As Bitcoin attempts to flirt with the all-time high and Ethereum is struggling hard to defend its key support, somewhat the bigger question remains in the air: Is the crypto market putting on its last euphoric push valediction or is it on the verge of a catastrophic crash?

Market signals are red, geopolitical tensions have heightened, and top analysts like EGRAG Crypto and Robert Kiyosaki are issuing warnings that just cannot be ignored. Here is a detailed look at the way this shifting macro environment may impact the very next move for cryptocurrencies.

The price of Bitcoin (BTC) fell 3.15% over the last 24 hours and was last trading near $104,500, after failing to surpass its previous all-time high. The rejection at the top coincided with heightened geopolitical tensions between Iran and Israel, prompting risk-off sentiment across global markets.

Source: TradingView

If BTC is unable to hold the crucial $100,000 psychological support level, swift correction towards $91,000-92,000 could come into place, say analysts. Until now, the sentiment has been cautiously bullish; however, EGRAG Crypto asserts that the current rally could merely be a "blow-off top" preceding an aggressive bear cycle.

Ethereum (ETH) appears weak as it tries to reclaim the $2,800-$2,850 resistance level. At the time of writing, ETH is at $2,500, just a bit above a recent low of $2,440. If it breaks below $2,400, the next major support would be near the $2,000 mark, presenting another opportunity for a massive plunge.

Source: TradingView

This trend fits in the general profile of altcoin sell-offs, with meme and mid-cap tokens each crashing between 2 and 10%, and, consequently, pulling the total cryptocurrency market cap down by 4.50% to $3.25 trillion. Such a wide-based decline reflects the nerves prevailing among investors and a move towards risk-off assets.

The macro analysis by EGRAG Crypto looms over volatility and uncertainty in the price range. While he doesn't rule out one more euphoric run higher, perhaps incited by short-term bulls on relief news such as US-China tariff cuts, he warns that a cataclysmic bear market is being spawned.

The most striking forecast made by EGRAG: a geopolitical contagion within the next 90 days between the US and Iran, followed by a global recession. Such a chain reaction could undermine not just crypto but the entire financial ecosystem, triggering a market-wide sell-off.

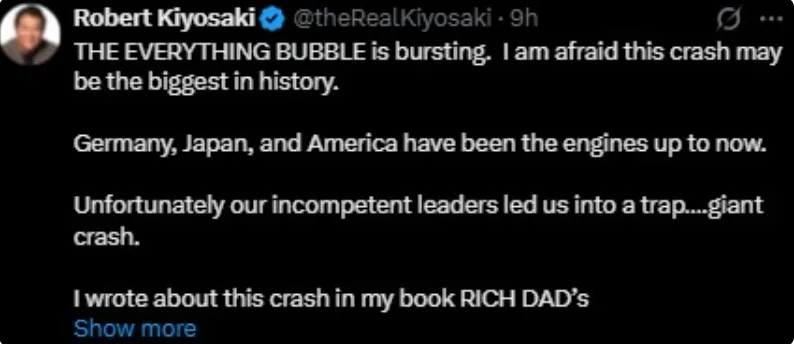

In saying this, Kiyosaki once again emphasized his long-held stance of a historic market crash. Designating 2025 as the year of probable "biggest crash in history," Kiyosaki issues a warning to investors on the job glut, collapsing housing market, and downward trend in asset prices.

He again revisited his 2014 Great Depression forecast and urged all to rethink their financial orientation while bracing for massive upheaval. In other words, it entails an effort to distinguish short-term hype from long-term endurance for crypto investors.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.