Bitcoin is not doing much right now. Price is moving in a small range, and nothing is really pushing forward. Every time it tries to go up, it slows down again. The moves are short and overlapping, which makes the market feel tired.

Altcoins are also not showing strength. Small rallies are getting sold, and volume is not supporting upside moves. In the broader crypto market, when both Bitcoin and altcoins behave like this, it usually means the market is waiting. Because of that, Bitcoin price prediction right now is more about watching this range closely than expecting a strong move.

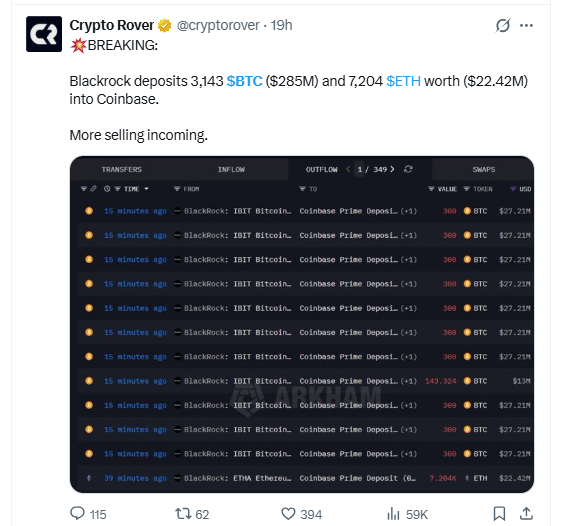

Recent on-chain data shows BlackRock moving 3,143 BTC, roughly $285 million, along with 7,204 ETH worth about $22.4 million, into Coinbase Prime. Big transfers like this usually get noticed, especially when the market is already going nowhere.

Source: X@cryptorover

When large amounts of institutional activity hit an exchange during a sideways phase, selling pressure becomes a concern. With BTC already struggling near resistance, these flows add weight on the upside. This does not mean a breakdown is confirmed and the market has collapsed, but it does make continuation higher harder for now.

The chart shared by the analyst Ted Pillows shows that long-term BTC holders are selling again. This kind of activity usually shows up when the market is unsure, not when a strong trend is building. In the past, selling from long-term holders has often added pressure during sideways phases.

Source: X@TedPillows

The coin is already stuck, moving back and forth in a narrow range, and in this kind of market, selling from long-term holders makes upside moves difficult to trust. It does not signal an immediate breakdown, but it does add another layer of caution for the near term.

On the 1-hour chart, BTC is still moving inside a rising channel, but the move does not look strong. Price has gone near $92,500 many times, and every time it gets pushed back. That level is clearly heavy right now. Upside attempts are there, but they are not holding.

Source: TradingView

As long as the price stays below $92,500, the upside feels limited. Even if the price moves toward $93,500 or $94,800, selling can show up again. On the downside, $90,600 is the first area to watch. If that breaks, the price can slide toward $89,800 and then $88,500. For now, the structure looks more tired than strong.

On the daily chart, BTC still feels heavy. Price moves up, reacts near the same level, and then fades again. There is no clean push through resistance, just slow grinding and rejection that usually is not what strength looks like.

Source: X@TedPillows

The chart shared points to a similar setup from the past. Back then, BTC bounced, ran into the moving average, and then slowly lost momentum. The current move feels close to that. You can see buyers trying, but it does not really go anywhere; selling starts earlier than it should if the market were strong.

As long as the price is trading below $92,500 on a daily close, upside feels capped. Price can still poke higher toward $93,800 or even $95,000, but those areas look heavy. On the downside, $90,600 is the level to watch. If that starts slipping, the market can slowly drift lower toward $89,000 and maybe $87,800. Right now, the daily chart does not really support a strong bullish idea.

On the weekly chart, Bitcoin’s structure is starting to look uncomfortable. For a long time, price was trading above both EMA 21 and EMA 50 while following a rising trendline. That trendline has now broken, and the price is no longer holding above those averages. Instead, it is moving below them, which changes the tone.

Source: TradingView

The focus now is on EMA 21 and EMA 50. The fast EMA is weakening and slowly turning toward the slower one. If a bearish crossover forms, it would echo an earlier setup where BTC stalled near these averages before rolling over. Back then, the move did not happen immediately, but once the downside opened, the price dropped by around 60%.

If this crossover confirms, $78,000 is the first area to watch, followed by $54,000 and $40,000. These are not fixed outcomes, just risk zones. If the crossover fails and the price moves back above both EMAs, this setup would likely be invalid.

Right now, Bitcoin is not really giving clear answers. Price moves up, hits resistance, and then slows down again. That keeps happening as long as the price stays below $92,500; it is hard to trust the upside. On the lower side, $90,600 is still important, and if that starts slipping, $88,500 is not far. On the weekly chart, trading below EMA 21 and 50 keeps things uncomfortable, with $78,000 still open if pressure builds. This Bitcoin price prediction remains cautious because strength has not really shown up yet.

YMYL Disclaimer: This price prediction article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile, and readers should conduct their own research before making investment decisions.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.