Bitcoin price hovered at $118,338 on July 29, showing resilience near key resistance levels. The cryptocurrency traded within a narrow range, signaling indecision among market participants.

Despite facing selling pressure near the $120,000 mark, Bitcoin continues to hold above the $115,000 support zone. The consolidation hints at a potential breakout, with the daily chart reflecting bullish undertones.

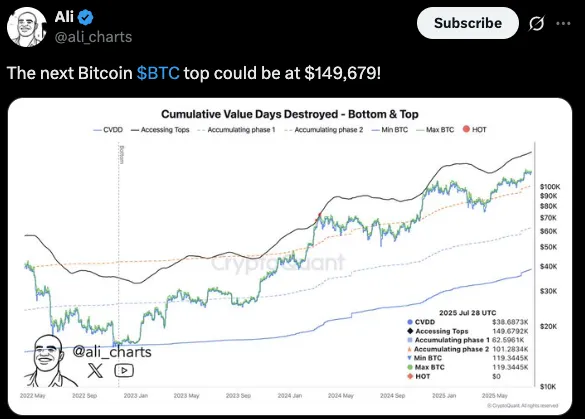

Bitcoin may be on track to hit a peak of $149,679, according to a recent analysis shared by crypto analyst Ali on X. The forecast is based on data from CryptoQuant's “Cumulative Value Days Destroyed” (CVDD) model, which has historically provided signals for BTC market tops and bottoms.

Source: Ali chart: Tweet

The chart shared by Ali highlights several key indicators. These include "Accessing Tops," "Accumulating Phase 1 and 2," along with minimum and maximum price estimates. The CVDD curve, a long-standing metric used to gauge the lifecycle of held coins, appears to support the possibility of an extended rally.

The CVDD as of July 28, 2025, is about $38.673. According to the model, it is possible that Bitcoin may be in the largest price discovery period, and a potential peak of Bitcoin is estimated at $149,679. The other peaks that are to be noticed are the highest path of BTC at the price of 119, 34,, and a lower level referred to as HOT at 119, 344.

It is a technical sign showing that more people are getting bullish about the future of BTC. It conforms to wider market expectations of an uptrend.

In the last 12 hours, Galaxy Digital is said to have transferred a massive quantity of BTC, worth approximately 3,782 BTC, worth almost $447 million, to various exchanges. The transfers have raised suspicion that the company is again involved in assisting in the sale of a large amount of Bitcoins on behalf of other clients.

It is also a notable operation by Galaxy Digital that has a following due to the involvement of the company in the crypto streams with high volumes.

On a related note, a wallet that had been created recently has been shown taking out a bankroll of 3,500 BTC, or about $415.8 million, of crypto exchange Gemini over the last four days.

On-chain statistics show that most of these transactions happened in the last three transactions, and the last movement was recorded within five hours of this writing.

The Relative Strength Index (RSI) currently reads 59.47, below its recent peak of 63.99. This suggests momentum remains in bullish territory but lacks full strength. A push above 64 could reignite upward momentum.

Source: Tradingview

In the meantime, an indicator of MACD is signaling the decline of bullish activity. The latest MACD line stands at 2,072.16, the signal line at 2,463.23 and the histogram value is negative at -391.06. This deviation does not mean that the rise is coming to an end, just that there is a slowing of momentum.

The first level of resistance is at $120,000. Should bulls conquer this level, the next bullish target would be $125 000. Below $115,000 on the other hand, can invite more selling pressure to $110,000.

Annah Mugoiri is an emerging voice in the crypto content space With More than 5 years of experience, with a growing passion for blockchain technology and digital finance. She possesses a sharp grasp of market dynamics and the broader cryptocurrency landscape, skillfully simplifying complex topics like Bitcoin, altcoins, DeFi, and NFTs into reader-friendly, engaging articles. Annah combines in-depth research with a clear and concise writing style that appeals to both beginners and seasoned crypto investors. Dedicated to monitoring price trends, project launches, and regulatory changes, she keeps her audience updated on the rapidly evolving crypto scene. Annah is a firm believer in blockchain’s transformative power to foster innovation and expand financial access worldwide.