According to ETH News, whale activity has exploded as Altcoin rose above $4,200, the first time it has done so since December 2021.

The big traders have experienced massive liquidations, and institutional inflows in Altcoin exchange-traded funds (ETFs) have contributed to strong buying pressure in the market.

On August 9, trader 0xcB92 was completely liquidated as Altcoin broke $4,200 level, losing over $15.85 million.

Several hours later, the trader was left with 10,000 Altcoin worth $40.8 millions, with the new liquidation price being 4,114.3.

About a week ago, whale 0x3c9E panick sold 38,582 Ethereums at $3,548 for $136.89 millions when the market was falling.

On August 9, they re-entered by buying 1,800 Ethereums at $4,010, spending $7.22 millions despite the higher entry point.

Another whale went through a quick short squeeze as $110 millions in Ethereums shorts were liquidated within 60 minutes.

This was over 50% of the total short liquidations of $199.61 millions made on the entire cryptocurrency market that day.

Lookonchain data indicated that on August 8, Ethereum ETFs registered $169.2 millions of net inflows led by iShares Altcoin Trust, which registered 26,604 Altcoin worth $103.89 million.

In the last four trading days, Farside Investors monitored a net inflow of $537 million into spot Ethereum ETFs, which shows the increase in institutional involvement.

Bitcoin & Ethereum ETF Flows : Source : Lookonchain

Bitcoin ETFs, too, saw demand with net inflows of $256.01 million on August 8, with the iShares Bitcoin Trust accounting for 1,191 BTC at a value of $138.93 million.

However, with these high daily inflows, most funds had negative seven-day values.

Altcoin News from CryptoQuant confirmed that ETH reserves on centralized exchanges dropped to 18.8 million Ethereums, the lowest in several years.

This decline marks high-growth buying by institutional investors, corporate treasuries, and whales, which decreases the liquidity in the market.

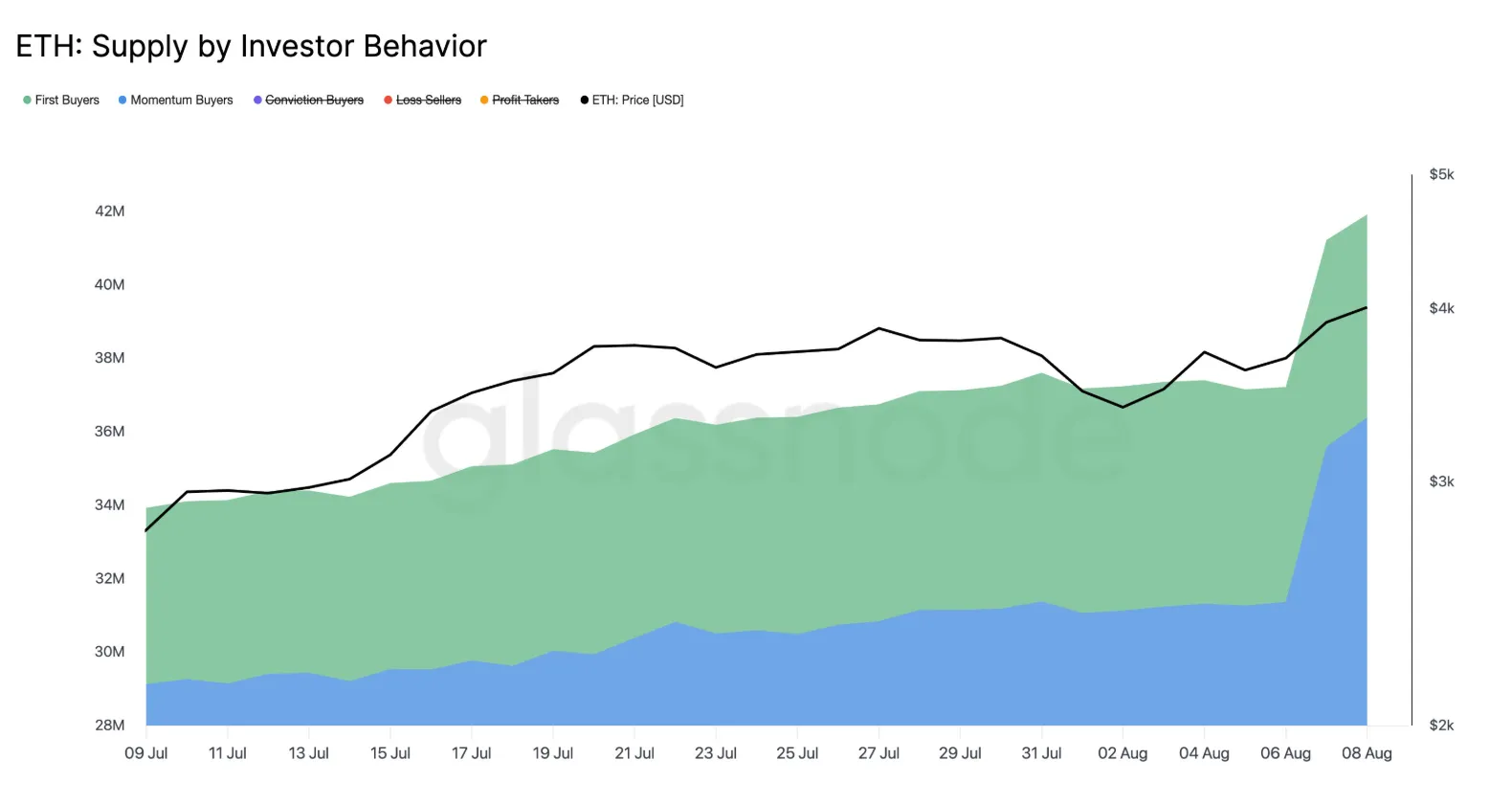

ETH Supply by Investor Behavior : Source : glassnode

Glassnode backed this claim, reporting that the first-time buyers and momentum buyers increased during recent sessions.

This combination brings out the fresh demand and re-interest of the current holders who are willing to increase average cost basis.

Aggregated liquidation heatmaps on Alphractal in 500, 180 and 90 days showed that the liquidation was concentrated above 4,000.

The breakout on Friday triggered losses for bearish traders, with price action pushing toward high-liquidity areas near $4,500.

ETH Aggregated Liquidation Levels : Source : Alphractal

The three-month chart had an uptrending momentum since mid-June, which was characterized by a gradual decline in short positions and the rise in long dominance.

The six-month analysis reinforced that every significant rally has coincided with heavy liquidation clusters.

The ETH/BTC ratio has risen 38.5% in the past 30 days, signaling Ethereum’s growing market strength relative to Bitcoin.

Simultaneously, Bitcoin’s dominance has fallen to 60.82%, suggesting an impending rotation into altcoins.

Market analyst Michaël van de Poppe has projected possible altcoin returns of 200-500% by October, with the breakout of Ethereum as a main trigger.

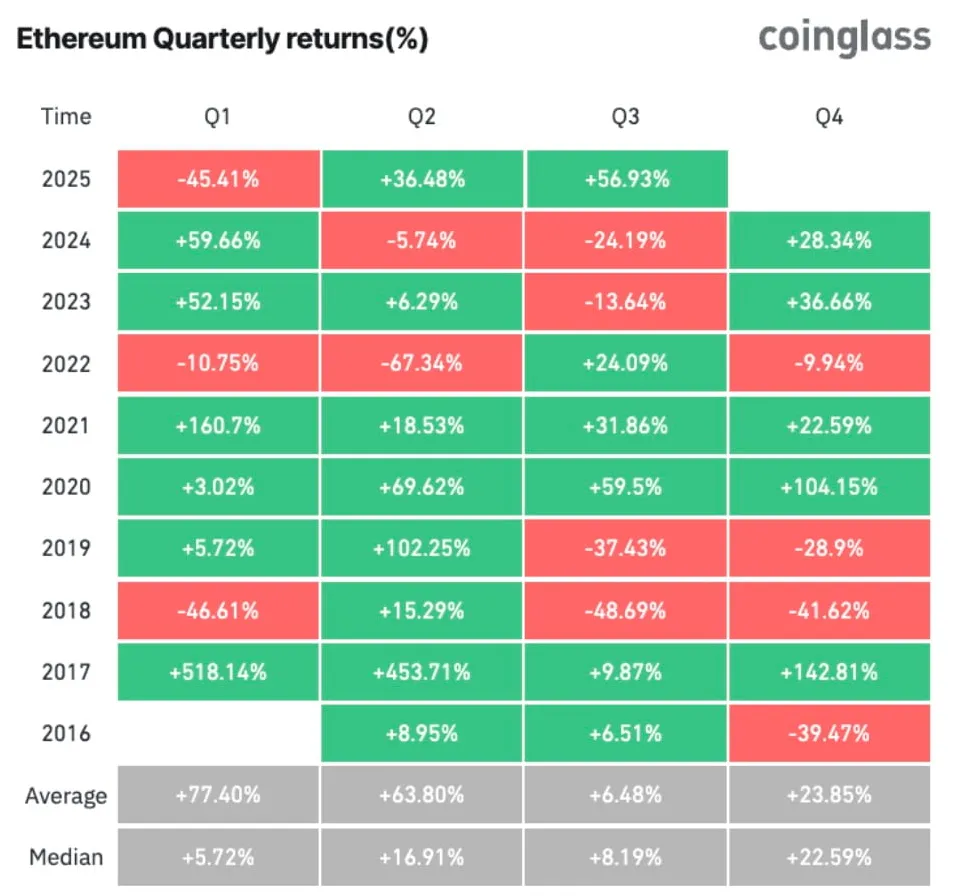

Ethereum Quarterly Returns(%) : Source : Coinglass

Nonetheless, the average Q3 return on Ethereums is just 6.48%, according to historical CoinGlass data, which means that there is a strong reason to be cautious despite the positive EthereumNews.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.