As Ethereum struggles to maintain its vital support and resistance zones, the inquiry which is being raised most frequently in the market is: Are the whales slowly getting ready for Ethereum's next big move?

The scenario of Ethereum is such that it could be at the very turning point of its cycle in which the altcoin’s outlook would then be dictated by the next phase.

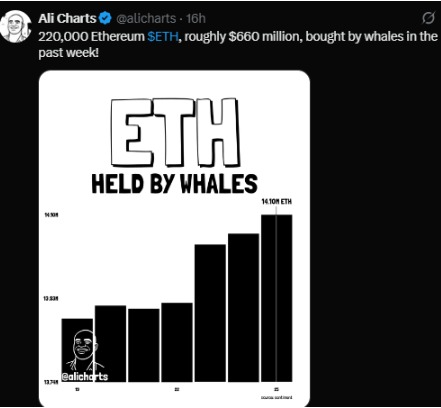

ETH whale activity has reached very high levels, with the big investors collecting almost 220,000 ETH, which is around $660 million, within just a week, based on Ali Charts' reports.

The gradual increase in whale-controlled ETH points to the whales' being informed about the future and not just trying to ride the price waves.

In the past, such behavior has indicated that the institutional investors have got the confidence of the market in the liquidity phases and smart money has already taken positions there while the other investors are still waiting to enter the market.

As if to corroborate this narrative, Lookonchain has reported that wallet 0x46DB recently acquired an additional 5,500 ETH worth $16.09 million, making its total since December 3, when it started buying, twenty-one days, 41,767 ETH valued at $130.7 million.

Although the whale is currently sitting on a loss of more than $8.3 million, it has still not given up on buying—showing a strong faith in Ethereum's future instead of being influenced by the present situation.

This intense accumulation has elicited a wave of optimism all over the crypto market again. Are the whales already making their moves in anticipation of the next ETH rally?

One of the main factors that contributed to the improvement of the Ethereum on-chain fundamentals was an increase in the number of active users which can be mainly attributed to whale accumulation.

Within a week, the number of active addresses jumped from 496,000 to almost 800,000, wich indicates a sharp rise in the number of people taking part in the network.

The active addresses thus have been giving support to the price during the consolidation and at the same time have been preparing the future upside. When growing user engagement happens to coincide with whales’ accumulation, the overall bullish on-chain hypothesis for Ethereum is usually strengthened.

Technical data has given further support to Ethereum’s optimistic outlook. The ETH/Silver ratio has fallen to the lowest levels of the bear market in 2022, and the monthly RSI has also hit an all-time low—such circumstances have, in the past, usually led to strong rebounds.

These kinds of oversold macro indicators point at limited risks for a downward move, especially when they are accompanied by the purchase of shares by the largest market players.

The co-occurrence of the strength of the blockchain and the exhaustion of the technical indicators may increase the likelihood of Ethereum nearing the close of its correction phase.

When the price is no longer considered, the future development roadmap of Ethereum adds another layer of optimism. Starting in 2026, ETH is planning big, first with the Glamsterdam fork, that will open up ways for parallel transaction processing and increase the gas limit from 60 million to 200 million.

Also, validators will start ZK proof validation which is a necessary step for the Ethereum 1.1s project of 10,000 transactions per second to be realized. Then Heze–Bogota fork will come next that will give priority to better privacy, anti-censorship, and deeper decentralization thus cementing Ethereum's scalability and durability for the long term.

Looking at the macro view, Ethereum's price movements are very similar to the periods of accumulation in 2017 and 2020. In both cases, after the prolonged sideways movement, the price shoots upward massively. The current charts indicate that the price of ETH is again consolidating, thus indicating the possibility of the market readying itself for the next movement in the upward direction.

On the weekly chart, the asset is most likely creating a long-term inverse head-and-shoulders pattern, which is a classic bullish reversal structure. The price is approaching the point at which the right shoulder is being formed, and after the breakout has been confirmed, the projected target as calculated might be around $7,600.

When whale accumulation, an increase in on-chain activity, and strong fundamentals come together, the bullish reversal pattern that it is is forming becomes very clear as a signal of the transition from accumulation to a strong uptrend.

If the current trends persist, then the price could stay within a range for the short term while building up the momentum. However, a confirmed breakout above the important resistance level could lead to a rapid price increase, with medium- to long-term targets stretched out towards $6,000–$7,600.

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.