The big question traders are asking today: will Espresso (ESP) explode after listing — or fade once hype cools?

The market is about to find out. Trading officially starts February 12, 2026, and this is the phase where many crypto projects either build long-term value — or quickly lose momentum. Listings often create strong price spikes, but sustained growth depends on adoption, liquidity, and market confidence.

And here’s why traders are watching ESP very closely right now.

The project is not just another token launch. Espresso powers real-time communication across multi-chain ecosystems, meaning it attempts to solve a real infrastructure problem: connecting blockchains smoothly.

If adoption follows, prices may stabilize and grow. If not, the listing rally could fade quickly.

The ESP token listing begins:

KuCoin: 13:00 UTC

Source: X

Exchange listings usually trigger three phases:

Pre-listing speculation

Listing volatility spike

Price discovery period

During price discovery, the market determines the real value of a token — not the presale price.

Because ESP launches simultaneously on two exchanges, liquidity should be stronger than average new listings. Strong liquidity typically reduces extreme crashes but also limits unrealistic pumps.

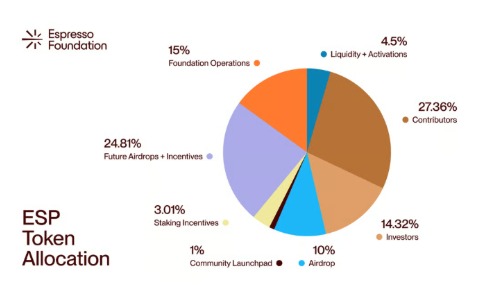

Total Supply: 3.59 Billion

The allocation shows the project is structured more like an infrastructure protocol rather than a meme coin.

Category | Allocation |

Contributors | 27.36% |

Future Incentives | 24.81% |

Foundation Operations | 15% |

Investors | 14.32% |

Airdrop | 10% |

Liquidity & Activations | 4.5% |

Staking Rewards | 3.01% |

Community Launchpad | 1% |

Large allocations to incentives and contributors usually lead to:

gradual token unlocks

periodic sell pressure

long-term ecosystem growth potential

In simple terms:

ESP is unlikely to behave like a short-term pump coin. It is structured for multi-year development.

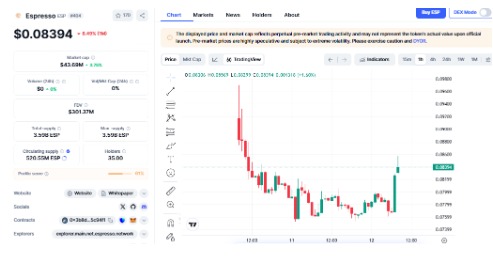

Espresso is trading near $0.0839 after a local high around $0.095. Instead of continuing downward, the price consolidated between $0.076 and $0.081, forming an accumulation zone where buyers slowly entered the market.

A strong breakout candle from this range shifted short-term sentiment from bearish to bullish and suggested traders began positioning for higher prices.

Important support now sits at $0.0815 (breakout support) and $0.0780 (demand zone), while a drop to $0.0760 would weaken the trend.

On the upside, resistance levels appear at $0.086, $0.090 (psychological barrier), and $0.095, which remains the major supply area where selling previously increased.

If the breakout holds, the price could retest $0.086 and possibly move toward $0.090, with strong momentum reaching $0.093–$0.095.

However, a fall below $0.081 would signal a false breakout and may push price back to $0.078 or even $0.076.

ESP appears to be in an early trend-reversal stage rather than a full bull run. Holding above $0.081 suggests an emerging uptrend, breaking $0.086 shows strengthening momentum, and reclaiming $0.090 would confirm a broader reversal.A drop under $0.076 would indicate bearish continuation.

As a blockchain infrastructure project, ESP’s value depends on real adoption. In 2026, the price may trade between $0.075 and $0.12. With growing integrations in 2027–2028, it could reach $0.15–$0.30.

By 2030, wide cross-chain usage could lift it to $0.40–$0.80, but without adoption it may struggle to stay above $0.10.

Every new crypto listing carries risk, especially infrastructure projects.

Main risks include:

Airdrop selling pressure

High token supply inflation

Low developer adoption

Exchange-listing hype fading

Competition from other interoperability protocols

Because of these risks, it should be considered a high-risk speculative asset.

Disclaimer: This content is educational, not financial advice. Cryptocurrency investments are risky. Always do your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.