Bitcoin (BTC) has again captured the spotlight after breaking above $97,000 for the first time in two months, gaining 2.5% in a single day and 3.4% on the weekly chart. The breakout followed eight days of tight consolidation and signals renewed investor confidence amid a backdrop of bullish on-chain and technical signals.

Based on CoinMarketCap, BTC jumped to an all-time peak of $97,438, pushing its market cap past the $2 trillion mark for the first time since the beginning of March. This dramatic shift has triggered new hope, with analysts and traders alike keeping a close eye on whether the rally can hold or if this is just a deviation before a correction.

The breakout has been fuelled by a combination of bullish forces, such as macroeconomic stability, rising institutional flows, and compelling on-chain data that enhance Bitcoin's mid-term strength.

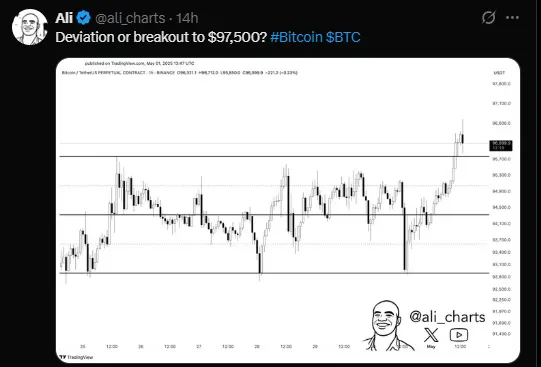

Renowned on-chain analyst Ali posted an insightful chart analysis indicating that there was a phase of consolidation leading up to the sudden price rally. He points out that Bitcoin is now probing a crucial support region of $96,000 — a point that could confirm the character of this breakout.

The behaviour seen is reminiscent of a textbook bullish continuation pattern. Be cautious, though, as BTC currently trades at high resistance levels, and a breakdown from here might lead to a short-term setback.

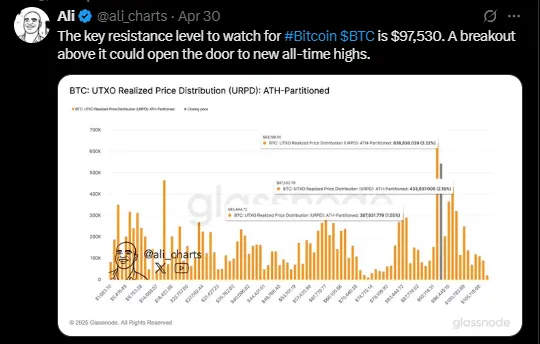

Ali also pointed out a key resistance at $97,530, which was calculated from Glassnode's UTXO Realized Price Distribution (URPD). The region is characterized by a high concentration of previously realized trades and is thus at a psychological and technical level.

A decisive move above $97,530 would represent the clearance of a traditionally congested supply zone, with the potential to open the gate to Bitcoin's next significant objective — $114,230 — as suggested by MVRV Pricing Bands. This forecast is now the bulls' focal point for a further rally.

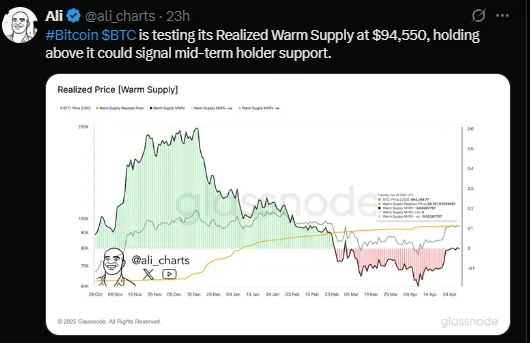

Finally, Bitcoin's remain above its Realized Warm Supply of $94,550 is another important metric emphasized by Ali. This value is the average purchase price of recently active addresses and is a very good measure of mid-term holder sentiment.

Above this level, holding would support bullish conviction and lower the odds of a substantial near-term correction. Holding the price above this level for an extended period indicates that investors who have recently bought BTC are not keen to close their positions, which is a sign of confidence.

The combination of bullish technicals with quite an encouraging outlook on on-chain metrics, coupled with the macro fundamentals, leads to the inference that while short-term volatility is in play, the uptrend might persist.

The $97,530 resistance level should now be keenly monitored by traders. A solid break above this mark could then push further towards the $100K milestone or even deeper, as far up as $114K on the next major leg in Bitcoin's bull cycle.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.