There is an old saying in the market—price never lies, but sometimes it tells the truth in a scary way.

Right now, Bitcoin feels like that.

In the last 24 hours, Bitcoin has dropped around 6.6% At the time of writing, BTC is trading near $82,500.

The broader crypto market is also under pressure.

For those tracking Bitcoin Price Prediction 2026, this does not look like a normal dip.

It feels more like a shift in market mood.

This fall did not come out of nowhere.

Leverage had built up on the long side.

When price slipped, liquidations started one after another.

Traders who expected strength suddenly became forced sellers.

Some analysts are also pointing to past cycles, where BTC saw pullbacks close to 50% before finding a base.

That comparison is now back in discussion as fear spreads across the market.

With economic, political, and policy uncertainty from the US adding pressure, strong support levels are breaking easily.

Now, the question is not why Bitcoin fell.

The real question now is how much lower the market can go before it finds real support.

What makes this drop heavier is who is selling, not just how fast price is falling.

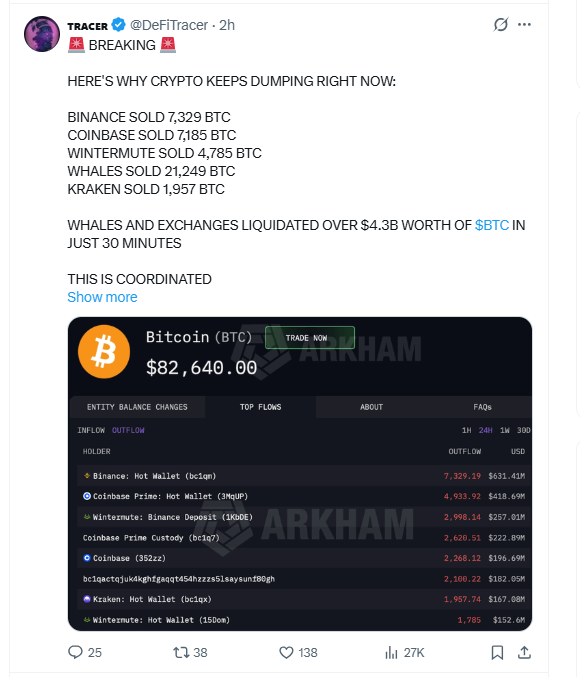

According to data shared by Tracer (@DeFiTracer), major players offloaded large amounts of Bitcoin in a short time window.

Binance sold 7,329 BTC, Coinbase sold 7,185 BTC, Wintermute sold 4,785 BTC, and Kraken sold 1,957 BTC.

Whales alone unloaded around 21,249 BTC during the same period.

In just 30 minutes, whales and exchanges liquidated more than $4.3 billion worth of Bitcoin.

This is not random retail panic.

This is a heavy supply hitting the market at once, such coordinated selling often feeds into a broader crypto market crash.

When selling comes from large holders during a weak macro phase, price does not get time to stabilize.

Traders shift focus from upside to survival.

The Coinbase Bitcoin premium has dropped to its lowest level since December 2024, showing weak demand from US-based buyers.

According to data shared by TedPillows, this shift reflects heavy selling activity in the market rather than fresh accumulation.

When the premium turns deeply negative, it often means spot buyers are stepping back while sellers stay active.

This adds to the pressure already seen on price and keeps short-term sentiment tilted toward caution.

On the BTC 4-hour TradingView Chart, BTC has clearly broken below its rising channel. What looked like a controlled move earlier turned into a sharp sell-off once the structure failed.

After the breakdown, price dropped close to 8%, showing how quickly sellers took control.

The 100 EMA is now acting like a wall near the upper side of the price. Instead of supporting the market, it is capping every attempt to bounce. That keeps pressure on the downside.

RSI has slipped into the oversold zone, which opens the door for a short-term pullback.

But any bounce is likely to face strong resistance around the previous support area near $84,000 and the next one from $87,000 to $90,000.

For now, the focus remains on the $80,000 zone as the next key area where price may try to slow down. Until structure improves, upside looks heavy and fragile, and short-term volatility and market sentiment remain weak

On the daily chart, price is moving inside a clear bearish flag pattern after a sharp drop.

This type of structure usually appears when price pauses before deciding its next move.

Right now, this pause looks more like consolidation than recovery.

Crypto analyst CryptoGerla has warned traders to stay cautious around this setup. According to the analysis, if price breaks below the lower boundary of this bearish flag, selling pressure could increase quickly.

In that case, the next area of interest lies near the $74,000 to $76,000 range, where buyers were active in the past.

Until the flag structure holds, patience remains important.

A clean breakdown would shift market focus from short-term bounces to deeper downside risk.

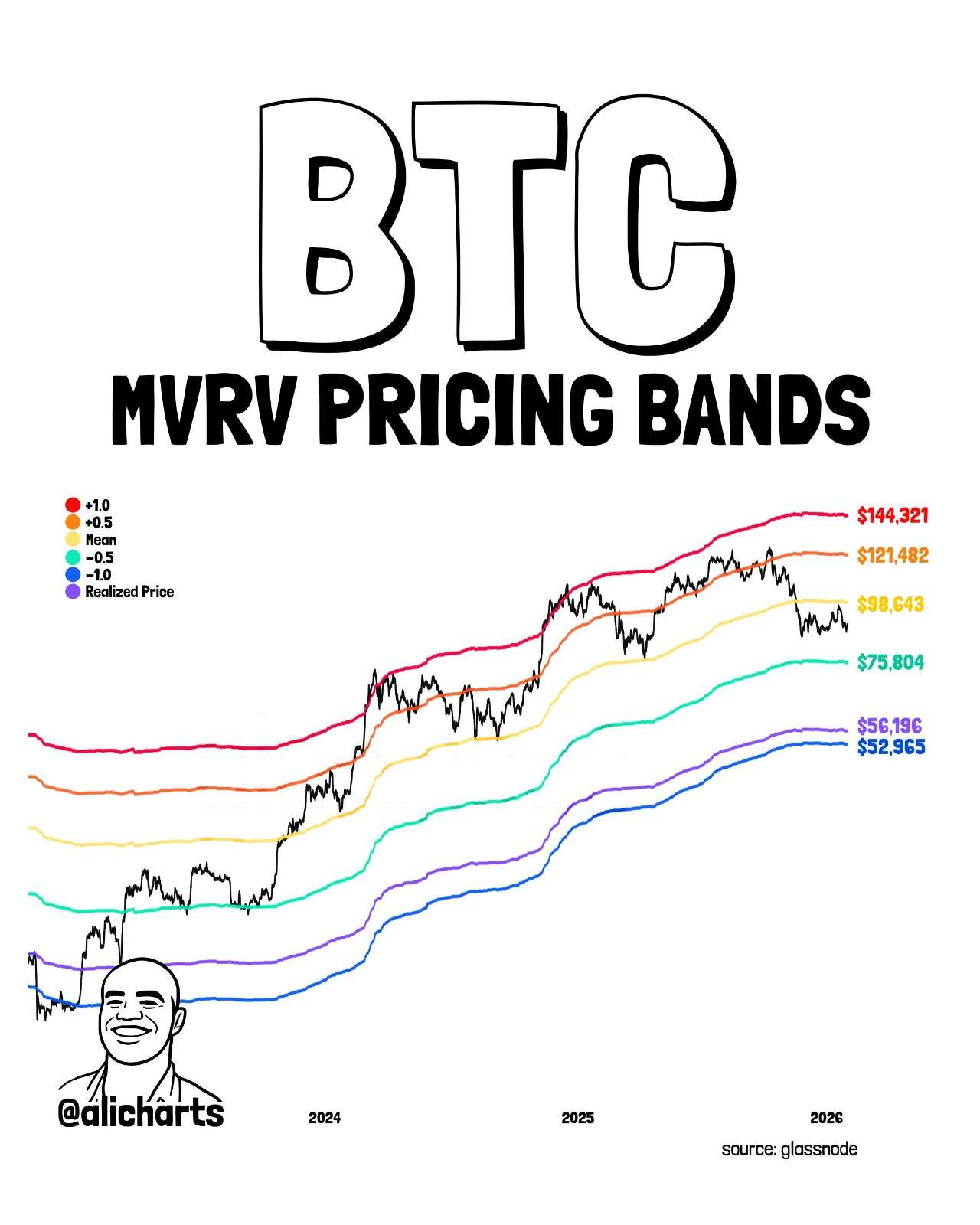

Long-term valuation data is starting to matter more as price weakens.

According to crypto analyst Ali Martinez, BTC is now moving closer to key support bands that have historically acted as reaction zones.

On the downside, important support levels sit near $75,804, followed by $56,196 and $52,965.

These zones mark areas where long-term buyers have shown interest in the past.

On the upside, resistance remains heavy near $98,643, then higher around $121,482 and $144,321.

This highlights how much effort price still needs before confidence can return.

With pressure building, traders are watching these valuation bands closely.

They do not promise a bounce, but they show where fear and value may collide next.

From an analyst perspective, Bitcoin Price Prediction 2026 is now being shaped by risk and caution rather than optimism. After the recent breakdown, the market is struggling to rebuild confidence, and selling pressure is still visible on rallies.

As long as price stays below heavy resistance zones, upside attempts are likely to face supply.

On the downside, attention remains on the $80,000 level as the first area where selling may slow. If weakness continues, the $76,000 zone becomes the next region where buyers may try to step in.

Until price action shows strength above resistance, Bitcoin Price Prediction 2026 remains defensive, with traders focusing more on capital protection than aggressive upside bets.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.