BlockDAG Network has released an official communication stating that their mainnet is now ready for production use, and the Token Generation Event (TGE) is going to take place very soon as the presale enters its final phase which will end on January 26.

The exchange listings that have been confirmed, the fastest delivery of miners, and an AMA on December 29 are all factors that are adding to the already big hype for BDAG—but is price prediction going to be the thing that proves the hype, or investors are having valid doubts about the timeline changes?

With the accumulation of events, BlockDAG has reached a very strategic point where both luck and suspicion are present, and this has raised the significance of price forecasts.

BlockDAG has said that the market makers are set, the launch positioning is finished, and miner deliveries will start at the end of January, thereby signaling very robust operational readiness. These milestones commonly lead to increased confidence among investors right before a TGE.

On the other hand, the pricing behavior during presale has been inconsistent which has raised concerns among the people following the event. On December 24, the official website had a countdown that suggested a price increase to $0.0133 in nine hours but after 24 hours, the price remained the same.

These kinds of discrepancies can be confusing, particularly for retail investors who are using time-based pricing strategies and thus want to get the exact price movements.

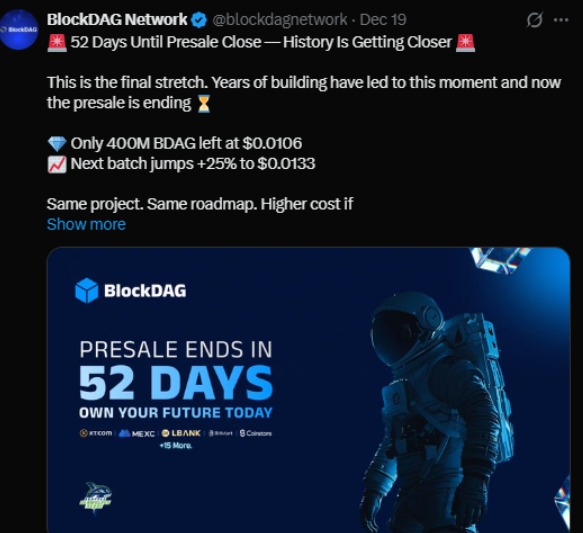

On December 19, BlockDAG tweeted that there were still 52 days until the presale ended, which indicated that the presale would end around February 10. However, the project afterwards made it clear that the presale would end on January 26 instead, thus very much narrowing the investment window.

The frequent alterations of the presale dates and prices, which have already been observed with BlockDAG, do indeed question the matter of transparency. In the case of crypto fundraising, the lack of clear and consistent information can lead to losing long-term investor trust—especially when it comes to the last phase of the presale.

BlockDAG is a digital asset that has a maximum supply of 150 billion tokens which means that it is one of the high-supply digital assets. The project also highlights value preservation and scarcity mechanisms after the presale, but a large supply like this one, in general, limits to a certain extent the extreme price targets unless an aggressive deflationary policy is adopted.

Nonetheless, BlockDAG has already been able to list its token on several exchanges such as XT.com, MEXC, LBank, BitMart, and Coinstore, along with more than 15 other exchanges, where it would be very easy to find and buy the BDAG token and also get early liquidity at the time of launch.

Taking into account the presale demand, access to exchanges, and only a limited amount in circulation at the beginning, most of the market models suggest that BDAG might come onto market with a price between $0.05 and $0.20.

This range corresponds to the following:

Good demand in the early stages

Several centralized exchange listings

Price discovery that is done by the early liquidity

If the buying momentum remains strong after TGE, the short-term volatility may very well drive BDAG towards the top extreme of this range.

The possibility of a listing on Binance or some other top-tier exchange could have a very positive impact on BDAG in the market. In this scenario, some analysts say that BDAG could set a target of $5–$10 by 2026, and the following factors:

Increased visibility

Higher trading volumes

Broader institutional participation

At the same time, getting to the desired price points will depend on the persistence of the ecosystem's development, the presence of real-world use cases, and the flowing of users into the network that are not just traders hoping for price appreciation.

The $20 price target for 2027 is still very cautiously optimistic. Under a wholly favorable scenario—uninterrupted development, increasing community adoption, and successful supply management—this milestone may not be too far in the future.

But then again, looking at the huge amount of tokens available in total, BDAG would need to see quite a lot of demand growth along with deflationary measures to be able to keep such high valuations realistically.

If by the year 2030 price of BDAG is $30, this would imply a market cap of approximately $4.5 trillion, which is a far-fetched figure taking into account the present condition of just 150 billion tokens circulating in the market.

The scenario could only arise if the following measures are taken:

The tokens are burned in massive amounts

The supply reduction policies are very aggressive and lasting

BlockDAG technology is widely adopted

Without these happenings, the price points would still be far away and improbable.

Crypto price predictions are for informational purposes only and not financial advice. The crypto market is highly volatile, and prices can change at any time. Do your own research before investing. We are not responsible for any financial losses.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.