Ethena price surged over 15% in the last 24 hours, hovering above $0.61 at press time. The rally comes amid a series of bullish developments, including a remarkable rise in the adoption of Ethena’s native stablecoin, USDe.

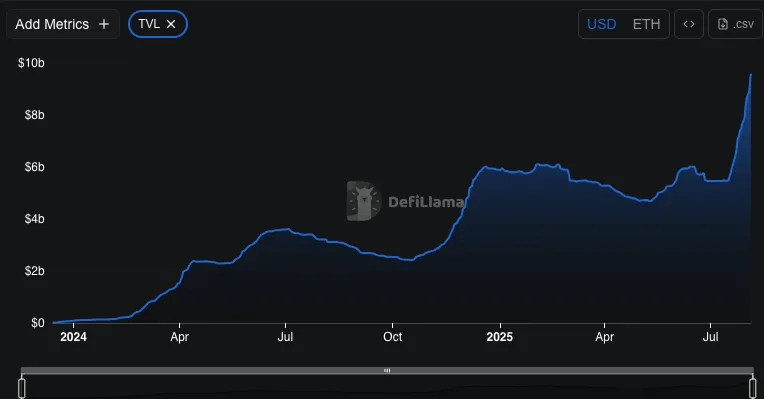

And now USDe has surpassed FDUSD to be the third-largest stablecoin in terms of market cap behind the Tether (USDT) and USD Coin (USDC). DeFiLlama calculates that the market value of USDe has risen by 75% over the last month on the back of soaring demand in the DeFi sector.

Ethena is now the sixth-largest DeFi platform globally, with over $9.47 billion in locked assets. It sits just behind industry leaders like Aave, Lido, and EigenLayer.

Source: defillama

The price rise is also accompanied by higher daily trading volumes that rose by 30% in the last 24 hours. This has turned ENA into the top-performing token of the day and added it to the 41st by the total crypto market capitalization.

The positive changes in regulation have carried momentum to the U.S., with the recently approved GENIUS Act. Ethena has disclosed that it is developing a version of its stablecoin to be compliant with USD in the effort to harmonize it with the new regulatory regime.

Major players around whales have contributed greatly to the rally that has happened in recent times. There are potential short-term headwinds that analysts caution, however. Ongoing unlocking of tokens and whale exits would potentially weigh down the gains of ENA.

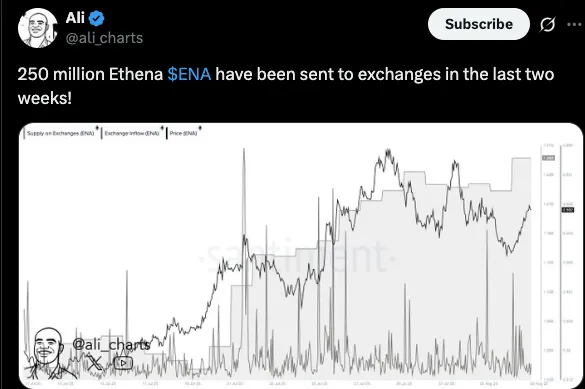

In a notable move, approximately 250 million Ethena tokens have been transferred to exchanges over the last two weeks.

This influx of exchange-bound tokens is an indicator of the height of trader activity which will most likely be as a result of price fluctuations and market speculation.

Source: Tweet

Data posted by analyst Ali suggests that the high number of tokens out of exchanges can be seen as a sign of possible selling pressure or the repositioning of serious token holders.

With activity to build further, market participants are keen to see how the influx changes the price path of ENA in the days to come.

ENA has exhibited a strong positive trend with its price rising to the value of $0.6188 at the time of writing. The cryptocurrency has surged 10% over the last 24 hours indicating that there is an increasing bullish action in the market.

Technical indicators show a bullish sign. The Relative Strength Index (RSI) currently sits at 59.8, indicating it is close to an overbought state but not yet there, and provides a certain leeway to the upside.

Source: Tradingview

Contributing to this impulse is the Chaikin Money Flow (CMF) ticking at 0.16. This would indicate a steady capital flow into ENA, which is an indication of investor confidence.

At the moment, ENA is trading above the important support at $0.60. The next big resistance to a bullish momentum is $0.70. Once it breaks out above this, the way towards $0.80, $0.85, and even $0.90 would be open in the medium term.

But failure to sustain the $0.60 level can cause a pullback. This range is where investors should watch as the price is consolidating around the recent highs.

Annah Mugoiri is an emerging voice in the crypto content space With More than 5 years of experience, with a growing passion for blockchain technology and digital finance. She possesses a sharp grasp of market dynamics and the broader cryptocurrency landscape, skillfully simplifying complex topics like Bitcoin, altcoins, DeFi, and NFTs into reader-friendly, engaging articles. Annah combines in-depth research with a clear and concise writing style that appeals to both beginners and seasoned crypto investors. Dedicated to monitoring price trends, project launches, and regulatory changes, she keeps her audience updated on the rapidly evolving crypto scene. Annah is a firm believer in blockchain’s transformative power to foster innovation and expand financial access worldwide.