In the past seven days, Ethereum ETFs attracted net inflows of 197,938 ETH, while Bitcoin ETFs registered net outflows of 2,448 BTC.

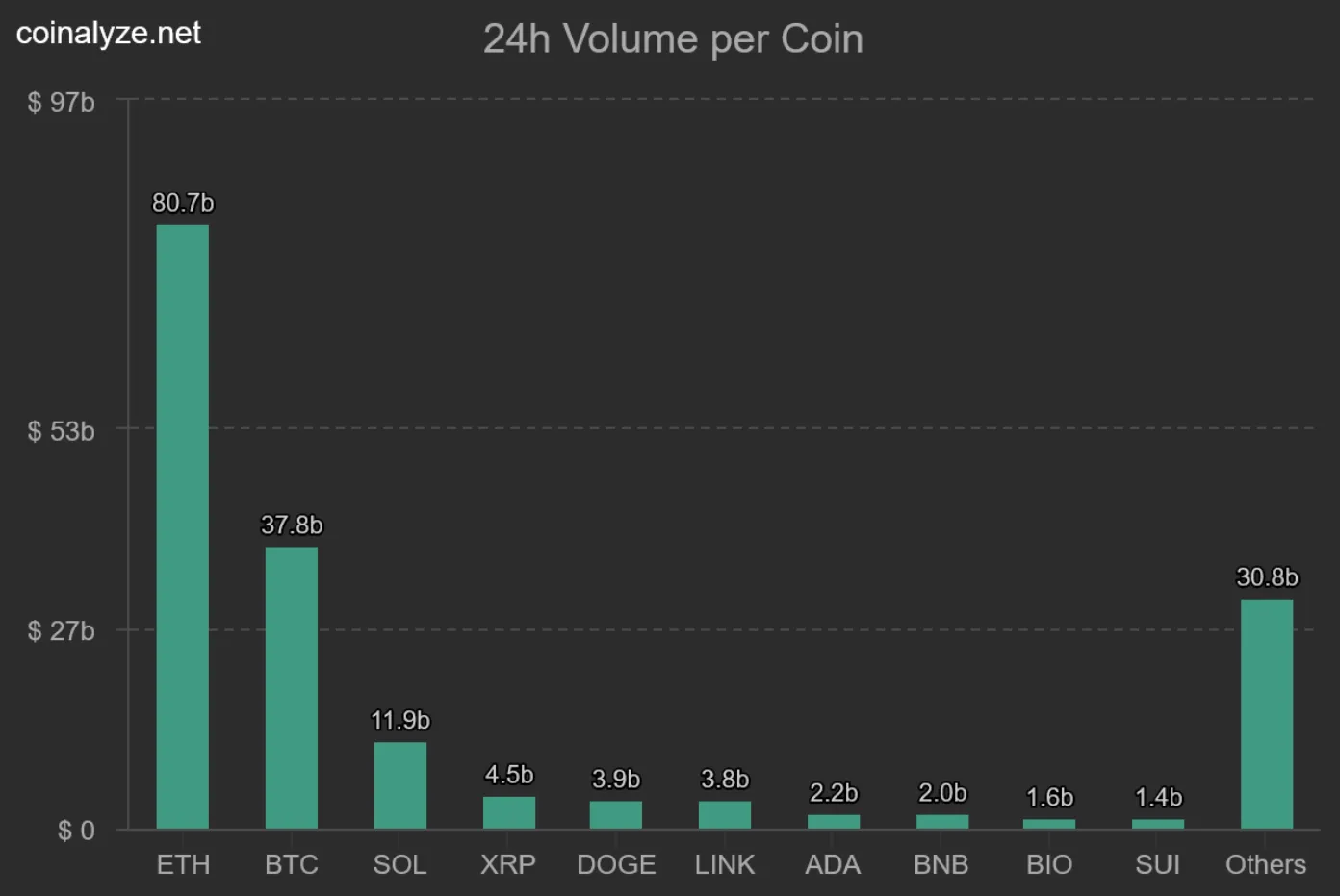

More so, the altcoin futures trading volume hit $80.7 billion, surpassing Bitcoin’s $37.8 billion, underscoring the stronger trading demand. At present, the token is trading at $4,301.90, up 0.33% in the last hour and 2.23% over the past 24 hours.

Yet it still sits 8.61% lower on the 7-day chart. Ethereum price sits just below the $4,647 resistance mark, which continues to act as a pivotal breakout level.

A longtime BTC whale has diverted capital into altcoins, signaling a notable shift in sentiment. The investor, still in possession of more than 14,800 BTC amassed seven years ago, recently divested 670.1 BTC valued at $76 million and committed to a long position in the altcoin.

https://x.com/lookonchain/status/1958457008862200076

The same whale subsequently transferred 1,000 BTC into Hyperliquid and redirected the funds into 19,794 ETH valued at roughly $85 million. The shift from leveraged longs to on-spot purchases underscores a deliberate accumulation strategy.

On-chain data confirm that this address now holds roughly 68,130 ETH worth more than $295 million across several different wallets. The shift signals a widening conviction that the top altcoin will outperform the top crypto by market cap during this market cycle.

At the same time, the U.S. Government increased its crypto tally by 76.56 coins, bringing its total to 65,232 ETH, valued at roughly $281 million. This points to rising institutional appetite for the crypto in tandem with whale activity.

Taken together, these developments reinforce the narrative of an impending cycle. Over the course of seven days, Ethereum ETFs saw net inflows of 197,938 ETH roughly equivalent to $824.21 million in capital.

Conversely, the top crypto ETFs registered net withdrawals of $411.79 million during the same period. Importantly, the iShares Ethereum Trust (ETHA) spearheaded the inflows, amassing 275,337 ETH to its holdings.

ETFs : Source : Lookonchain

Although Fidelity recorded notable ETF outflows from both the top and second biggest cryptos by market cap. The top altcoin nonetheless recorded net gains for the week overall.

24h volume per coin : Source : Coinalyze.net

Likewise, the altcoin commands the majority of futures trading, recording $80.7 billion of volume, more than twice Bitcoin’s $37.8 billion, within the past 24 hours.

The altcoin price is at present probing a multi-year resistance at $4,647, and a decisive breach could propel prices toward targets above $10,700. Technical charts indicate breakout from a long-term ascending triangle, supported by robust weekly candles.

Ethereum ascending triangle : Source : X

According to market analyst Crypto Patel, the token remains only 132% from the $10,000 level. At the same time, ETH/BTC is near a pivotal resistance at 0.043, and a clear breakout could spark substantial momentum among the altcoins.

ETH/BTC : Source : X

Current price action is echoing the framework of the top crypto's 2018–2021 bull run, during which the flagship cryptocurrency surged 1,724%.

BTC vs ETH comparison : Source : X

Should this fractal repeat, the crypto may surge 1,250% from its correction low and potentially top $15,000.

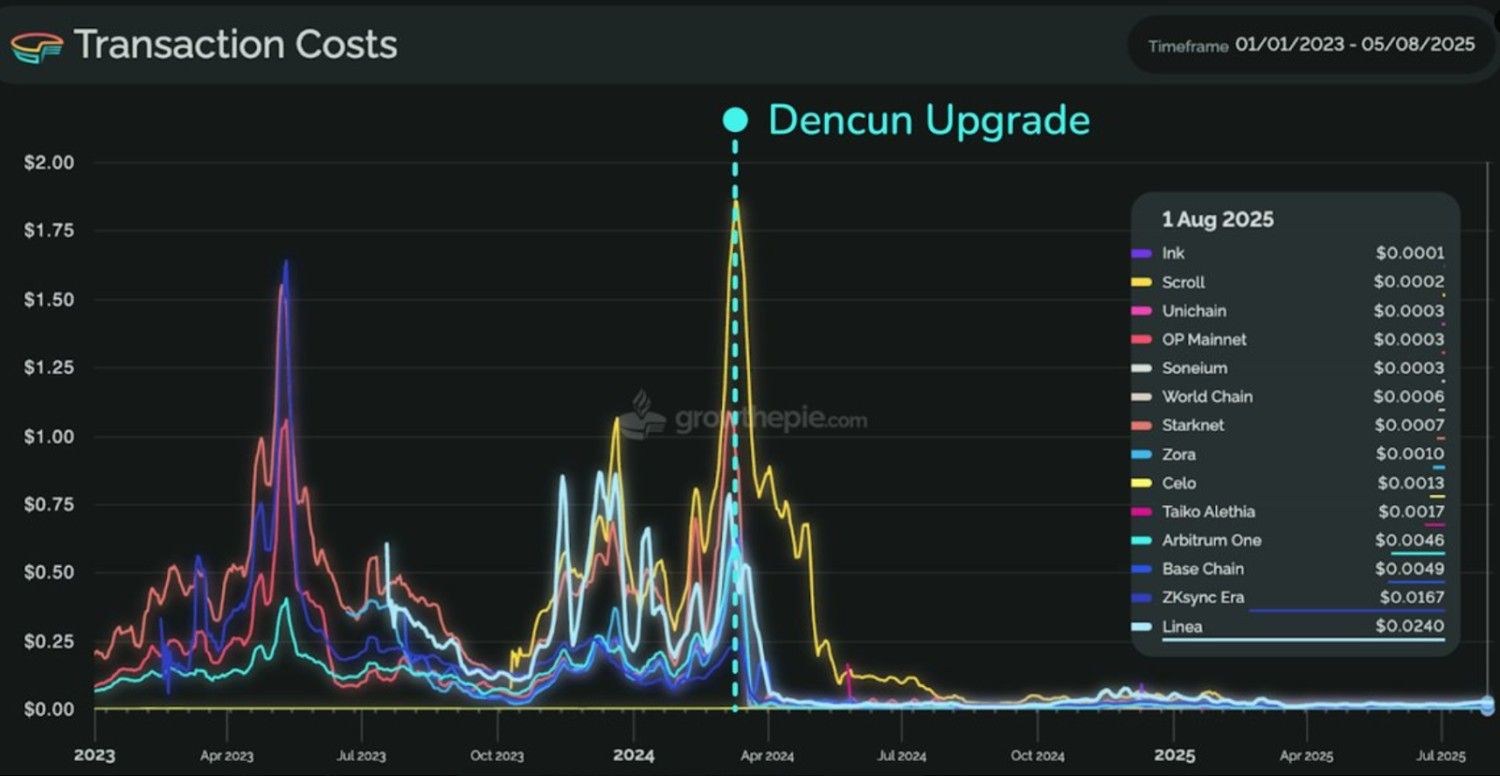

The Dencun upgrade has likewise dramatically lowered gas prices on both Ethereum L1 and L2, thereby easing transaction friction. The advent of sub-cent transaction fees will enable further scaling of user and developer activity.

Transaction costs : Source : growthepie.com

Recent worries about Bitcoin’s network centralization have rekindled comparisons with the two largest cryptocurrencies.

Two mining pools presently command more than 51% of Bitcoin’s hash rate, renewing concerns over a 51% attack. Ethereum, by contrast, moved to proof-of-stake, tying its security to the staked capital itself rather than to mining rewards.

Researcher Leon Waidmann argues that the altcoin today seems more decentralized and economically sustainable than Bitcoin. Because PoS rewards are anchored to long-term alignment, Ethereum could experience a reduced likelihood of manipulation.

These dynamics may, in turn, boost price stability and strengthen investor confidence during the forthcoming market cycle. Moreover, scaling through rollups and L2 solutions bolsters network resilience and enhances the user experience.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.