XRP price has been experiencing notable price fluctuations over the last 24 hours, showing a significant downtrend from just over $3.10 to below $3.00. The most recent price point sits at $2.95, signaling a slight rebound after a sharp drop.

This XRP decline is part of a broader trend in the market, where economic factors, including upcoming reports from the Federal Reserve and the Bank of England, could influence future movements in crypto.

The July release for the FOMC is scheduled for August 20 and policymaker views on hazards on upward risks are under the microscope. Tariff pass-through assessments, specifically, are being sought by investors.

Pricing of a rate cut in September is already underway in the markets. However, the recent weak payroll numbers and downward revisions of prior reports have created uncertainty in investor sentiment. Maybe they will discuss the labor market critical factor in monetary policy and how much the Fed would want to ease if this weakness stayed.

Meanwhile, eyes will be on whether Chairman Powell's hawkish press vantage was aligned with the committee consensus or simply the chair's bid to contain dissenting voices. These upcoming clumps of revelations could result in a significant upswing in broader market movements, including the XRP space. The continued role of the labor market as a key factor in these policy discussions will be fundamental for the investor community to keep track.

Meanwhile, across the Atlantic, the UK is slated to witness the arrival of July CPI data on August 20, with inflation expected to inch just a bit higher to 3.7% y-o-y. Food, fuel, and accommodation costs are likely to be pushing inflation up, while services CPI may also jump to 4.8%.

These numbers will be critical as they test the Bank of England's stance on inflation. Previously, the Bank of England had thought inflation would peak at 4% in September, and a higher-than-expected reading could be used as an argument to delay rate cuts. If inflation keeps on outdoing expectations, the Bank of England could very well defer any rate cut until 2026, thereby contorting the jaws of uncertainty in global markets, including cryptos.

Expectations on the Bank of England's policy will largely be shaped by the inflation path prevalent in the UK. These events could definitely sway investor sentiment, whether for cryptocurrencies or major assets.

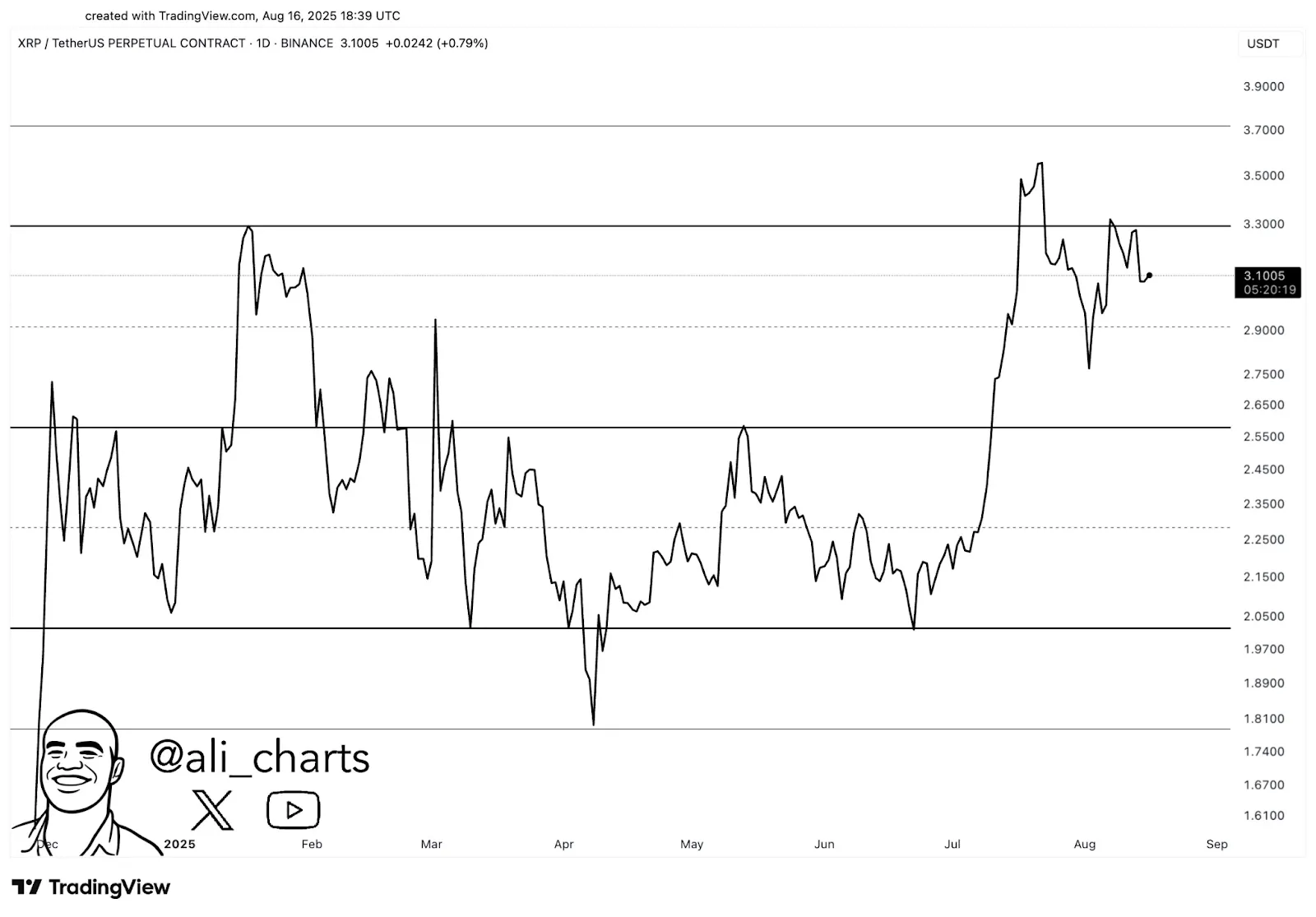

In the grand schema of economic events, the price of XRP is testing a critical resistance level. Ali Martinez states that $3.30 poses significant resistance for XRP. If it fails to break this barrier, the downward movement may commence with support levels gaining primacy. Should $3.30 not be reclaimed or sustained as support from resistance, then $2.60 will be the price to retreat to for XRP.

Source: X

If that support at $2.60 is lost, then the next major support that the analyst is eyeing sits around $2.00, which would be a significant drop from the current price where it trades. The extent of volatility of XRP was evident, as all price fluctuations showed the extent to which the asset is sensitive to market and economic forces.

And so, investors and traders are urged to closely monitor these levels. As soon as these key support zones stop holding, it would signal a deeper retracement for the crypto in the short term.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.