The broader crypto market is moving green today. Bitcoin and a few major altcoins are holding mild gains, nothing aggressive, but enough to keep sentiment positive. In that setting, Cardano Price Prediction starts feeling slightly awkward. ADA is trading around $0.4051, down nearly 3.59% over the last 24 hours, and volume does not look convincing either. While early 2026 discussions are already leaning toward a possible altcoin season, this kind of price behavior raises a different question. Why does one of the older large-cap projects still look stuck when the market mood is slowly improving? Some traders tracking broader crypto market trends see this phase as hesitation; others see it as quiet positioning.

On analyzing the 4-hour chart, Cardano pushed into the $0.42–$0.43 area not long ago, but the move faded quickly; price did not spend much time there, as the area acted as a strong supply zone. It got rejected and slipped back toward the $0.39–$0.40 zone, where it is sitting now. This area is not random; it lines up with the 0.5–0.618 Fibonacci range, a zone where Cardano has reacted before.

Source: TradingView

The drop itself feels quiet; the volume is light. That usually means this is not panic, more like traders taking profit or momentum cooling off after the push. RSI is stuck in the middle, not stretched on either side; that kind of reading usually shows hesitation, not a strong directional call.

There is also the 100 EMA sitting just below price. So far, it is still acting like support. As long as ADA stays above it, the short-term structure does not look broken. Price could consolidate for some time here and then try higher again.

If buyers show up, the first level to watch is $0.4294; after that, momentum would open the door toward $0.4535. If the bullish trend builds beyond that, the $0.5000 area, near the Fib 1.618 level, comes into focus.

But if this Fibonacci zone gives way, downside risk increases. In that case, the next support sits much lower, around $0.3559–$0.3299.

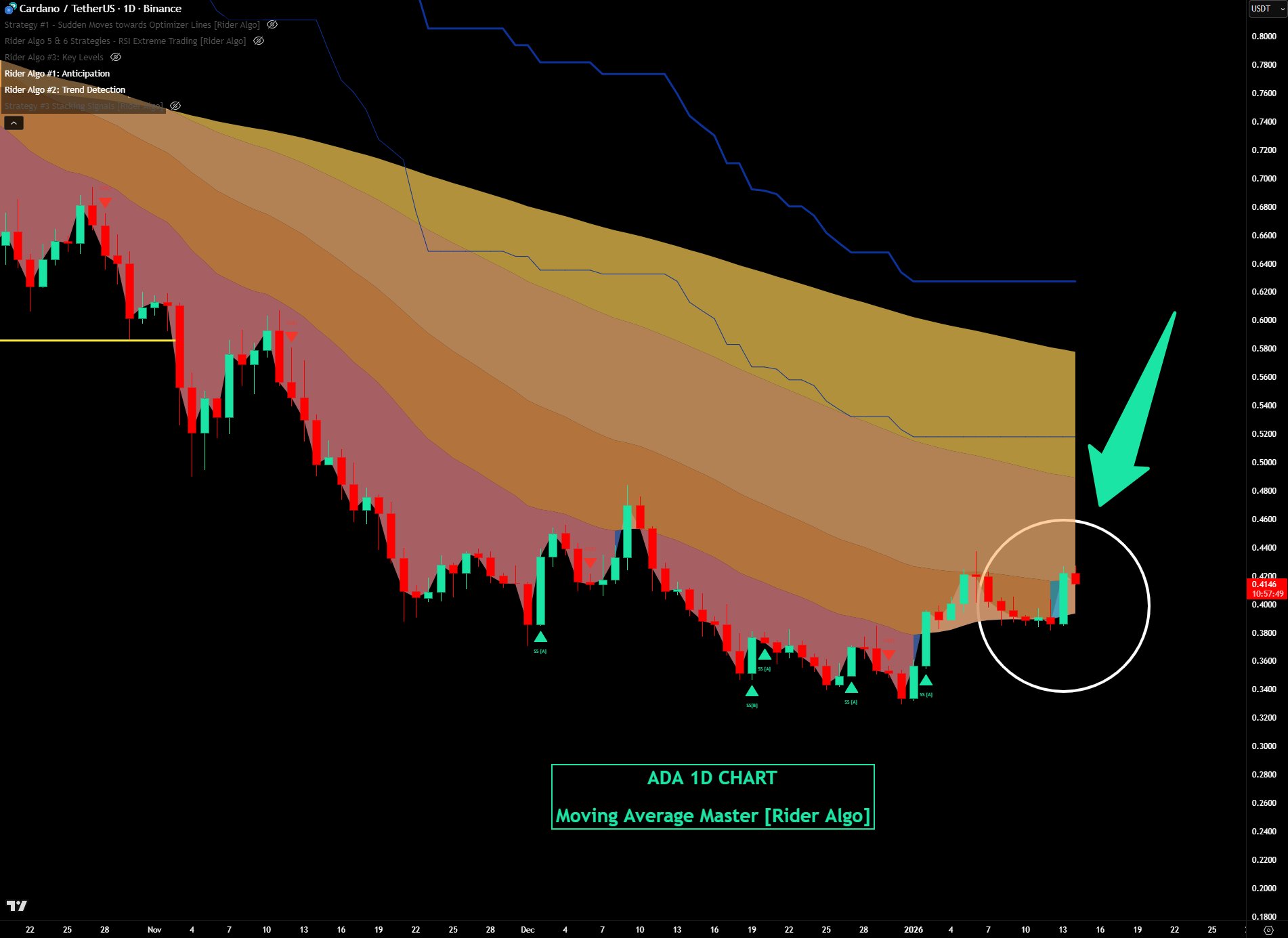

On the daily chart, ADA is showing early signs of strength after a prolonged downtrend. Price is trading around $0.41, and the recent candles suggest selling pressure is cooling off rather than accelerating. According to the analyst, the indicator on the 1D timeframe has flipped bullish after a long consolidation phase, with multiple upward signals appearing. This usually shows up when downside momentum starts fading, not when a move is already crowded.

Source: X@TrendRidersTR

Price is still trading below the descending moving average band, so the trend has not fully flipped yet. But the fact that ADA is holding ground instead of rolling over matters here. This zone looks more like a base-building area than a rejection so far. The next few daily closes are important to see whether this strength holds or fades again.

Daily targets: If momentum continues, the first upside area sits near $0.45. A stronger daily push could open room toward $0.48–$0.50, where the upper moving average zone comes into play.

Invalidation: If price fails to hold and slips back below structure, downside support sits near $0.36, with a deeper floor around $0.33.

Market analysts suggest Cardano price prediction is entering a transition phase rather than extending its downtrend. The recent bullish flip on the daily indicator after a long consolidation points to weakening selling pressure, even though price is still below the descending moving average band. Holding near the $0.40–$0.41 area while the broader market improves is seen as a constructive sign. Experts note that this kind of price behavior often appears during early base formation. However, confirmation is still needed. Analysts emphasize that the next few daily closes will be key in determining whether ADA can sustain this shift or remains stuck in consolidation.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.