In early 2026, investors and traders are discussing new highs for the world’s largest cryptocurrency, Bitcoin, along with expectations of an upcoming altcoin season following the recent upside move. At the same time, Bitcoin Price Prediction 2026 is no longer a comfortable discussion for investors who are still expecting easy upside. Bitcoin has been hovering near key levels, but the price is not behaving like a market ready to push higher. Every attempt to move up is meeting pressure, not strength.

As price continues to react near major resistance zones, the structure underneath is slowly changing across broader cryptocurrency market trends. The current setup looks less like accumulation and more like distribution, especially when compared with earlier cycles. In the past, similar conditions developed quietly before sharp declines followed. BTC Price Prediction 2026 now points to a phase where risk is being underestimated. If critical support zones fail, the market may not give investors much time to react, and sentiment could turn far faster than most expect.

Recent on-chain and ETF flow data show growing pressure from large holders. According to Whale Insider reports, BlackRock-linked clients sold nearly 130.79 million dollars' worth of Bitcoin, signaling reduced institutional risk appetite near key resistance levels.

Source: X @WhaleInsider

Earlier data from January 8, 2026, showed similar behavior when US Bitcoin spot ETFs recorded a net outflow of 398.95 million dollars in a single day, highlighting strong institutional selling pressure near local market highs.

On the 4-hour timeframe, Price is sitting right on a zone that has decided trend direction many times before. Price is hovering near the $90,000 level, and the reaction here does not look confident. Instead of strong continuation candles, the chart shows hesitation, long wicks, and repeated failures to hold above this area. That usually means sellers are active, even if the price is not collapsing yet.

Source: X @Karman_1s

What makes this level more dangerous is the recent pullback from higher prices. After failing near the $94,000–$95,000 range, price dropped quickly and is now attempting to stabilize. According to an analyst, if buyers cannot defend the $90,000 zone, the next visible liquidity sits around 88,000, followed by a deeper pocket near $85,000. A clean 4-hour close below this level would shift the short-term structure clearly in favor of the downside.

On the other side, for any bullish continuation to regain control, price would need to reclaim and hold above $91,500–$92,000 with strong volume. Until that happens, this area remains a make-or-break zone, with downside risk still outweighing upside comfort.

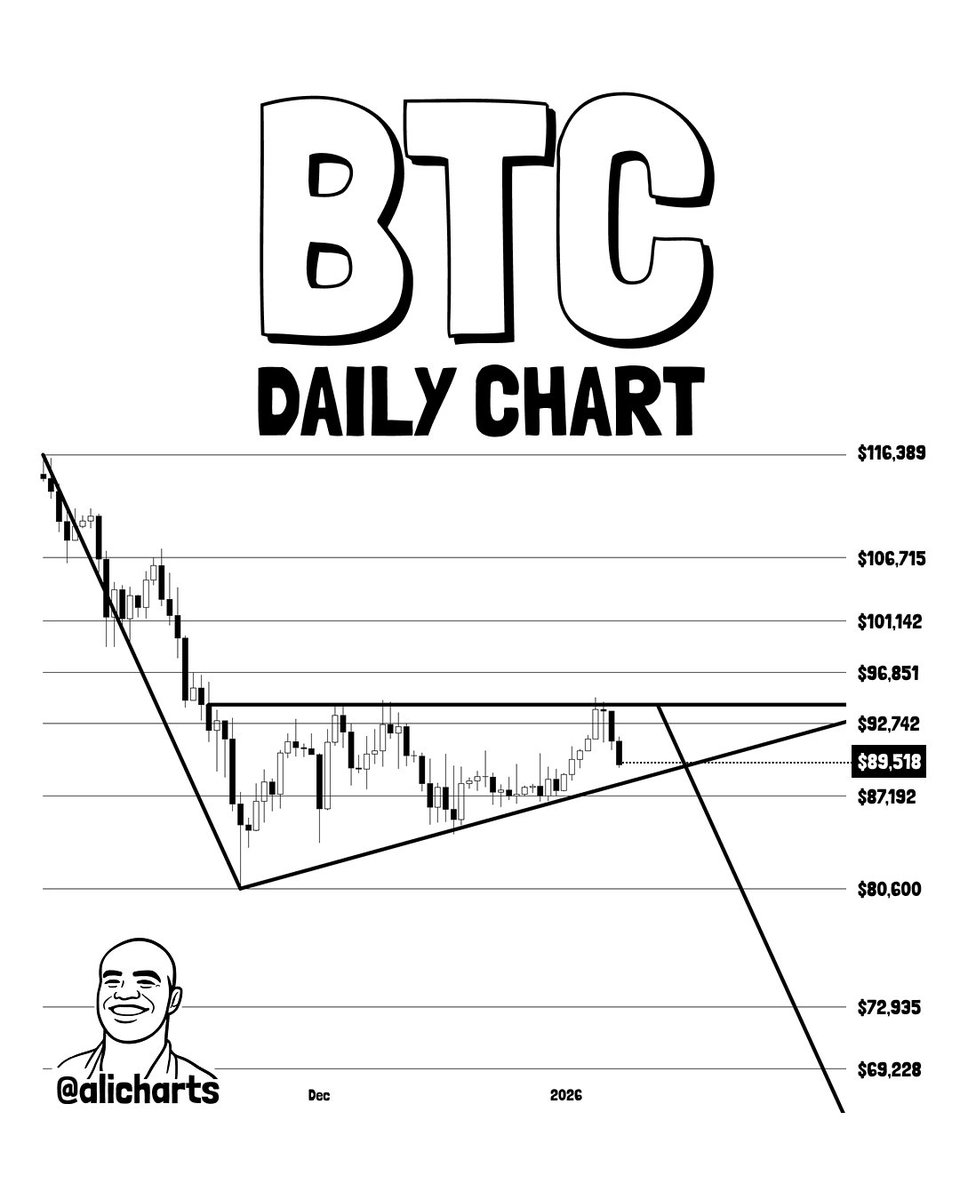

On the daily chart, BTC looks stuck rather than strong. Price keeps moving inside a tight range between $89,518 and $92,742, but there is no real progress. This is not calm consolidation. It feels more like the market is running out of momentum. Each attempt to push above $92,742 has failed, which shows that sellers are still controlling the higher levels.

Source: X@alicharts

Above the current range, Bitcoin is still dealing with heavy resistance. Levels around $96,851, $101,142, $106,715, and $116,389 have stopped prices before, and nothing on the chart suggests they have lost importance. Each time BTC moved into these zones, selling pressure showed up quickly and pushed the price back down.

On the downside, BTC is leaning on a rising daily support line, but that support does not look fresh anymore. It has already been tested multiple times, and on higher timeframes, it usually makes a level weaker, not stronger. If Bitcoin fails to hold the $89,518–$90,000 area on a daily close, the drop is unlikely to be slow or controlled. The chart shows very low support until around $80,600, which makes that level the first real downside magnet. Even there, buyers may not step in aggressively.

If selling pressure stays heavy, the price can easily slide toward $72,935, where the market previously spent time consolidating. In a more aggressive sell-off, BTC could be dragged as low as $69,228. Until price can clearly reclaim $92,742, the daily chart continues to lean toward risk rather than relief.

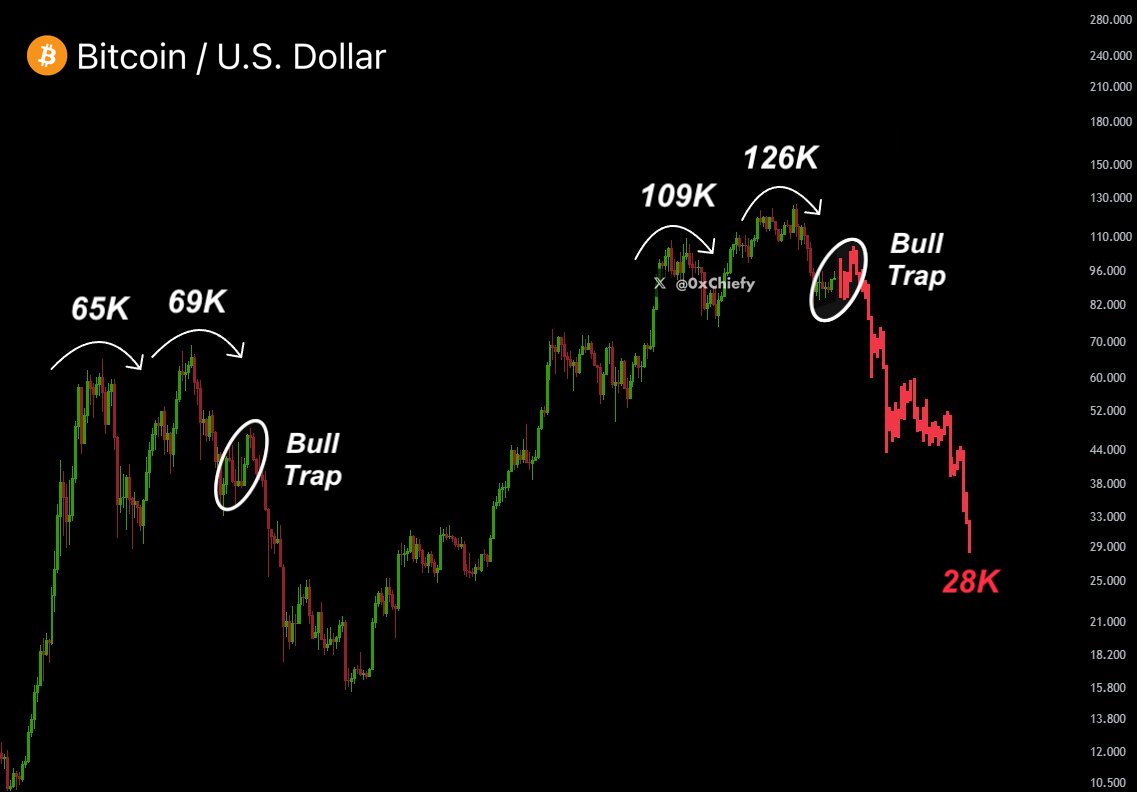

This long-term chart reflects a pattern that has appeared near previous Bitcoin cycle tops. In earlier cycles, similar structures developed when the price was already extended and optimism was at its peak.

Source: @0xChiefy

According to this analysis, the current setup leaves room for a deeper correction if history starts to rhyme. Based on past behavior seen across historical market cycles, downside levels around $30,000 have emerged during comparable phases. This does not imply certainty, but it highlights how quickly price can unwind once bullish confidence begins to crack.

Bitcoin Price Prediction 2026 is not about chasing big upside anymore. The charts are not showing confidence; they are showing hesitation. Institutional selling, ETF outflows, and weak structure keep stacking on the risk side.This does not mean Bitcoin must crash, but it does mean the market is not as safe as it looks. Until price starts holding key levels with real strength, caution feels more sensible than optimism.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.