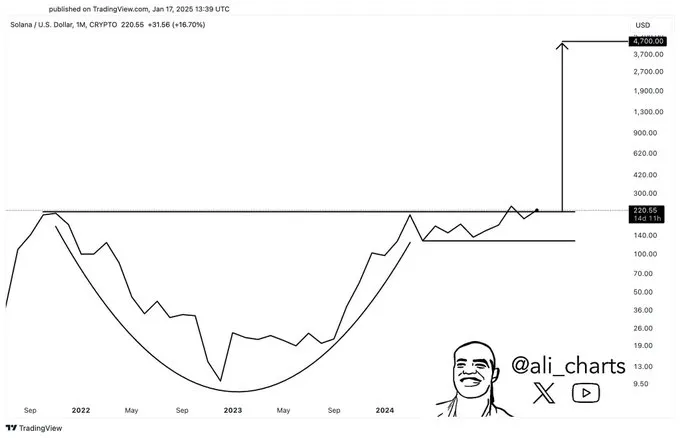

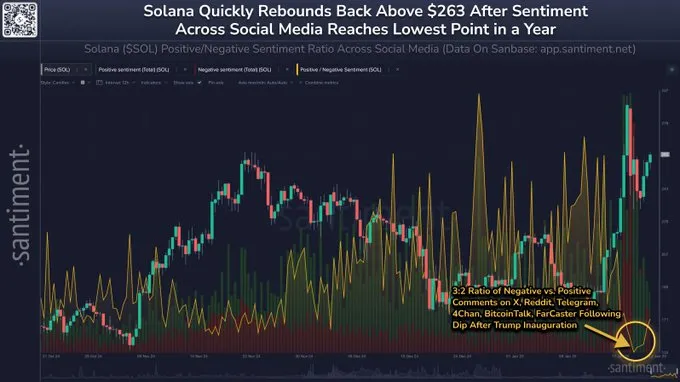

CME Group has introduced a Solana futures page on their staging domain, signaling a potential launch on February 10. The product page on CME Group’s website outlines two options: SOL Futures with a contract size of 500 SOL, and Micro SOL Futures, which offer a smaller contract size of 25 SOL. Analyst Ali has forecasted the launch of a Solana $SOL ETF by March. According to the charts, Solana price has been trading within a Rounded Bottom pattern since late 2021. However, the altcoin’s price continues to face challenges in breaking through the pattern's neckline. Ali has set a price target of $4,700, calculated by adding the pattern's distance to the potential breakout point. According to Santiment, Solana has seen a 12.3% increase in the past 36 hours. This surge has been supported by the buzz around meme coins like #Trumpcoin, which has sparked divided trader opinions and retail panic over transaction delays. As retail traders offloaded their holdings over the last few days, whales and sharks have taken advantage of the situation, accumulating the coins being sold off. On the 4-hour chart, Solana is trading inside the triangle pattern after forming a high near $295. The support is seen near $245, a break will take the altcoin towards $230 or even $200. However, a positive breakout above $265 can open the door for $300 or $500. Source: TradingviewCME Group Introduces Solana Futures Ahead of February Launch

Analyst Predicts Solana $SOL ETF by March

Solana Price Forecast:

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.