BlockDAG is once again in the spotlight after announcing a major roadmap update and calling its $0.0005 presale the “final hours”. With over 865 million BDAG tokens still left, investors are now asking a critical question: will the presale really end, or could there be another extension before listing?

This uncertainty has sparked debate across the community—but it has also created hype. If this truly marks the end of the presale phase, BlockDAG could be entering its most important price discovery period yet.

Let’s break down what the roadmap update means and how it could impact BDAG’s price in the short, mid, and long term.

According to the latest announcement, the team has confirmed a rollout plan, signaling that the project is moving closer to public market readiness.

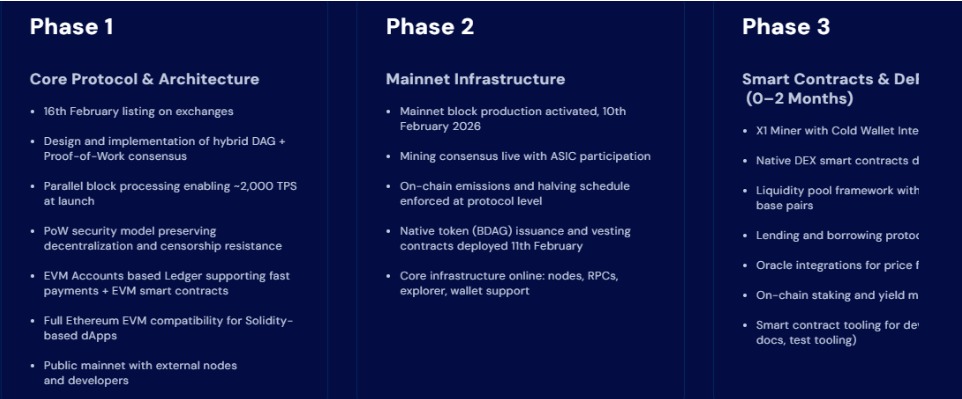

Focuses on building the foundation of BDAG. This includes a hybrid DAG + Proof-of-Work design, Ethereum EVM compatibility, fast transactions, and decentralized security.

Most importantly, the roadmap confirms an exchange listing planned for February 16, which could finally end months of pre-sale speculation.

BlockDAG will activate its mainnet infrastructure. This enables block production, mining (including ASICs), BDAG token issuance, and full ecosystem support such as wallets, nodes, and explorers.

Expected within 0–2 months, the team introduces smart contracts and DeFi features, including a native DEX, liquidity pools, staking, lending, oracles, and developer tools—key drivers for long-term value.

Despite the “final hours” messaging, the presence of 865.74 million unsold tokens has raised doubts. Past pre-sale extensions have made investors cautious, as delays often reduce urgency and buying pressure.

However, if the presale ends without another extension, it could restore confidence quickly. A firm cutoff would shift attention from presale pricing to open-market demand, which often supports stronger early price action.

Based on the latest updates:

TGE (Token Generation Event): February 11, 2026

Exchange Listing Date: February 16, 2026

BlockDAG has already confirmed listings on MEXC, LBank, XT, Coinstore, and BitMart, giving BDAG solid early liquidity. The team has also hinted at 15+ additional Tier-1 and U.S. exchange listings, which could significantly improve volume and stability after launch.

In the days following the listing, high volatility is expected as pre-sale buyers take profits and new traders enter.

Expected price range: $0.005 – $0.015

Early selling pressure is likely

Buyers wait for confirmation and stability

A clean presale close improves chances of testing $0.01+

If the team delivers on mainnet activation, ecosystem tools, and exchange expansion, BDAG could regain momentum.

Target range: $0.02 – $0.03

Broader exchange access boosts volume

Utility-driven demand begins to matter

Market conditions remain a key factor

The projected $0.05 target is ambitious but achievable—only if execution stays consistent.

Bull case: $0.05 or higher

Base case: $0.03 – $0.04

Bear case: Below $0.01 if delays continue

Long-term success will depend on development speed, transparency, and real adoption, not hype alone.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk. Always conduct your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.