Ethereum pushed up to around $3,403 on January 14, its highest point so far this month. That move did not last very long. Traders locked in profits, and the price slipped back into a sideways zone. Today, ETH is still moving without much direction, which matches the broader cryptocurrency market trends, where Bitcoin is also struggling to find strength and sentiment feels slightly heavy.

Even so, ETH is not breaking down either. Price is just sitting near recent levels, holding its ground. That keeps the Ethereum price prediction discussion alive. Is this simply a pause after a strong push, or is the market quietly setting up for another attempt higher? And with the $4,000 level still visible on the chart, the bigger question remains—is it closer than it looks, or does Ethereum need more time before trying again?

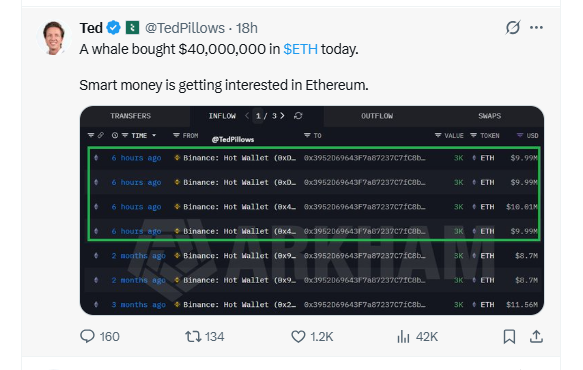

A fresh on-chain update shared by TedPillows shows a whale picking up close to $40 million worth of ETH in one day. The data points to multiple buys of around 3,000 ETH at a time, all moving from a Binance hot wallet. It does not look like a single rushed trade. More like steady accumulation, spread out.

Source: X@Tedpillows

What makes it interesting is the timing. This buying is happening while ETH is mostly moving sideways and the broader market feels weak. Bitcoin movement is not helping much either. Moves like this usually get attention in the cryptocurrency market, since whales tend to build positions quietly. It does not mean the price has to jump right away, but it does add some weight to the ongoing Ethereum price discussion.

Ethereum is still moving within a rising channel on the 4-hour chart, and while the price movement isn't entirely clean, the structure hasn't broken down yet. The first thing to notice on the chart is the bullish crossover between EMA 9 and EMA 21, which is usually a signal of short-term strength, but it doesn't guarantee an immediate move. Following that crossover, ETH has repeatedly approached the EMA zone and bounced slightly from there, which simply indicates that sellers aren't in complete control.

Source: TradingView

The price is currently stuck between $3,300 and $3,350, with no strong follow-through in sight, but no breakdown imminent either. As long as ETH holds above the EMA, the trend will remain technically intact. While remaining within the rising channel, the price could slowly slide towards $3,480, and if momentum builds slightly and the channel breaks out from the upper side, the $3,600 area could be tested. Without a channel break, this move could simply remain a slow grind, not an explosive rally.

If ETH slips below EMA support at any point, the picture will become a bit uncomfortable. The first reaction zone could be around $3,180, followed by $3,040, and if market pressure increases further, a pullback to $2,910 is not impossible. For now, however, staying above the EMA is keeping this entire structure alive, and the ETH short-term price prediction bias is on the positive side, but confidence still seems a bit doubtful.

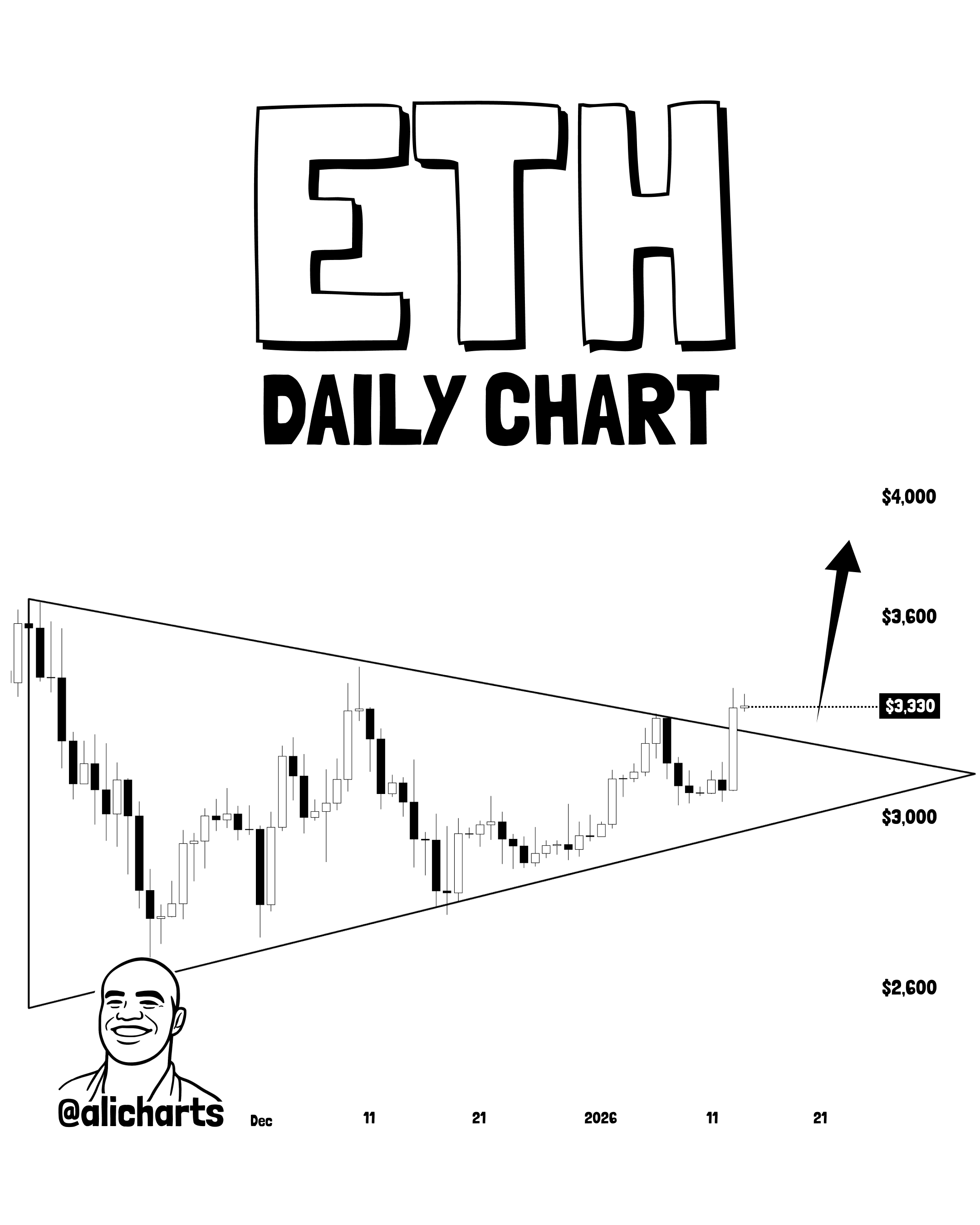

Ethereum is currently compressing inside a tight triangle on the daily chart, with price hovering near $3,330. This kind of structure usually does not stay quiet for long. If ETH breaks and holds above the upper trendline, the next upside zone opens toward $3,600-$4,000.

Source: TradingView

However, this setup remains conditional. As per the analyst view, if the price fails to sustain and drops below $3,000, the structure weakens, and a deeper pullback toward $2,600 cannot be ruled out.

A recent market tweet hints that Ethereum could be moving into a larger rotation phase of 8 years on higher timeframes. The structure being pointed out looks similar to past cycles, where ETH spent a long time going nowhere, building quietly, before stronger moves eventually showed up. Right now, it feels more like an accumulation stretch than a breakout phase.

Source: X @wacy_time1

The difference this time, as pointed out, is scale. Participation from larger players and heavier capital flows appears to be building quietly. This phase does not show explosive price action yet, but historically, such stretches have often tested patience rather than timing. Whether it fully plays out or not, this rotation narrative is now part of the broader Ethereum price outlook.

Right now, Ethereum is giving mixed signals. There are signs of accumulation and some whale activity, and the short-term structure does look better than before. But at the same time, price is still stuck in a narrow range, and higher timeframes are not fully confirming anything yet. It feels constructive, yes, but not settled.

So when it comes to the $4,000 question, it looks more like a level for later, not something that feels immediate. The current Ethereum price prediction stays slightly positive as long as key structures hold, but ETH probably needs a clean breakout and follow-through before that level really comes into play. For now, the market seems more focused on waiting than rushing.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.