What happens when a new crypto token gets an exclusive early launch on Binance Alpha? That’s exactly the question investors are asking as Infinex (INX) prepares to go live on January 30.

With airdrop hype, limited access, and strong community interest, INX has quickly entered the spotlight. So, can this early momentum turn into real price growth, or is volatility ahead?

Source: X

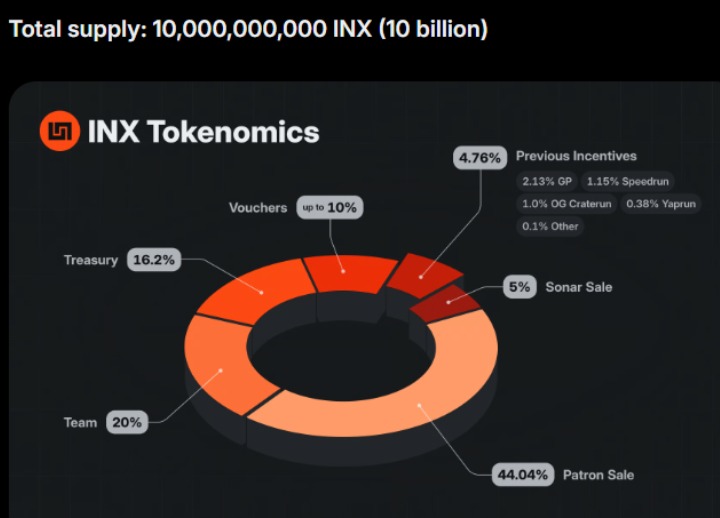

Understanding tokenomics is key to evaluating any crypto project’s future price action. Infinex has a total supply of 10 billion tokens, designed to balance liquidity, long-term development, and community incentives.

Patron Sale – 44.04%: Ensures strong early liquidity and broad participation

Team – 20%: Locked for long-term development and execution

Treasury – 16.2%: Funds ecosystem growth, partnerships, and incentives

Vouchers – Up to 10%: Used for user rewards and engagement

Sonar Sale – 5%: Strategic early distribution

Previous Incentives – 4.76%: Rewards early contributors and community members

This distribution shows a balanced approach, reducing excessive centralization while supporting long-term sustainability—an important factor for future price stability.

At launch, it is expected to see high volatility, mainly due to its Binance Alpha debut and airdrop-driven demand. Since only Alpha users can claim the airdrop initially, buying pressure may remain strong.

Based on current sentiment, tokenomics, and similar Binance Alpha launches, the token could list between $0.015 and $0.03. Short-lived price spikes are possible if demand exceeds the initial circulating supply, but quick pullbacks should not be ruled out.

In the weeks following launch, price fluctuations are likely as airdrop recipients and buyers take profits. This phase often leads to consolidation before a clearer trend forms.

If the team continues rolling out user incentives and ecosystem updates, the price could stabilize in the $0.02–$0.05 range. Strong token utility and consistent platform engagement would be key drivers during this period.

Over the long term, INX’s growth depends on adoption, product delivery, and market conditions. The sizeable treasury allocation and structured token releases provide room for sustained expansion.

In a bullish crypto cycle, and if Infinex successfully scales its platform, it could target $0.08–$0.15 or higher. This would reflect deeper liquidity, stronger utility, and broader ecosystem integration.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.