Ethereum price has faced strong resistance after peaking near $4,000 in late July, prompting renewed attention to key support levels. On-chain data from the Ethereums Cost Basis Distribution Heatmap shows areas where wallets acquired and are still holding large amounts of eth. According to analysts, the critical cost basis support zones are concentrated around $2,924 and $2,750.

According to recent analysis, Ethereum price has two major cost basis zones. These zones indicated where large volumes of Ethereums were previously accumulated. The first support level is between $2,911 and $2,924 where data showed that wallets hold more than 608,000 ETH in this range.

More so, the second, and stronger zone, lies between $2,744 and $2,757. Over 1.94 million Ethereums was acquired here, marking it as the primary support area.

Source: Ethereum Cost Basis Chart

These levels were identified on August 2, 2025, using data from the Ethereums Cost Basis Distribution Heatmap. The heatmap visualized ETH supply by price bands, with the zones near $2,750 and $2,924 showing high wallet concentration.

Ethereum price recent correction brought the altcoin closer to these zones. If Ethereums revisits these areas, buyer activity may resume. In previous cycles, such cost basis zones acted as floors during retracements. Buyers tend to defend these zones, especially if volume aligns.

Despite the current bearish trend, analysts have also compared Altcoin price momentum to Bitcoin’s 2020 cycle. A recurring RSI pattern is visible on the ETH 3-week chart. The Relative Strength Index touched the 60 level three times in recent months. After the third tap, the RSI flipped above its moving average.

This exact RSI structure appeared in Bitcoin before its 2020 breakout. After a similar triple-tap, BTC surged past resistance and entered a steep rally. The RSI flip was viewed as a strong indicator of momentum shift and Altcoin price now appears to mirror that phase.

ETH/USD 3 Weeks Chart | Source: X

Additionally, the RSI crossover occurred as Altcoin price formed a falling wedge on the macro chart. This long-term wedge dates back to the 2021 all-time high. Ethereum price has compressed within narrowing boundaries with RSI strength suggesting bullish momentum.

Ethereums 3-week chart shows the top altcoin near the apex of a multi-year falling wedge. This pattern formed after the 2021 peak. Analysts have drawn comparisons between this structure and Bitcoin’s 2020 falling wedge. When Bitcoin broke out of that wedge, it rallied from $10,000 to over $60,000.

Should Altcoin price break out in the same way, the forecast would then see a move towards the range of $7,500 to $8,000. The pattern matched earlier wedge break outs in which a rectification is followed by sharp movements.

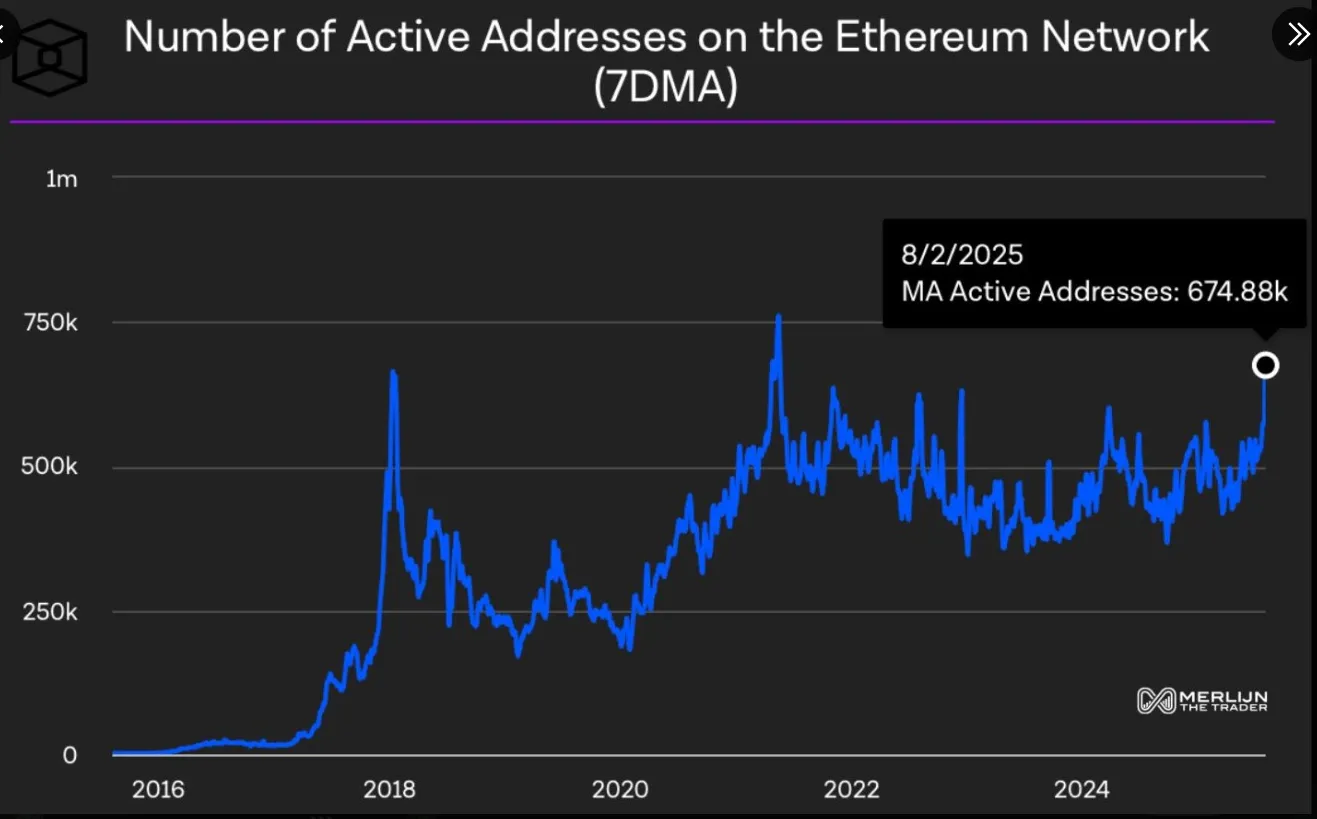

Another indicator that supports the reversal forecast is the number of Altcoin active addresses which increased to the present 674,880 based on the 7-day average. Merlijn The Trader gave higher priority to this on-chain influx as yet another important bullish indicator.

According to him this kind of activity in the address has not been witnessed since the previous market peak.

Ethereum active addresses | Source: X

The indicator soared higher than the earlier highs in 2022 and 2024 to create a form that resembled that of the spike earlier in 2021. At the time, Ethereums active addresses rose before the cryptocurrency surged above $4,800.

In the meantime, SharpLink continued to pursue its Altcoin buying plan to the extent of adding another 100 million in the market even after recent corrections.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.