The first 20 days of 2026 have seen a few rallies, but none of them held at higher levels. Price moved up, interest picked up for a moment, and then it slipped back again.

Each time Bitcoin pushed higher, traders talked about a move toward $100k, but the move never stayed, and optimism quickly faded.

This is where Bitcoin price prediction starts to feel uncomfortable.

That pattern has repeated more than once.

BTC is already down close to 7,000 points from its last lower high, and today alone it is trading around 1.80% lower. The market keeps trying to find its footing, but strength is not sustained.

Sentiment is starting to reflect that hesitation; the Crypto Fear and Greed Index has slipped to 42. Not panicking yet, but confidence is clearly missing; tariff-related concerns have added another layer of pressure.

Are these failed rallies just noise, or is the market slowly drifting into a danger zone?

Bitcoin short-term price action is starting to feel heavy; price has been moving inside a falling wedge, but the context matters here.

This structure is forming after repeated failures at higher levels, not after any real strength.

Source: TradingView

Things shifted once the 50 and 100 EMA printed a bearish crossover. Soon after, Bitcoin slipped below the $94,850–$93,500 support zone, an area that had been holding price earlier.

That loss changed the tone; what used to act as support is now behaving like a ceiling.

Since then, selling has stayed controlled but persistent. Bounces are getting sold into rather than followed. On the downside, the $90,950–$91,000 zone is the first area where price could try to slow down. Below that, $89,100 stands as the next demand pocket.

On the upside, any recovery needs a clear reclaim above $94,850 to ease pressure.

On the 4-hour chart, Bitcoin price action looked similar; price broke $97,000, but it did not hold. Price went higher, took liquidity, and for a short while it felt like a breakout, and that move failed soon after.

Source: X@nehalzzzz1

Once the price gets rejected from a higher level, the slide starts, and the breakout will convert into a fakeout.

The $92,000 level, which had been holding earlier, gave way. Since then, selling has stayed steady. Not panic; just pressure and bounces are getting sold, and follow-through is missing.

Now the price is sitting below $91,500, so attention naturally shifts lower. The next area to watch is around $90,000-$89,400, where the price may try to slow down.

On the upside, $93,000–$93,500 is the zone that matters. According to analysts watching short-term structure, the risk remains tilted toward further downside unless key levels are reclaimed.

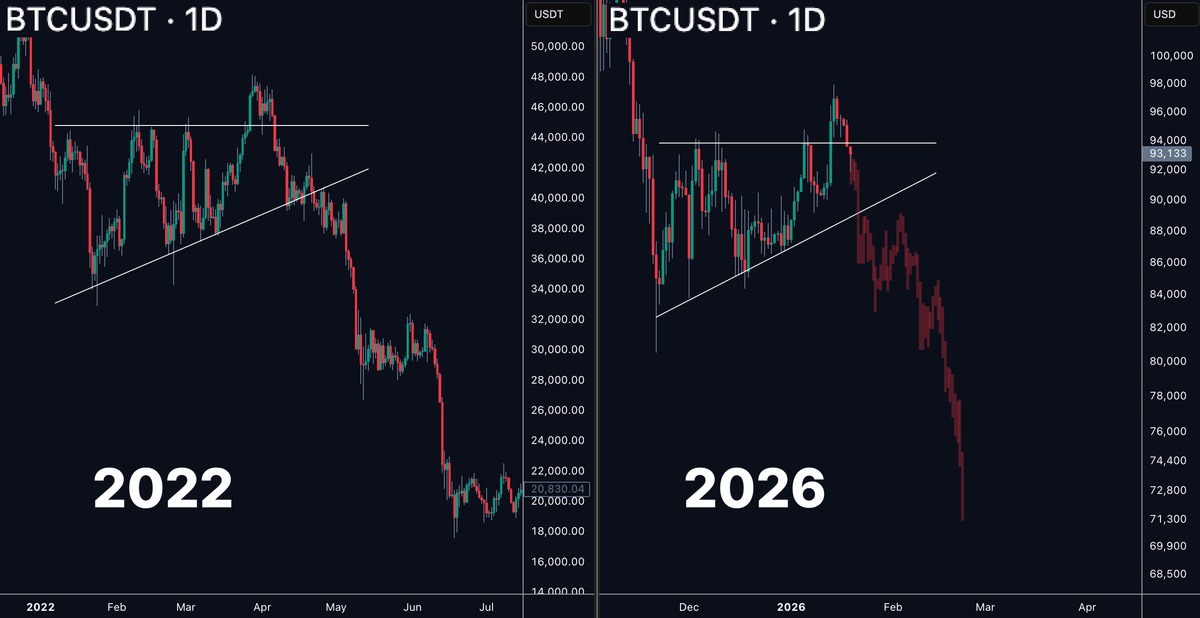

On the daily chart, BTC is starting to trace a pattern that feels familiar. Back in 2022, price first saw a relief rally. That move gave hope, but it failed to break real resistance.

What followed was a bull trap, where buyers stepped in too early.

Source: X@LintonWorm

After that, rising support gave way. The breakdown did not look dramatic at first, but once it happened, downside momentum picked up.

Liquidity was pulled, and trapped buyers were forced to exit as pressure accelerated.

Market watchers note that a similar sequence is starting to appear now. Bitcoin saw short relief rallies, but each one struggled under resistance. Price has already slipped below its rising support, and follow-through is beginning to show.

This does not guarantee the same outcome, but the structure is close enough to make traders cautious.

If daily weakness continues, focus shifts toward the $80,000–$82,000 zone as the next area where buyers may try to step in. Below that, $75,000 stands as a deeper support if pressure builds further.

From a structural perspective, losing daily support often pushes the broader Bitcoin sentiment into a more defensive phase.

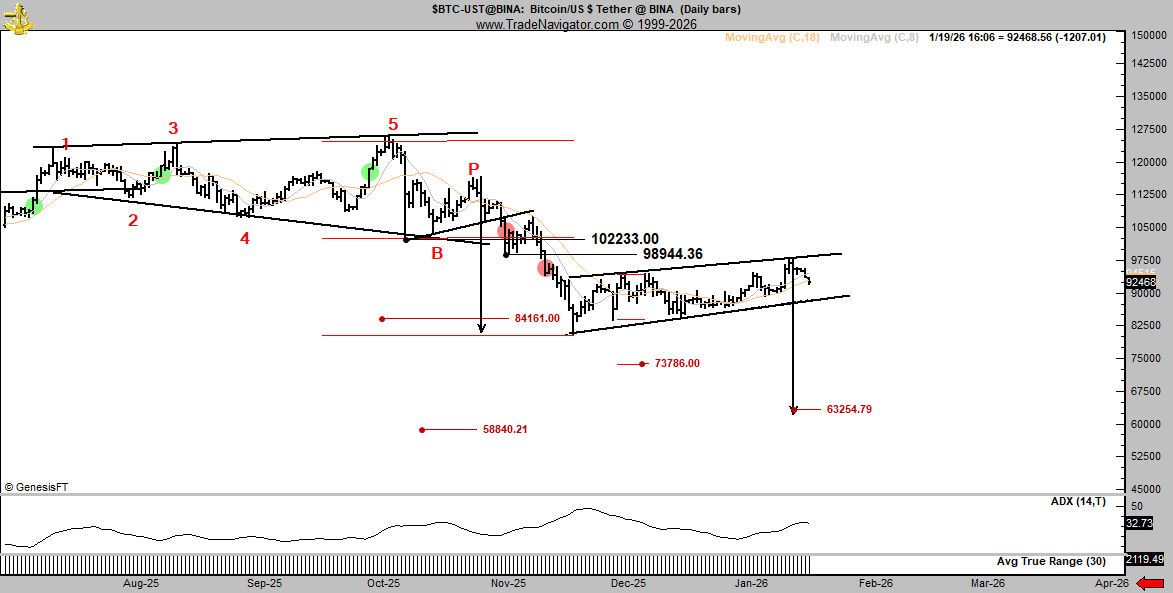

This tweet adds an uncomfortable layer to the bigger picture. As the long-term structure weakens, some traders are no longer focused on nearby support zones. Attention is slowly drifting lower.

One analyst recently shared a view that if Bitcoin keeps losing daily structure, the $58,840–$63,254 range could come into play, but this is not presented as a sure outcome.

Source: X@PeterLBrandt

It is more a reflection of what can happen if downside pressure continues and confidence keeps slipping.

The analyst himself admitted the possibility of being wrong, which says a lot about how uncertain this phase is.

This is not a base case scenario, but when structure breaks, sentiment often changes quickly. Deeper levels start getting discussed, not as targets, but as places where price might eventually try to stabilize.

Bitcoin is moving through a sensitive phase where structure and sentiment are being tested. Recent price action shows hesitation, but it also highlights how closely traders are watching key levels. This is not a one-way market yet, but it is clearly a zone where reactions matter more than expectations.

For now, Bitcoin price prediction is about staying alert rather than aggressive. Whether the price stabilizes or slips further will depend on how the market reacts around major support and resistance zones in the coming sessions.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.