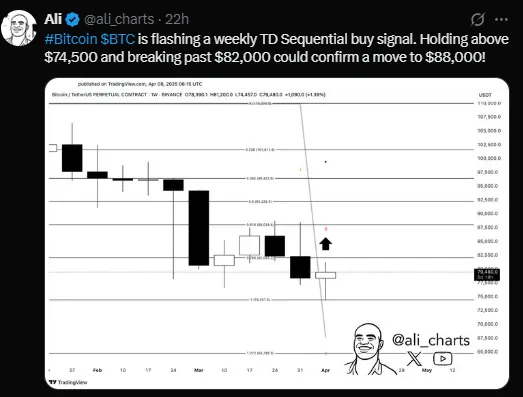

Furthermore, the world's largest cryptocurrency is now showing a weekly TD Sequential buy signal, which has a history of indicating strong reversal opportunities. There is going to be great importance in holding key levels in the following days.

If the token does manage to stage a rebound and push beyond the $80K-$82 K resistance zone, it could mark a resurgence of bullish sentiment, reinvigorating the broader market and validating corporate accumulation strategies.

However, if BTC slips below Strategy’s breakeven and struggles to recover, it may prompt questions not just about the company's exposure but about Bitcoin’s short-term resilience amid macroeconomic uncertainty.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.