Will Hyperliquid (HYPE) emerge as one of the breakout tokens of 2026?

The asset is currently consolidating near the $30 support zone, yet several market analysts have begun discussing the possibility of a move toward the $150 level.

While that target remains ambitious, it has quickly become part of the broader conversation around the HYPE price prediction.

As Hyperliquid strengthens its position within the decentralized exchange ecosystem, sentiment around the token is gradually shifting.

Growing platform activity, improving liquidity dynamics, and tightening supply conditions are fueling speculation that a larger expansion phase could develop.

Whether a 500% move, i.e., $150, becomes realistic will ultimately depend on sustained demand and structural market support rather than short-term excitement.

Recent on-chain data from OnchainLens shows that trader Machi continues to open high-leverage positions despite unrealized losses of over $27.8 million.

His exposure includes 25x on ETH, 40x on BTC, and 10x on HYPE.

Such aggressive positioning can amplify upside during strong moves but also raises liquidation risk if volatility spikes.

For HYPE, large leveraged longs may contribute to sharper short-term price swings.

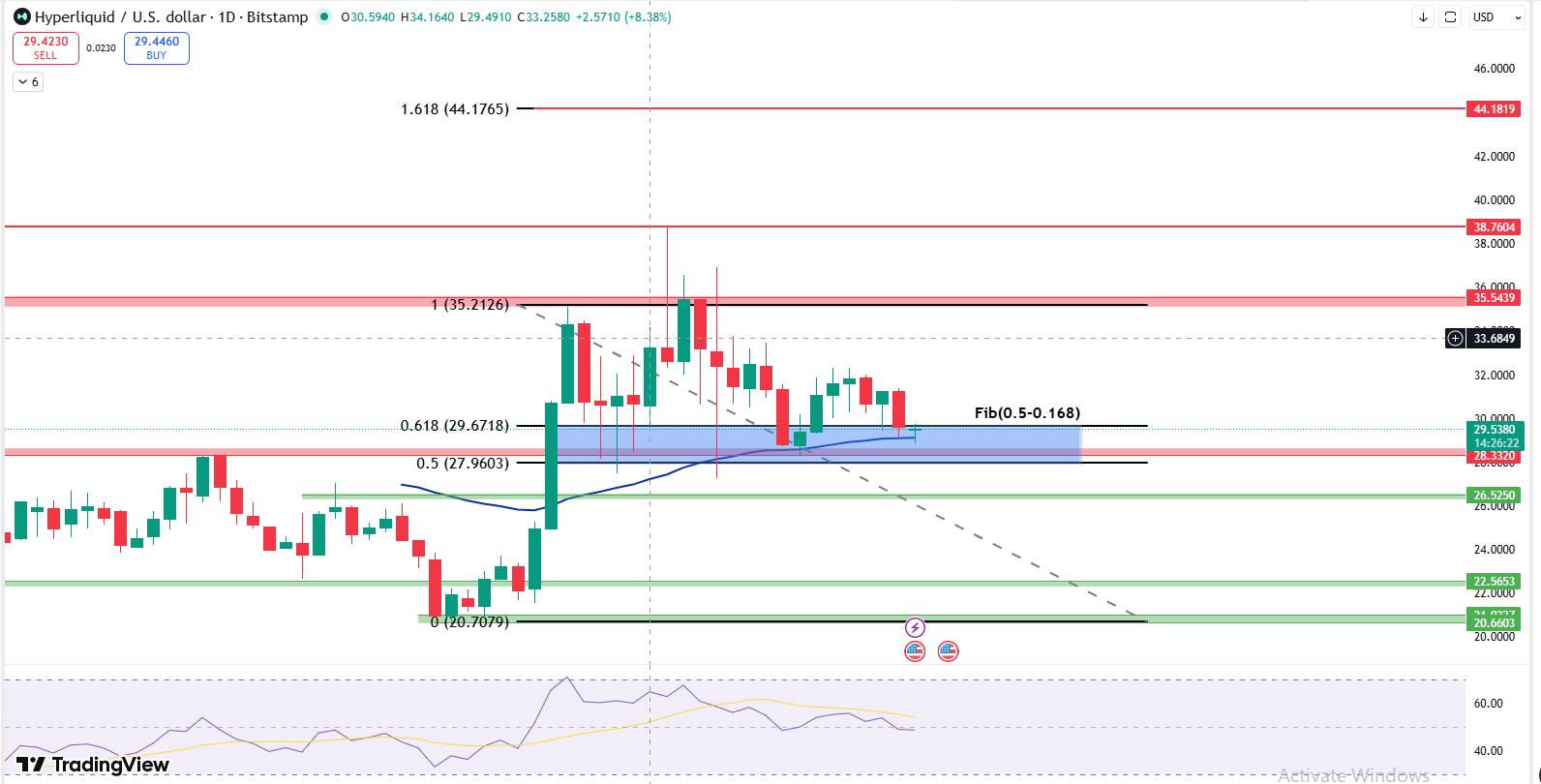

On the TradingView daily chart, Fibonacci is drawn from the swing low near $20 to the recent high around $35.

After tagging that resistance zone, price entered a controlled pullback phase.

At present, HYPE is holding inside the 0.5–0.618 Fibonacci retracement area, roughly between $27.9 and $29.6.

This zone is typically viewed as a healthy correction range within a broader uptrend.

Importantly, price has reacted from this retracement cluster instead of breaking below it, indicating that buyers are still defending structure.

The 50 EMA is now aligning near this zone and beginning to act as dynamic support rather than resistance.

If this retracement base continues to hold, the first upside level remains the prior high near $35.

A sustained breakout above that region opens room toward the 1.618 Fibonacci extension near $44.

However, a breakdown below the 0.5–0.618 support band could shift short-term momentum lower, with the $26 and $22 zones acting as deeper support areas.

For now, as long as the price remains above the Fibonacci structure and EMA support, the broader bullish framework stays intact.

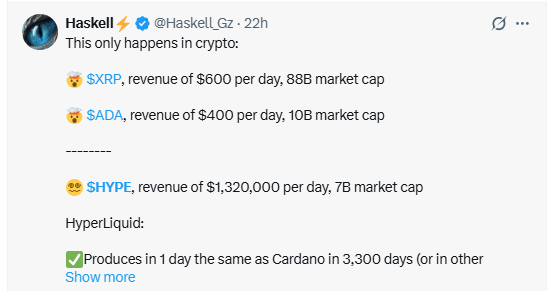

A recent tweet shared by crypto analyst Haskell suggests Hyperliquid is generating nearly $1.32M in daily revenue with a market cap around $7B, while some larger networks generate far less relative to their valuation.

If sustained, this revenue gap raises an important question about relative valuation. Over time, real protocol income may matter more than narrative alone.

Whether others are overvalued or HYPE is undervalued remains open for debate.

According to a recent post circulating on social media, Arthur Hayes is reportedly looking to increase exposure to HYPE and has floated a $150 price target by July.

The projection is based on his broader thesis around liquidity cycles and stablecoin deployment into high-growth assets.

While such a target reflects strong conviction, it remains conditional on macro liquidity trends and continued exchange dominance by Hyperliquid.

If institutional capital rotates aggressively into high-revenue DeFi platforms, the $150 narrative could gain traction.

However, without sustained volume and structural follow-through, the move would require exceptional momentum rather than gradual appreciation.

Short Term: As long as HYPE holds above the $28–$30 support zone and sustains above the 50 EMA, the structure favors another attempt toward $35.

A breakout above that level could open room toward the $44 Fibonacci extension.

Long Term: If exchange dominance, protocol revenue growth, and broader market liquidity continue expanding, the $150 target discussed by analysts remains a high-conviction but conditional scenario.

However, failure to hold key retracement support could delay any aggressive upside projections.

Overall, the Hyperliquid price prediction now depends on whether key support holds and momentum is sustained. The broader outlook remains conditional on liquidity, revenue strength, and market structure.

Disclaimer: Cryptocurrency markets are highly volatile. This analysis is based on technical structure and publicly available information and does not constitute financial advice. Investors should conduct their own research and assess risk tolerance before making investment decisions.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.