Ethereum is back in the news, but this time for all the wrong reasons. The second-largest cryptocurrency recorded another drop of 10% on the day, pulling down the price to $1,400, a level unseen since early 2023.

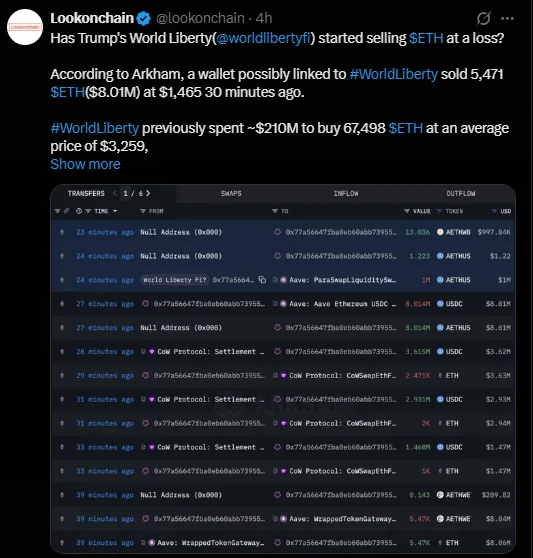

The current bearish sentiment in the market has reportedly led to the wallet allegedly associated with Donald Trump's DeFi project, World Liberty Financial, dumping 5,471 ETH at a loss of $8.01M, which triggered a panic sell-off among retail and institutional investors alike.

According to data from Arkham Intelligence, a wallet potentially connected to World Liberty Financial offloaded 5,471 ETH at an average price of $1,465 per ETH, far below the reported acquisition cost of $3,259 per token. This move resulted in a realized loss exceeding $10M, with a total estimated unrealized loss of $125M on its remaining the token holdings.

The project's prior investment? A massive $210 million purchase of 67,498 ETH, now underwater by over 66% as the altcoin continues its brutal 2025 downtrend.

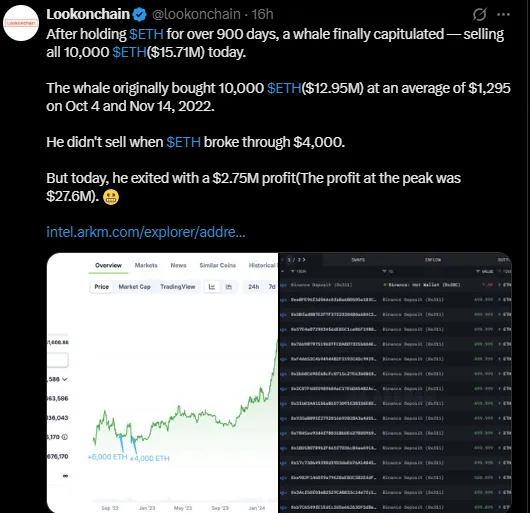

The institutional wallet selling pressure doesn't end there. One of the biggest Ethereum whales, having held 10,000 ETH for more than 900 days, has now sold out entirely for $15.71 million. Even having previously sat on $27.6 million in unrealized profit when the token last topped more than $4,000, the whale eventually succumbed, earning a considerably smaller profit of only $2.75 million.

The capitulation indicates a disturbing trend; even long-term holders are beginning to lose faith in Ethereum's possibilities for very near-term recovery.

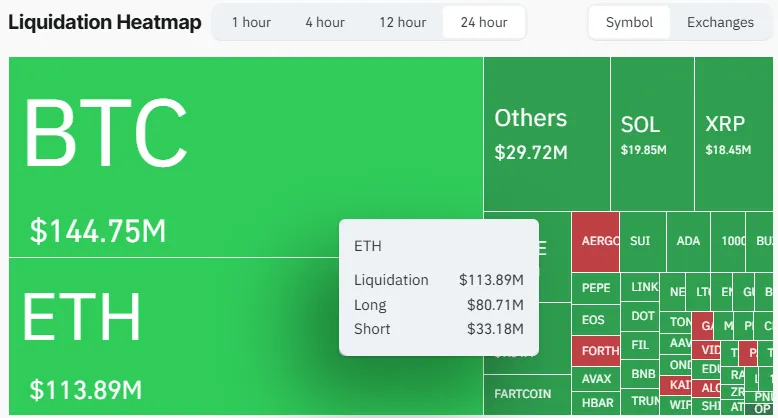

Analyzing data from Coinglass, a recent liquidation heatmap has revealed that $113.89 million of altcoin positions were in the liquidation process over the last 24 hours. Among them, long traders took losses of $80.71 million, an indication that bulls were caught off guard by the recent fall.

Typically, this kind of liquidation will represent extreme volatility, stop-loss triggers, and margin calls, all adding to cascading sell pressure in already fragile market conditions.

As far as well-known crypto analysts, Ali Martinez believes that the next support level for Ethereum is at $1,200. This might go downhill, and without holding this level, the market could come crashing in a fast decline back to the levels that were seen during a pandemic.

Meanwhile, other analysts suggest that token has just dropped below its realized price, a rare occurrence, historically marking one of the bottom-buying opportunities in a cycle.

Even if it's not completely true, it's realistic to think that the money from the macro sentiment, policy unclarity, and enormous volume of institutional sell-offs may take time before any recovery is seen.

In the current market structure, the price of Ethereum is likely to test the $1,200 level in a few days. A break below could mean a retest to as low as $1,000, depending on the performance of selling by top holders such as World Liberty Financial. However, if support is found near $1,200 level and the altcoin consolidates, there could be a relief rally back to the range of $1,550-$1,600.

The one thing that stands out now is the short-term bearish outlook, even as smart investors check the long-term opportunities within the learning curve. Historical evidence suggests that purchasing below the realized price often precedes bullish markets .

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.