Bitcoin Price Prediction 2026 is suddenly looking far more dangerous than most traders expected.

BTC is failing to hold above the 90,000 level; every bounce is getting sold into faster than before.

Retail investors were still waiting for another big rally.

But smart money now seems to be quietly moving toward the exit.

The market feels heavy.

Fear is slowly replacing FOMO.

On the macro side, the pressure is growing.

Federal Reserve Chair Jerome Powell tied future rate cuts to labor market data that single message reduced hopes of near-term easing.

Risk assets did not like that. BTC felt it immediately.

With 90K no longer acting as support, the mood is changing fast.

Traders are no longer talking only about upside.

Is a 50 percent deep correction near for Bitcoin in 2026?

The Bitcoin Price Prediction 2026 story is starting to shift toward a deeper correction.

In a tweet shared by crypto analyst Ted Pillows on X, BlackRock has moved a large amount of Bitcoin to Coinbase in a short time. On-chain data shows over 103.87 million dollars in BTC and nearly 59.27 million dollars in ETH sent to the exchange through multiple transfers.

These were not slow or random moves. They came in quick batches, which usually points to intention rather than simple wallet management.

This shift is happening while Bitcoin is already weak and failing to hold key levels. That timing makes traders uneasy.

Moving BTC to Coinbase does not confirm selling on its own. But it does place those coins closer to the market than to long-term storage.

In the current mood, that change matters. It suggests large players are shifting into defensive mode, not chasing higher prices, while institutions remain unconvinced by the dollar devaluation narrative.

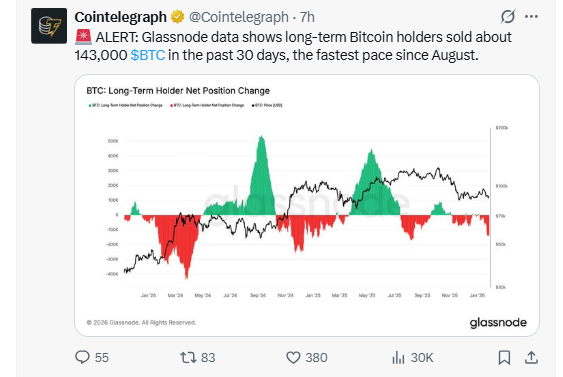

According to Cointelegraph, recent Glassnode data shows that long-term Bitcoin holders sold about 143,000 BTC in the past 30 days, marking the fastest pace of selling since August.

This metric reflects the net position change of long-term holders, who usually hold through volatility.

This data matters because when even long-term holders start reducing exposure at this pace, the market tone begins to change.

It signals that selling pressure is no longer limited to short-term traders and adds weight to the fear that the current weakness is becoming structural, not just a temporary dip.

According to data shared by analyst Ali Martinez (@alicahrts), a drop toward $87,000 could trigger more than 46 million dollars in Bitcoin liquidations.

The liquidation map shows heavy leverage stacked just below current price levels.

This means a small breakdown can turn into forced selling very quickly. When liquidations start, price does not fall slowly.

It slides because positions are being closed automatically.

That is why this zone feels dangerous for short-term traders and adds to the downside risk building in the market, making this data important for traders to watch.

On the TradingView 4-hour chart, price had been moving inside a rising channel after bouncing from the $86,600 zone. Price kept making higher lows, and the structure looked stable for a short-term recovery.

But the move stalled near $90,000. Buyers tried to push through resistance, failed, and heavy selling came in from the top.

That rejection broke the channel structure, and it looked like a recovery pattern turned into a failed breakout attempt.

The break of the channel changes the tone. Instead of controlled upside, price is now slipping back into weakness.

What the Indicators Say

RSI: RSI on the 4-hour chart is near 44, staying in bearish territory and showing there is still room for further downside.

100 EMA: Price remains below the 100 EMA, which is acting as resistance after rejecting recent upside attempts.

Structure: The rising channel from $86,600 has broken after rejection near $90,000, weakening the short-term price outlook.

Key Levels to Watch

Resistance: The main resistance remains near $90,000, where price faced strong selling.

Support: Immediate support lies in the $87,200 to $86,500 zone.

Invalidation: A break below $86,500 opens the path toward the next support near $85,000.

Short-Term Bitcoin Price Outlook 2026

Price is leaning weak after the channel breakdown and failure at the 100 EMA.

A test of the $87,200 to $86,500 area looks likely, with $85,000 as the next downside level if support fails.

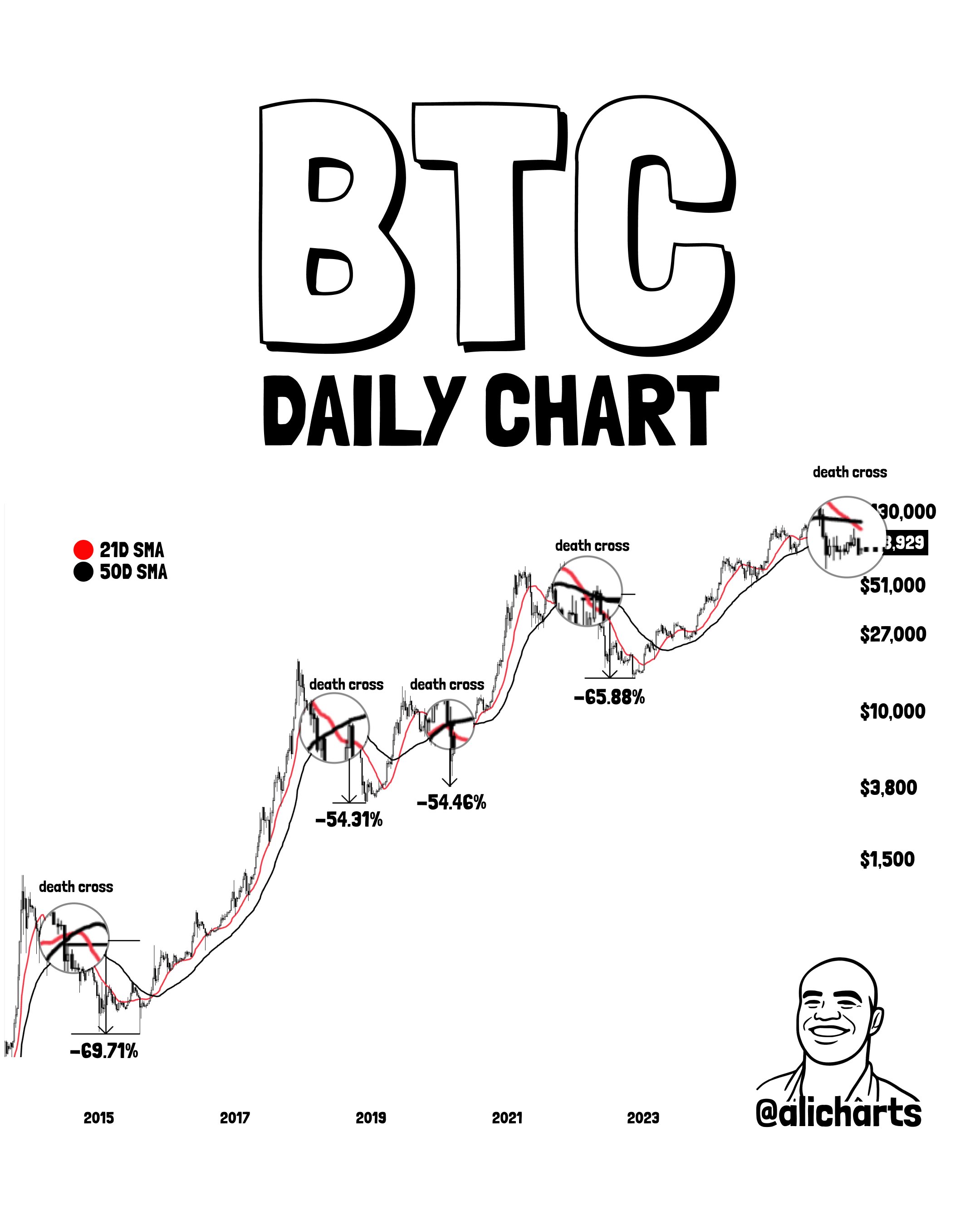

A chart shared by renowned crypto analyst Ali Martinez on X highlights that the BTC daily chart shows repeated death cross patterns between the 21-day SMA and 50-day SMA.

Each time this crossover appeared in past cycles, price entered a deep correction phase.

In 2015, Price dropped around -69.71% after the death cross. In 2019, a similar signal led to a fall of nearly -54.31%.

Another death cross in 2021 was followed by a decline of about -54.46%. In 2023, the pattern again resulted in a sharp correction of roughly -65.88%.

This structure matters because the same moving averages are once again converging. The 21-day SMA is rolling over toward the 50-day SMA, recreating a setup that previously marked major downside phases.

With history showing repeated 50% or deeper drops after this signal, the current setup fits the broader Bitcoin Price Prediction 2026 fear narrative.

The pattern does not guarantee the same outcome, but it explains why traders are no longer treating this pullback as a small dip.

Based on current market signals, the Bitcoin price forecast for 2026 is turning cautious. Institutional transfers, long-term holder selling, and rising liquidation risk are all pointing toward pressure rather than strength.

The rejection near $90,000 and repeated death cross patterns also suggest that downside scenarios cannot be ignored.

Market observers suggest this setup looks less like a healthy correction and more like a phase of risk reduction.

If these conditions continue, the Bitcoin Price Prediction 2026 narrative is likely to stay focused on downside risk instead of fresh upside targets.

YMYL Disclaimer: This Bitcoin article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.