After a drop of nearly 18 percent in three days, the token Pi coin shows a sign of weakness. Trading around $0.61 currently, the coin has drained down to almost all recovering gains from a lifetime low of $0.40. Further analyst warnings of a probable drop of 35% to as much as 50% potential after token unlocks and abnormal exchange listings have laid it out for the next couple of months, possibly around the $0.30 level.

So, now let's analyze the reasons behind this bearish projection, if anything makes it different for Pi Coin from now on.

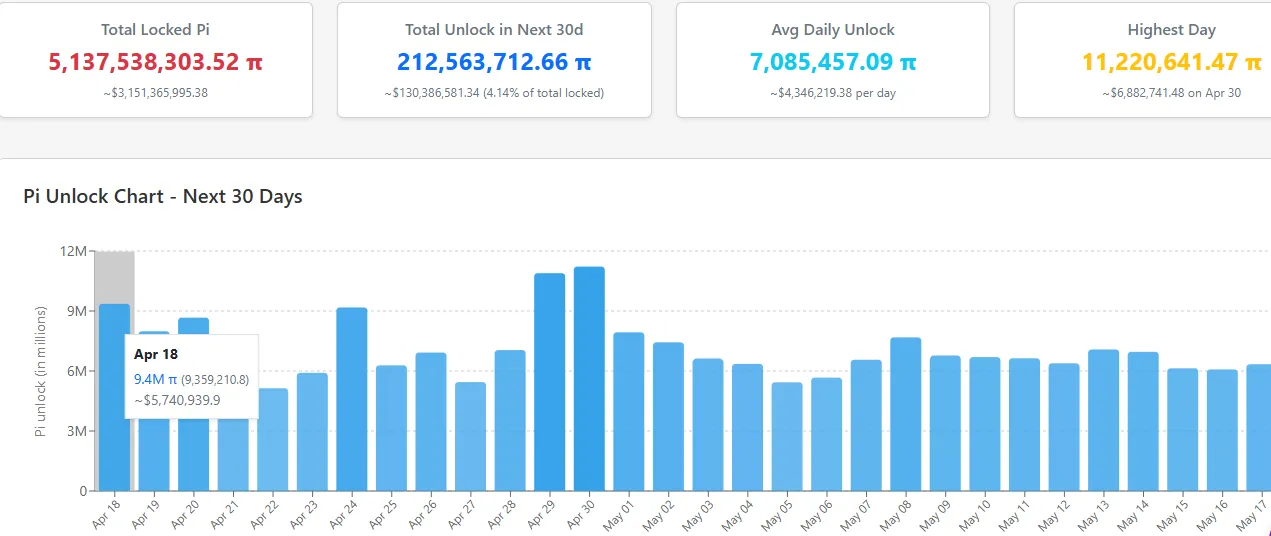

The core reason for the drop is a sudden increase in the supply of tokens. For the next 30 days, over 212.5M tokens will unlock, almost 4.14% of the total locked supply of 5.13 billion coins. These unveilings start on April 18, when approximately 9.4 million tokens (worth nearly ~5.7 million USD) will enter circulation.

Average daily unlock: 7.08 million tokens ($4.34 million/day)

Peak unlock date: April 30 with 11.2 million tokens ($6.88 million)

Projected for the month: More than 100 million tokens will be released

Annual unlock estimate-over 1.5 billion new coins

Source: piscan.io

This overwhelming increase in supply without any accompanying demand is putting tremendous downward pressure on prices.

A number of market analysts like Dr. Altcoin proclaim, "If the Pi Core does not wake up now, the altcoin would hit the floor at $0.30 in a matter of months." The logic? Straight up supply-demand economics.

"When there is a sudden increase in the amount of coins, but no corresponding increase in several buyers, prices must fall," says Dr. Altcoin.

To add to this, even the Coin is not available at most major exchanges, of Binance, Coinbase, or Kraken, which almost closes the door for retail buyers and institutional buyers as well.

According to some blockchain experts, there should be strategic supply management strategies that can save the Pi Network token from further losses. This is how they put it:

1. Token Burns

The Pi Foundation currently holds over 70 billion tokens. Just burning a small percentage of this extremely high supply, similar to Ethereum's EIP-1559 mechanism, could assist in stabilizing or increasing the price because of having a reduced circulating supply.

2. Burn Transaction Fees

Burning some percentage of transaction fees from the Pi app ecosystem is also an interesting idea that has been gaining traction, just like what is seen in projects like BNB and Luna Classic.

These two measures could potentially reignite interest in price support areas during the stages of level token unlock.

From a bearish point of view, the Coin has recently broken down through its ascending channel on the 4-hour chart. It also could not break up way past strong resistance around $0.78-$0.79; thus, it led towards a steep 22% fall.

Key Levels to Watch:

Support Zone: $0.60 (breakdown may lead to $0.40 or $0.30)

Resistance Zone: $0.78-$0.80 (breakout could target $1.00)

Source: TradingView

Once the token gets past this $0.60 level, analysts believe it should lead to a swift fall towards the $0.40 level and, perhaps, $0.30, which would amount to a 50% decrease from these current levels. Meanwhile, any decisive move over $0.80 would, possibly, change premises and push to $1.

At this point, the altcoin is at its turning point. How its eventual potential will develop accumulates with what it will do next through action from the Core Team. To control supply inflation and boost adoption, they may or may not list themselves with top-tier exchanges. Without these and other conclusive moves, the token risks falling into a bearish phase.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.