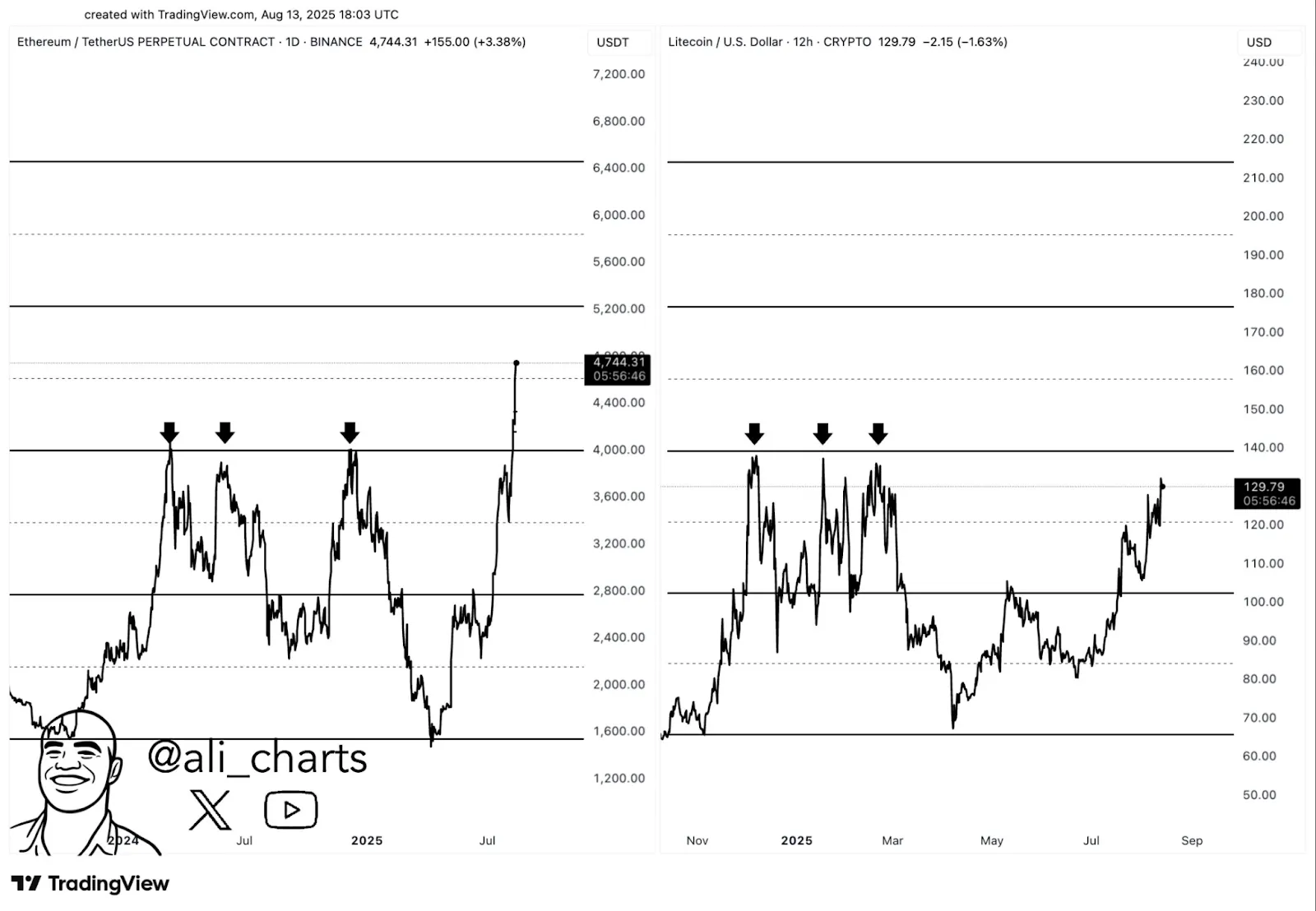

After several unsuccessful breakout attempts over the past few months, Litecoin price is approaching a vital resistance level of $140.

The cryptocurrency has surged more than 38% in the last month, attracting renewed attention from traders and institutions.

Market sentiment is unclear, with technical indicators and on-chain information pointing to both a breakout and a short-term price volatility.

The $140 level has acted as a strong ceiling for the Litecoin price, rejecting advances on three prior occasions.

Analysts observe that a clean break above this level could open the path towards $160 and beyond.

Source : X

Loss of momentum, though, threatens to trigger a retreat toward a support zone of $120, which has been reliable in the past.

Daily and 4-hour charts indicate price consolidating slightly below this resistance, with RSI and MACD indicators being in an upward bias.

According to analyst CJ Bennett, LTC staying above $119.58 is significant to prevent a bearish technical reversal. A high-close above this could support the breakout argument into the weekend.

Institutional involvement has been a booster in the current Litecoin price rally, such as the $100 million treasury investment by MEI Pharma that included GSR and Litecoin founder Charlie Lee.

On the derivatives side, the Binance and OKX data indicate a high level of long positioning, with long/short ratios in excess of 2.2.

But overall 24-hour long/short ratio is 0.9175, which means that some traders are going short in expectation of resistance taking hold.

The open interest declined by 3.47% to $1.07 billion, and the trading volume fell by almost 47% to $1.34 billion, which is an indication of a cool-down after the initial surge.

Options market activityis also weak, and falling volumes indicate a more cautious positioning.

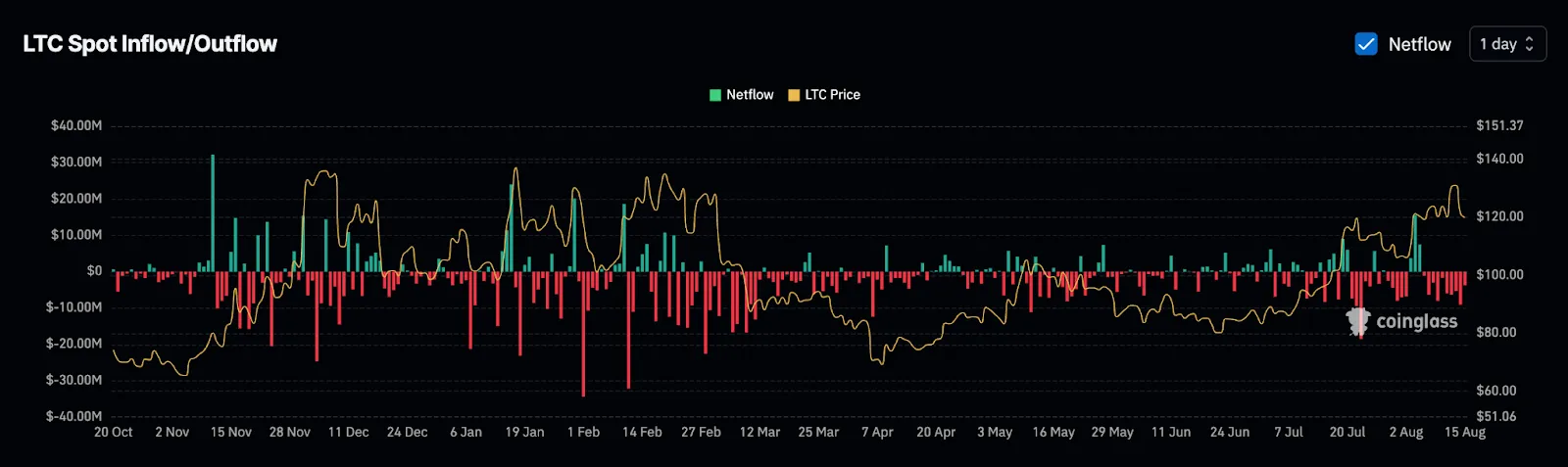

Litecoin spot inflow/outflow data indicates a continuing net outflow into exchanges over the past weeks as holders accumulate.

Nonetheless, there have been small inflow spikes in recent days, implying that these traders may be removing coins out of exchanges to cash out.

LTC Spot Inflow/Outflow | Source : Coinglass

Any sustained inflow increase could signal potential selling pressure if traders decide to exit positions near resistance.

Funding rates remain positive, meaning leveraged longs continue to pay shorts, indicating a bullish bias in the futures market.

On long-term technical analysis, Litecoin price is seen to have broken a multi-year consolidation pattern, and upside potential lies between $280 and $362, assuming the momentum can be maintained.

As SatoashiLite illustrates, the monthly RSI and MACD patterns have been growing steadily since 2022 and are indicative of a slow bullish trend.

The Elliott Wave counts by various analysts are indicating the initial phases of a possible protracted rally.

Source : X

However, traders are wary of the fact that short-term volatility may increase further in case $140 remains a barrier.

A successful breakout and volume growth would increase the chances of reaching $160 soon, but failure can result in retests of $120 or even $112.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.