Will InterLink Network be able to make it to the list of the most important human-based blockchains in Web3? Close to 5 million authenticated users and an increasing interest from the institutions are the signs that investors are keeping a close eye on the InterLink opening date and the ITLG price forecast as the speculation surrounding 2026 gets stronger.

The project’s distinctive human verification system, together with an eventual network upgrade, a capped token supply have formed a strong buzz in the crypto market. As the beginning of 2026 draws nearer, a lot of voices are asking: Is InterLink Network the next big thing in Web3?

InterLink Network is a blockchain network that is decentralized and thus, suitable for a global Human Network. Different from regular blockchains, which utilize anonymous wallets, InterLink performs human verification using facial recognition and liveness detection, while personal data remains totally private.

After verification, users are turned into Human Nodes; they not only get to play a part in network securing but also in Sybil attack prevention. With this, fair governance, trust-based applications, and real-world coordination across Web3 are made possible—these are some of the things that most blockchains are still striving to achieve.

A major event happened on the 28th of December, when an announcement from different institutions around the world declared the ITL token a treasury asset.

The team was active on X sharing the information.

The institutions involved are New To The Street (USA), AI Supercluster (Singapore), Superior AI Labs (Hong Kong), Immersion Consulting (Singapore), Idom Capital (USA), HPX LLC (Dubai), and Qihong Entertainment (Hong Kong).

InterLink runs on twin tokens:

ITL: Aimed at being a treasury and institutional asset

ITLG: The 10 billion fixed-supply main ecosystem token

The non-fluctuating supply of ITLG is very beneficial to its long-term valuation, mainly due to the fact that, alongside the robust growth in adoption and ecosystem utility, the price of the token will also go up.

The date for the InterLink Network token listing has not been publicly declared but it would seem that the market is expecting the listing during Q1 of 2026, with February being the month that is frequently mentioned.

Just to be clear, this is all that remains since the InterLink team has yet to issue an official statement. However, a ecosystem upgrade that is planned to happen in the near future is also thought to be one of the factors contributing to the listing.

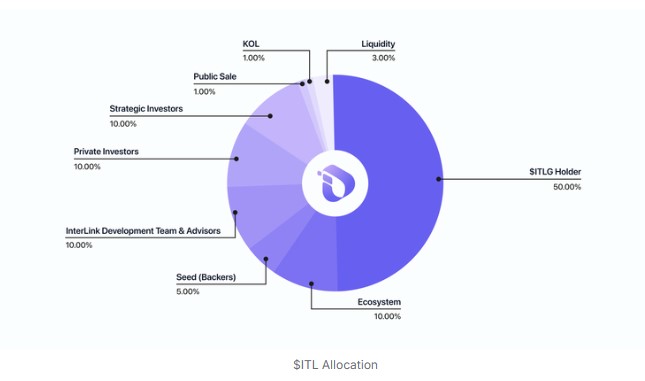

During the initial period, ITLG price fluctuation will be largely influenced by the presence of very few circulating supply tokens. A tiny fraction of the tokens—approximately 3% liquidity, 1% public sale, and 1% KOL distribution—will be allowed for trading.

This situation will most likely result in the demand for trading being limited due to the volatility of the market. On the other hand, the high demand caused by the limited supply may help to keep prices during the initial trading session.

Expected short-term price range:

$0.0025 – $0.006

There may be short-term price spikes if the exposure to influencers and early ecosystem updates generate speculative demand. However, profit-taking would still apply and so it is the case that sharp rallies would be limited.

The gradual unlocking of more tokens will coincide with the ongoing development of the ecosystem. A total of 10% of the tokens will be used for platform purposes, while the seed and strategic investor allocations will be gradually entering the market.

The determining factors at this point will be the acceptance of the product in the market, the number of partnerships, and the number of active users, rather than just the hype around the project.

Expected medium-term price range:

$0.01 – $0.03

If the InterLink maintains a steady upward trend, then the market might be able to digest the new supply without the pressure of a significant price drop.

ITLG’s fixed supply of 10 billion that is to last over the long run turns out to be a huge advantage for the coin. With 50% to be given to the holders, there will be long-term incentives in line with the growth of the community that will lead to reduced selling pressure.

If the InterLink can significantly increase its user base and at the same time, it’s the right time in the crypto market, ITLG may very well get a price boost of considerable amount.

Expected long-term price range:

$0.08 - $0.15

Higher levels, during a very strong bull market, are possible but the long-term value will still depend on the ecosystem's revenue, network effects, and the overall market situation.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crypto investments involve risk; always do your own research.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.