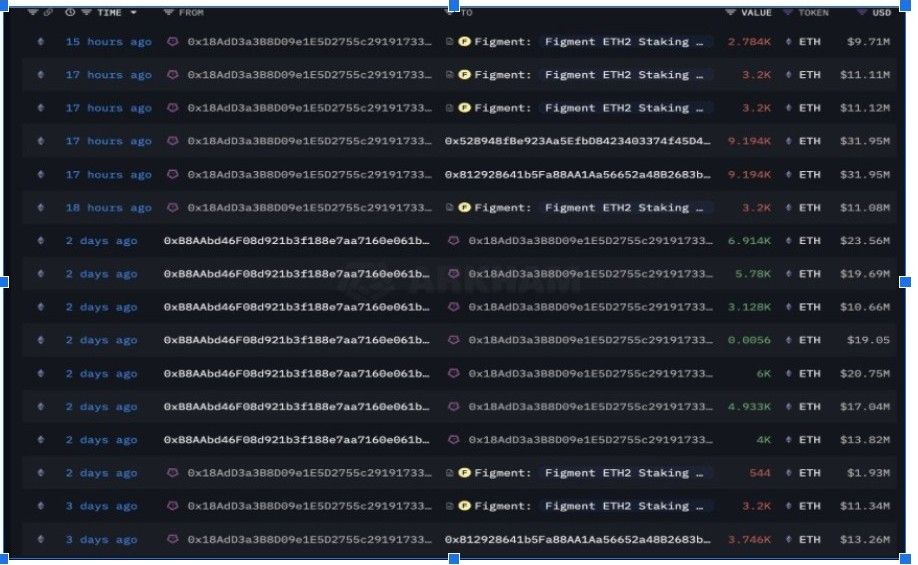

Ethereum price gained renewed attention after a $105.5 million ETH purchase was traced to address 0x18A. According to the Altcoin news, the wallet received the funds issued by Galaxy Digital and staked the entire amount on Figment.

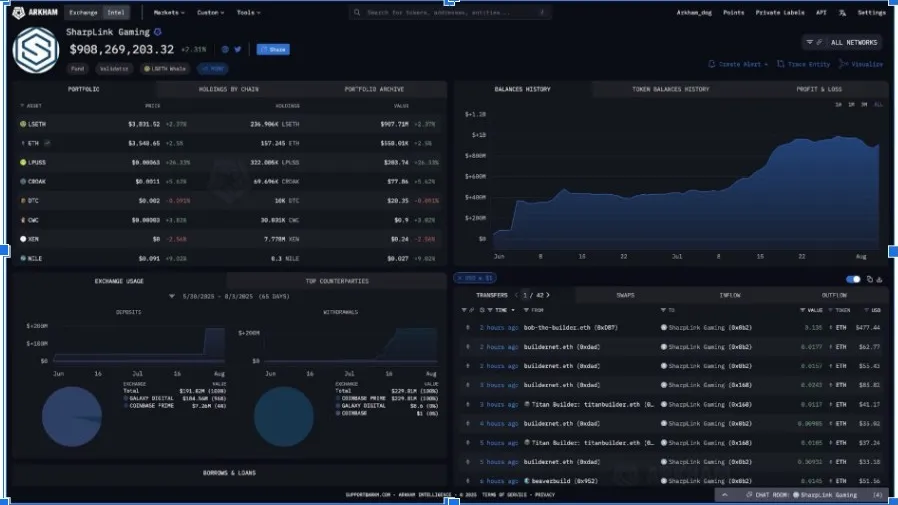

According to blockchain data, connections were made with this address to SharpLink Gaming. Meanwhile, in recent days, there has been talk of institutional Ethereums amassing strategies.

Ethereum price moved steadily higher after the large purchase and stake of $105.5 million worth of ETH over the weekend. The buyer, wallet 0x18A, conducted several transactions totaling over 30,000 Altcoins, all of which were staked via Figment. Each transaction ranged from $9 million to $11 million and occurred within 48 hours according to the Altcoin news.

Source: Arkham Intelligence

According to Arkham Intelligence, this address received Altcoin from Galaxy Digital. The stake activity did not coincide with exchange movement, reinforcing that ETH was intended for validator deposits rather than short-term trades.

Moreover, the wallet is currently appearing in Arkham's network flow graphs and is linked to SharpLink Gaming. This game-oriented blockchain has assets worth more than $900 million and is possibly organizing staking processes.

Based on Arkham’s portfolio dashboard, SharpLink Gaming assets are part of a larger strategy focused on Altcoin staking and yield optimization. Recent inflows have been observed on Coinbase Prime and Galaxy Digital, supporting this thesis.

Source: Arkam Intelligence

Between July 31 and August 2, the ETH balance at wallet 0x18A surged, aligning with confirmed transactions from intermediary wallets associated with Anchorage Digital.

More so, SharpLink’s token balance history showed a clear upward trend through July and early August. Altcoin price corresponded with these inflows, thus, implication on the market were realized.

At the time of writing, ETH rose more than 5% in the last 24 hours to $3,650, with a substantial daily volume. The analysts see this institutional demand as a support layer to the present Ethereum price action.

From a technical standpoint, Altcoin price trend over the past week mirrored its late June recovery pattern. Analyst Batman noted that the latest correction to $3,400 is similar to the one in June of about $2,100, which was corrected sharply.

Source: Batman, X

From the Ethereum news, the chart pattern showed a clear breakdown-shakeout-rebound sequence. This pattern resulted in a 30% rally to $3,900 in June. Altcoin price has already retested the support level of $3,500 and is making higher lows. This trend indicated that the top altcoin might retest the level of $3,900 in the middle of August.

The analysts also pointed out the daily RSI and MACD momentum recovery, which supported the bullish opinion. However, resistance at $3,700 remains critical. Any break over it would confirm a larger continuation pattern to the past high. For now, price remains range-bound but structurally intact.

According to CryptoGoos, Ethereum price entered an uptrend following several small shakeouts in early August. On the 15-minute chart, ETH price formed a sequence of dips followed by sharp recoveries. The latest breakout contributed 11.46% and brought the price up to above $3,550.

Ethereum 15-Hour Chart | Source: X

The analyst expected ETH price to reach $3,879, which aligned with its late July peak. The volume profiles are in line with this move, whereby there is accumulation just below the resistance band. CryptoGoos also pointed out that the breakout of the recent downtrend was accompanied by a clean structural shift.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.