Bitcoin is trading in a zone where every small move feels important.

On one side, there is the big psychological level near $100k, and on the other side, traders are quietly buying dips instead of chasing price.

Bitcoin Price Prediction 2026 is no longer only about chart patterns.

It is starting to reflect how large holders are slowly reducing supply in the market.

What looks like slow sideways movement is not weakness.

It feels like a pause before a bigger move.

When fear grows and small traders exit, stronger hands usually take control. The market seems to be building pressure rather than losing strength.

The main question is simple.

Will 2026 repeat history or create a new one?

Bitcoin rose 1.73% to $88,643 over the last 24 hours, slightly underperforming the total crypto market’s 1.9% gain. This move interrupts a 4% weekly decline, pointing more toward a relief rally than a full trend shift.

What the Indicators Say

RSI is recovering from near oversold levels and is now trying to stabilize. This shows that selling pressure is cooling down and downside momentum is losing strength.

MACD is printing a bullish divergence on the TradingView 4-hour chart, where price made a lower low but momentum did not. This points to hidden buying strength building beneath the surface.

Key Levels

Support:

$86,600–$87,200

Resistance:

$90,000–$91,200

BTC Short-term Outlook: $91,200–$92,000

BTC Long-Term Potential Move: $93,500–$95,000 if structure holds

Invalidation: A sustained move below $86,600 weakens the recovery view and shifts BTC's short-term outlook back to the downside.

Bitcoin on the weekly chart does not look broken.

It looks tested.

Price is holding inside the $86,000–$95,000 zone, a range where buyers and sellers are both active. This is the same type of area where earlier pullbacks slowed down before the next expansion phase.

In past cycles, similar corrections stretched between 32% and 35% before price resumed its broader move. The current decline is playing out in the same neighborhood, which keeps the larger structure intact for now.

A recent comment from market observer CyclesWithBach, in his tweet on X, sums up the mood well:

“Nothing is broken. You’re just being tested.”

This phase feels less like distribution and more like patience being filtered out.

Momentum on higher timeframes is still trying to turn up, and the broader trend remains in place.

The market is not celebrating yet; it is checking who is still willing to wait.

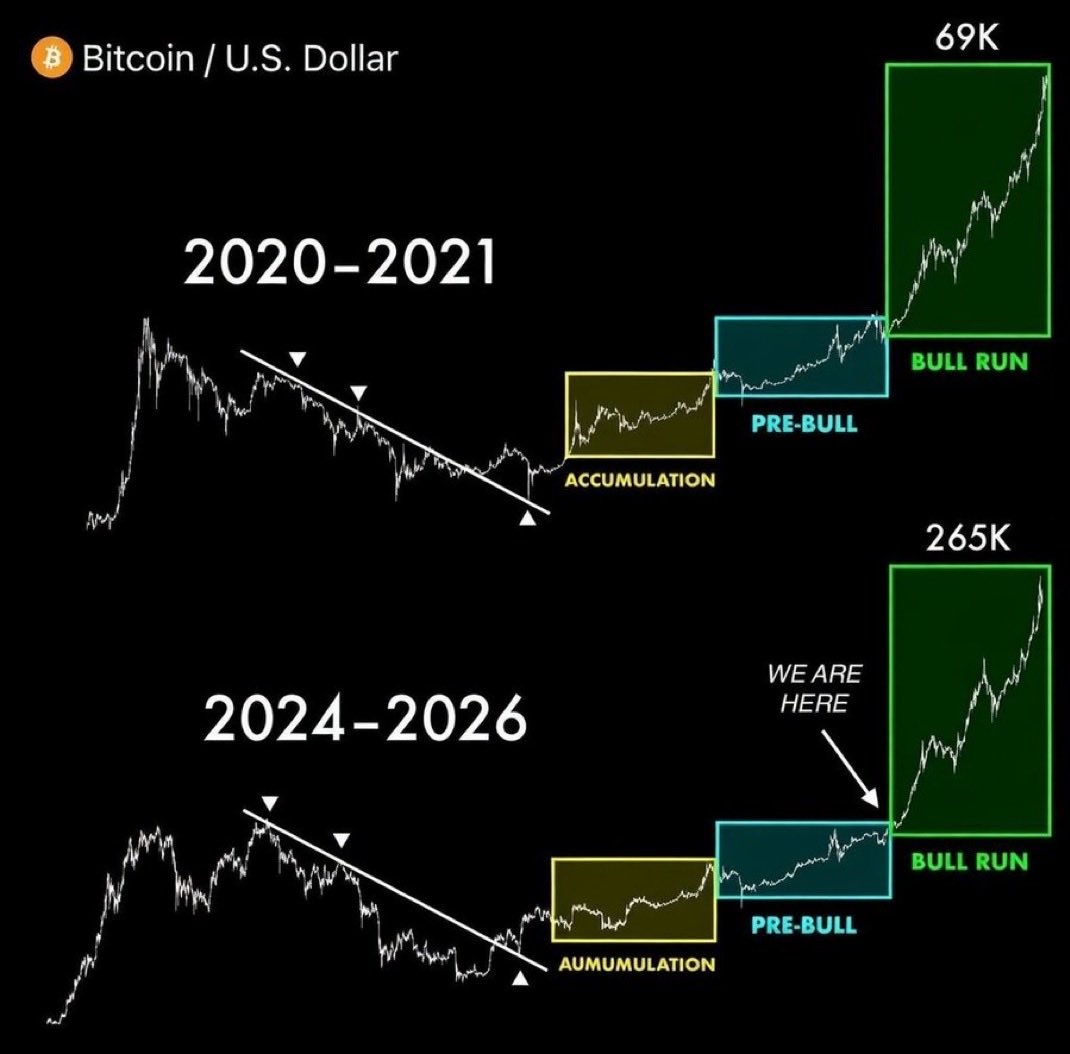

The current Bitcoin cycle looks a lot like what happened in 2020–2021. Back then, price spent time in accumulation, moved into a pre-bull phase, and only after that came the sharp expansion.

In that run, Bitcoin pushed from the pre-bull zone all the way to around $69,000.

Market analyst and investor CryptoGems555 has pointed out a similar structure forming again. If this rhythm plays out the same way into 2026, the expansion area on the chart sits somewhere between $200,000 and $265,000.

It is not a straight path, but the shape of the move feels familiar.

Right now, the market seems to be sitting in that quiet pre-bull zone again. Price is not racing, but it is also not falling apart.

This does not lock in a top or a target. It just shows how past behavior is starting to shape what traders expect for the next cycle peak.

Bitcoin Price Prediction 2026 is still moving through a holding phase rather than a strong trend. Price staying above the $86,600 area keeps the recovery idea alive for now, with the $91,000–$95,000 zone acting as the next area of interest.

On higher timeframes, the structure shows pressure but not failure. This keeps the broader outlook open, while direction will depend on how price behaves around current support rather than on any single long-term target.

YMYL Disclaimer: This Bitcoin article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.