The airdrop of ETH Gas has reached its most crucial stage, and one great question has arisen among the people: Is the GWEI capable of being the next essential Ethereum utility token? Binance Alpha will be the first platform to launch ETHGas (GWEI) on 21 January 2026. The catch of Binance Alpha showing ETHGas and a constant airdrop schedule is definitely a reason for the Ethereum community to be excited.

This event is more than just a new token release. It signifies a change in the rewarding method of Ethereum users to one based on actual gas consumption. That is the reason why the price prediction of the ETHGas token is gaining interest quickly as the listing date gets closer.

ETHGas is not intended to be a meme token driven by hype. Rather, $GWEI is an active participant in the governance of the ETH Gas ecosystem. It is meant to be the pricing and usage's real-time influence in the Ethereum blockspace.

The historical gas spent and verified participation in the Gasless Future movement were the parameters for airdrop eligibility. The users' community actions and the Gas ID had to prove the real usage, thereby making this a utility-first distribution model.

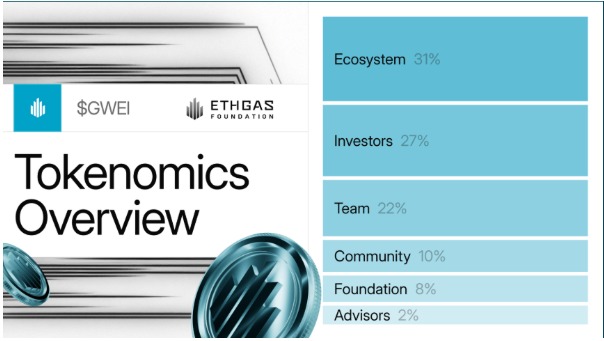

The robust tokenomics generally create the long-term price performance. The tokens follow a proposal of a 10-year distribution with a limited supply of 10 billion ERC-20 tokens on the Ethereum Mainnet and a balanced model.

Token Allocation:

Ecosystem: 31%

Investors: 27%

Team: 22%

Community: 10%

Foundation: 8%

Advisors: 2%

Such a distribution would not only lessen the risk of sudden sell-off but also foster the gradual growth of the ecosystem, which in turn is good for the stability of the price.

With the supply, allocation, and backing of the platform at an early stage, the analysts predict a conservative but healthy launch.

GWEI is likely to be in the price range of $0.002 to $0.005, which is a nice spread in terms of liquidity without too much volatility. This price range is also similar to that of other Ethereum projects with a governance focus.

In the near future, the price movement will be determined by the claiming of airdrops, the trading activities of the initial traders, and the announcements about the ecosystem.

Short-Term Outlook:

If the adoption keeps growing and the vested tokens are not released, it could be in the range of $0.006-$0.015. The demand from the community could be the factor supporting the slow but steady upward trend.

There will be no long-term value without real utility. If it turns out to be the winner in terms of Ethereum gas efficiency and governance, GWEI's demand may go up a lot.

Long-Term Outlook:

If the adoption is continued, it could reach the price range of $0.05-$0.12 in a few years. This is assuming that the governance is used actively and the ecosystem is still being developed.

This content is for educational purposes only and does not constitute financial advice. Cryptocurrency investments involve risk. Always DYOR before making decisions.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.