After low of $13.08, Chainlink (LINK) has seen a notable price recovery and surged to $16.00 among increased market volatility. The recent surge in the crypto asset coincides with a forthcoming event with possibly more general consequences: March 7 is the White House Crypto Summit attendance date for Sergey Nazarov, a co-founder of Chainlink. This step is probably going to generate more institutional and legal interest for LINK, thereby boosting investor mood.

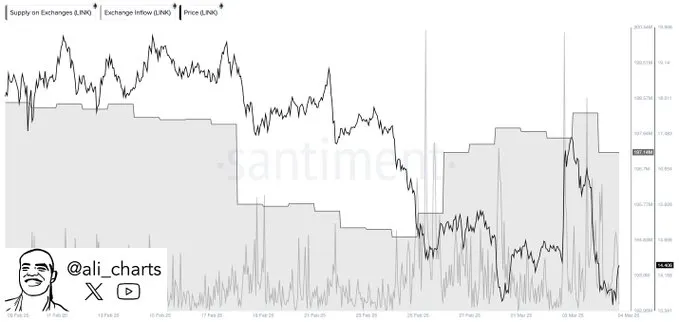

LINK has gained 16% over the previous 24 hours, increasing its market capitalization to $10.45 billion. Based on on-chain data, 2.23 million LINK tokens have been transferred to exchanges during the past two weeks, most likely a sign of rising selling pressure.

However, the top five LINK wallets have continued accumulating, now controlling 18.15% of the total supply (valued at approximately $2.93 billion), signaling strong confidence from major holders.

However, the top five LINK wallets have continued accumulating, now controlling 18.15% of the total supply (valued at approximately $2.93 billion), signaling strong confidence from major holders.

On the daily chart, Chainlink is forming a falling wedge pattern, historically a bullish setup that often precedes a breakout. Key technical indicators suggest growing momentum:

Support Level: LINK found strong support at $13.18, preventing further downside. If this level holds, a bullish breakout remains likely.

Resistance Levels: The first major resistance stands at $16.98, aligning with the 0.618 Fibonacci retracement level. A breakout above $22.08 (0.5 Fibonacci level) would confirm a trend reversal, potentially driving LINK towards the $26–$28 range in the mid-term.

RSI & MACD Indicators: The Relative Strength Index (RSI) at 42.10 suggests LINK is in a neutral-to-oversold zone, indicating room for a rebound. Meanwhile, the MACD histogram is showing early signs of a bullish crossover, hinting at a shift in momentum.

LINK's price behavior may be much driven by the forthcoming White House Crypto Summit. LINK's usefulness in practical uses may become more known as authorities and institutions debate blockchain technologies and distributed oracles.

Furthermore supporting Chainlink's long-term optimistic view are its ongoing adoption in DeFi, cross-chain interoperability, and traditional financial integration.

Short-Term Outlook: LINK is expected to trade within the $13–$17 range, with a potential breakout above $17–$18 leading to higher price targets.

Mid-Term Outlook: If LINK surpasses $22, the next target range is $26–$28. However, failure to maintain support at $13.18 could lead to a retest of $12.00 before any recovery.

Source: TradingView

Chainlink offers traders a great chance with increasing positive momentum, institutional interest, and technical indications indicating a breakout. Investors should, however, regularly check market conditions, legislative changes, and significant whale movements. While a decline below $13.18 may cause more consolidation, a clear advance over $17–$18 might validate a bullish breakout.

Right now, everyone's gaze stays on the White House Crypto Summit and how the conversations might affect LINK's long-term course.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.