The crypto market saw significant developments today, as Bitcoin (BTC) dropped by 1.73% over the 24 hours, bringing its price to $116,081. Despite this, a massive surge in BTC buy activity has sparked interest.

A prominent whale, likely from the Bitfinex exchange, ramped up their purchases this morning, driving up the price and signaling potential shifts in sentiment. Bitcoin's evolving price scene grows more complex along with this investor's movements, with recent undertakings by corporate treasuries also weighing in.

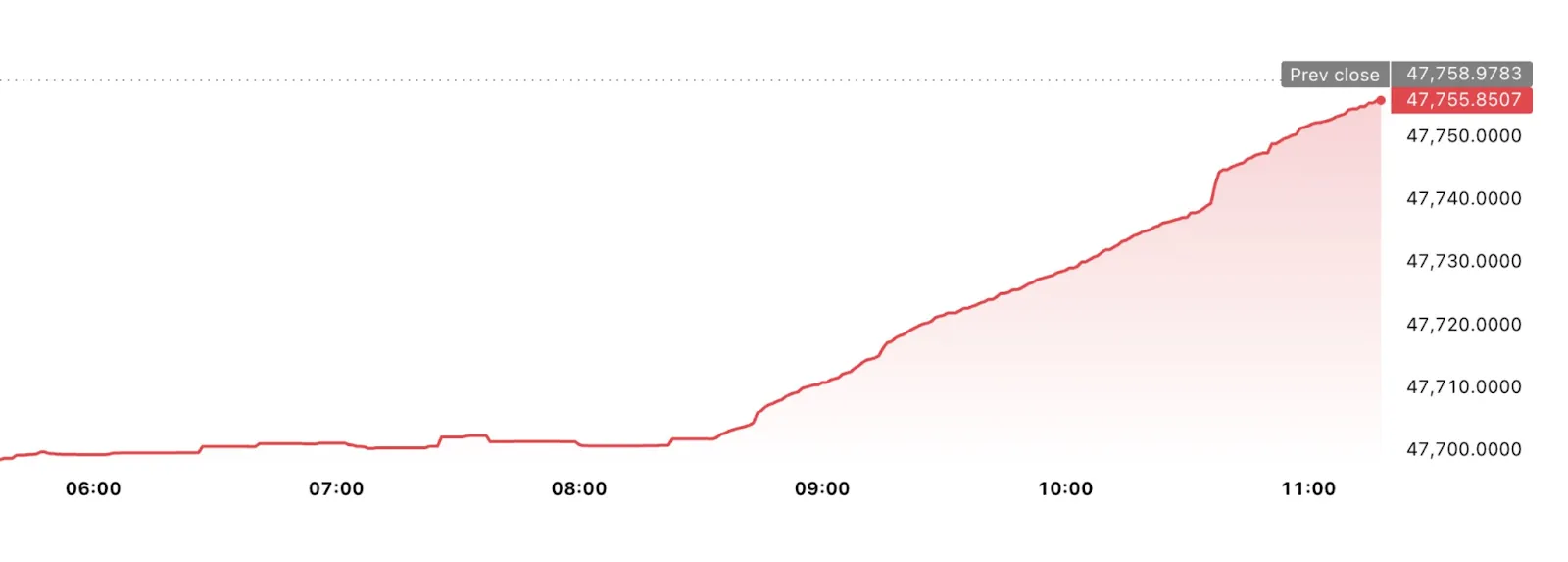

The action began when a whale started purchasing Bitcoin at around 8:30 am CET while the crypto price hovered around $115,500. The whale bought BTC at the rate of about $600 per second and ended the day having acquired 450 BTC.

Such buying actions had to force the price to keep up with the demand, with visible momentum in the price position developing after the heavy buying. Analysts have remarked that an activity so large could denote a longer-term strategic accumulation or perhaps an attempt to direct sentiment into a bullish direction.

Bitcoin price began to rise steadily with heavier buying by the whale, just as theories suggested that large investors could significantly influence dynamics. These aggressive purchases raise questions as to the whale's intentions and whether this is simply the start of a larger trend. Such buying activity on this scale could suggest the investor is positioning for greater price appreciation, causing a stir through the market.

MicroStrategy, acquired 430 Bitcoins for its corporate treasury between the 11th and 17th of August. The total acquisition was valued at $51.4 million, with an average cost of $119,666 for each coin.

Therefore, MicroStrategy is currently holding 629,376 Bitcoins, which come with a valuation of roughly $46.15 billion. The acquisition came when the price of Bitcoin had fallen 5% during the past week, dipping below $115,000.

The announcement came at the same time as a strategic shift with respect to MicroStrategy's process for the issue of MSTR Equity ATM. The firm changed its guidance to link share issuance to the price of stock relative to its adjusted net asset value (NAV).

If shares of MSTR trade above 4.0x NAV, MicroStrategy will begin issuing shares to purchase more Bitcoin.

NAV issuance from the range of 2.5x to 4.0x will be more selective and will seek to accumulate more BTC. Should it be below 2.5x, proceeds would essentially be distributed to repay debt and for internal needs, with share buyback potentials should the ratio fall below 1.0x.

This shift in strategy reflected a growing commitment to BTC as a core asset, with the company positioning itself for further accumulation depending on the performance of its stock relative to Bitcoin’svalue.

Therefore, the move reinforced the continuing institutional demand for the crypto as a store of value and a strategic asset.

Kelvin Munene is an experienced crypto and finance journalist with over five years in the industry, known for delivering detailed market insights and expert analysis. Holding a Bachelor’s degree in Journalism and Actuarial Science from Mount Kenya University, he is recognized for his thorough research and strong writing abilities, especially in cryptocurrency, blockchain, and financial markets. Kelvin consistently offers timely, accurate updates and data-driven perspectives, helping readers navigate the complex world of digital assets. His work focuses on identifying emerging trends, analyzing market cycles, exploring technological advancements, and monitoring regulatory changes that influence the crypto sector. Outside of journalism, Kelvin enjoys chess, traveling, and embracing new adventures.