The market is closely observing the announcements made by Binance Alpha regarding DeepNode's exclusive airdrop, simultaneous listings on top exchanges, and the first-ever feature.

With the opening of Alpha trading on January 9, 2026, the anticipation surrounding $DN is rapidly purging—investors are already asking the major question: what is the range of the DeepNode token price at launch?

This article presents price prediction, tokenomics, and future potential aspects.

DeepNode is a revolutionary blockchain-based ecosystem of decentralized AI, where it is used as the main utility token. The token links all the different areas of the platform together and, thus, ensures the principles of equity, openness, and participation of the users in the ecosystem.

The users can traditionally:

Stake $DN and earn rewards

Get paid for helping the platform

Use AI models through $DN access

This robust real utility puts DeepNode's valuation at a long-term speculation-based value.

Binance Alpha is famous for spotting high-potential projects in their early stages. It being here implies:

It will get massive early exposure

Access to an active trading community

One-time points at Binance Alpha for an exclusive airdrop

Besides, the token will be available for trading at 10:00 AM UTC along with listings on Gate, Bitget, MEXC, and KuCoin; simultaneously, this will lead to rich liquidity and robust early trading volume.

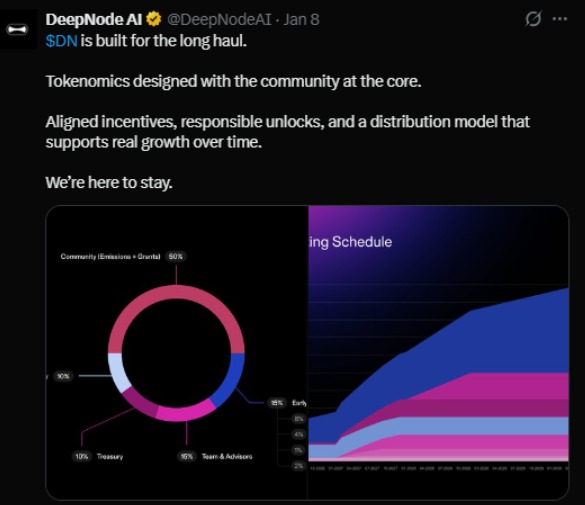

The tokenomics of DeepNode are characterized by a limited supply, tangible use, and gradual growth over a long time.

Total Supply: 100 million DN

Circulating Supply: ~22.5 million DN

Token Allocation

Community: 50% (emissions and grants)

Early Backers & Airdrops: 15%

Team & Advisors: 15% (long-term unlocks)

Treasury: 10%

Liquidity: 10%

Such a distribution helps to keep the ecosystem alive while the selection pressure is limited.

The premarket price is hovering near $0.8 per token. So the expected listing could be between $0.80 and $1.20 for $DN trading. One factor that could lead to the initial demand is the exposure from Binance Alpha, plus the relatively low amounts of coins in circulation. There could be a lot of uncertainty in the market, but good liquidity pools might serve to keep the price variation under control.

In the first few months, adoption will play a key role. As:

Staking demand increases

Community grants roll out

AI model access expands

The $DN price would be on its way up, so it could get to $1.50-$2.00 then. The mining and selling can be controlled, whereas the treasury support can reduce the risk of sudden dumps, thus leading to more organic price movement.

A few things will determine the future, one being the acceptance of the project, which is based on the following:

Platform growth

Strategic partnerships

Responsible token unlocks

If the development remains consistent, then $DN could exceed the $2.50-$4.00 mark in the long run. This is not the case with hype-busters; these upswings are in line with investor trust over the long haul.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.