Bitcoin (BTC) continues to move sideways, consolidating between very important support and resistance zones. As a big move is anticipated in the market, some critical technical indicators, as well as on-chain data, a start show signs that could define the next leg for the world's largest cryptocurrency.

Over the last seven days, Bitcoin has been trading very closely within a very close channel, priced between $83,000 and $86,000.

According to CryptoQuant, it is so strange that institutional interest increases and reserves decrease while the price keeps moving in this tight range. Perhaps a strict upper breakout would allow doors to test again the psychological resistance at $91,275, which happens to align quite well with that of Short-Term.

An important historical level that is quite often associated with significant trend reversals. But a definitive breakdown below $83K could open a larger corrective phase down to the $78,000-$80,000 region, where strong buying interest has previously surfaced.

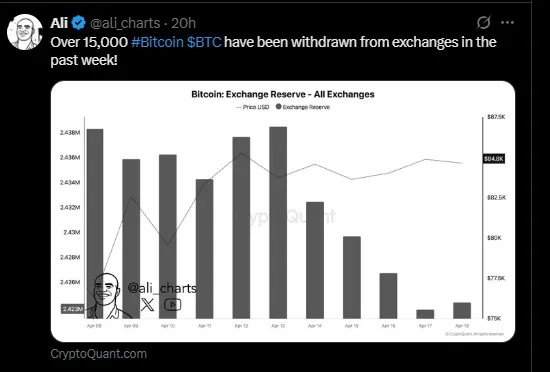

As per CryptoQuant, Bitcoin's balances are out of exchanges frantically, as far as bullish on-chain insights go. Over 15,000 BTC was taken out from the platforms just last week, which is signaling a shift into long-term holding or away from short-term gambling.

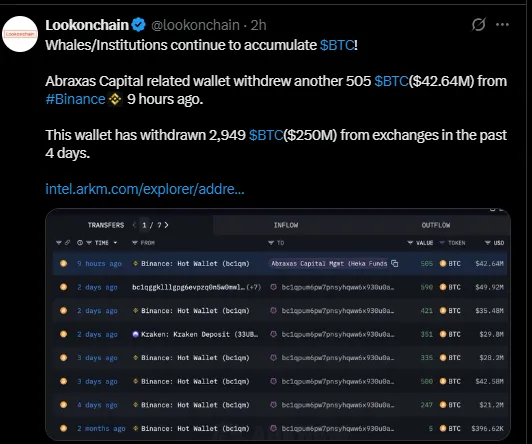

As per chain analysis, Arkham Intelligence, nine hours ago, a wallet linked to Abraxas Capital withdrew 505 BTC ($42.64 million) from Binance. Over the last four days, this wallet has removed a staggering 2,949 BTC ($250 million) from various platforms, reinforcing the accumulation trend among institutional players and whales.

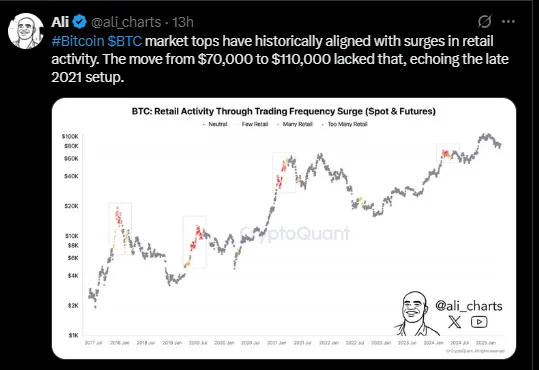

This bull run from $70K to $110K in some markets is certainly not what the average retail frenzy has looked like at the top of the Bitcoin bull run in 2021. Talking about the historical correlation of the tops in the Bitcoin market with heightened retail activity and social media buzz, neither of those conditions exists at the moment at significant levels.

This low reading in sentiment might imply that Bitcoin has more running room before the momentum develops and macro conditions remain positive.

Resistance Levels:

$86,000 – Short-term breakout level

$91,275 – Key resistance aligned with STH Realized Price

$100,000+ – Psychological milestone and long-term target

Support Zones:

$83,000 – Near-term support

$78,000–$80,000 – Demand zone

$70,000 – Strong historical support level

If on volume, such a clean break occurs above $91K, it might signal a later move toward $100K. Failure to maintain at $83K could invite a sharper pullback, especially if macro risk factors resurface.

Bitcoin is at a critical point between two roads, with price action coiling tighter and fundamentals growing stronger. As institutional accumulation intensifies while retail still mostly sits on the sidelines, whatever direction the next move is, the impact is likely to be explosive.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.